With ~ €31b revenue, SAP is one of the largest and oldest ERP vendors.1

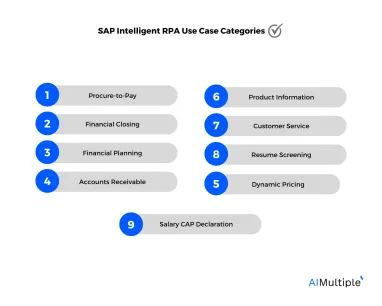

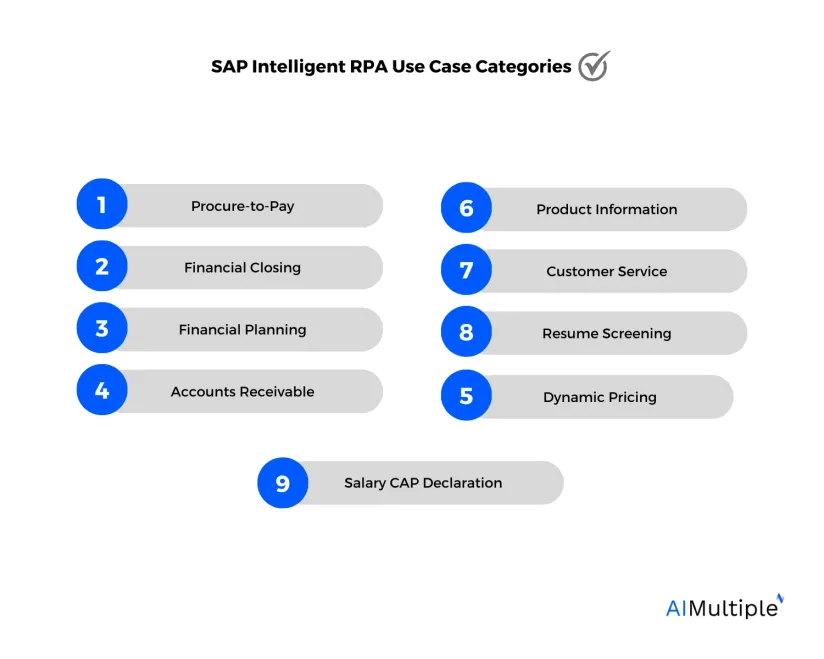

With the rise of Robotic Process Automation (RPA) to automate routine, time-consuming, and menial tasks, users might wonder how RPA can automate business workflows in SAP. However, SAP touches almost every critical aspect of a business. And as a result, businesses have a hard time correctly prioritizing their automation initiatives.

To help businesses prioritize their SAP automation initiatives and achieve greater results earlier, we will go over some of the top priority business applications that can be automated on SAP through RPA.

Use cases in accounting & finance

1. Procure-to-pay

Procure-to-pay (P2P) is the end-to-end process of receiving invoices from vendors, processing them, and then paying them. Thanks to the consistent nature of the P2P process, they are automatable by SAP software.

1.1. Accounts payable

Accounts payable is receiving invoices from suppliers for the goods/services they provide, verifying them, and paying them on time. Failure to do so could result in supply chain disruptions, thus tampering with operational continuity.

SAP intelligent RPA automation offers end-to-end automation of the process of accounts payable. The bot:

- Creates a list of all contracted suppliers in Excel,

- Confirm the purchase order for each,

- Conducts a 3-way invoice matching to ensure that the amount, the beneficiary, and the description all match,

- Extracts the delivery timeline and payment deadline from the purchase invoice,

- Inputs all the order data in the row corresponding to each supplier,

- Schedules a payment to be processed either on the payment deadline or whenever the delivery has been received,

- Notifies the accounting team if the payment does not go through or if they still need to approve it,

- Makes entries onto the account payables sub-ledger as well as the general ledger.

For other ERP solutions with AP automation capabilities, check:

- Dynamics 365 in Accounts Payable Automation: In-Depth Review

- NetSuite Accounts Payable (AP) Automation

- Blackbaud Accounts Payable (AP) Automation: In-Depth Review

- Sage Accounts Payable (AP) Automation

1.2. Invoice capturing

It’s difficult to pay an invoice if you don’t know when it’s due, who the beneficiary is, or what it’s for. SAP allows users to create RPA bots that will monitor the company’s inbox for incoming invoices. Thanks to IA integration, the bots will then read, capture, and standardize the invoice data into a machine-readable format.

The ERP’s can also leverage plugins with OCR capture & document management capabilities automate process. You can learn here more about the invoice and AP integration of these plugins.

The deadline date for payment is then automatically added to the accounting team’s calendar via API, and a notification can also be scheduled to be sent on the date to remind the team to make payment.

To learn more about invoice capturing, click here.

2. Financial closing

Financial close, the process of balancing and reporting a company’s financial accounts in the last fiscal period, is a lengthy process that involves multiple sub-domains. And financial close, if done manually, can be a time-consuming and error-prone process.

SAP leverages RPA to automate the following sub-categories within the financial close process:

2.1. General ledger entries

General ledger entries are the aggregation of all recurring, sub-ledger transactions – such as accounts payables, accounts receivables, etc. – into one ledger. General ledger entries are among the first steps in the long process of financial closing.

However, with businesses today having multiple selling channels – “traditional” marketplaces such as Amazon, “modern” marketplaces such as Facebook and Instagram, their own website, wholesale, retail, etc. – the incoming invoices are to be later authorized and entered onto the ledger, might be unorganized and unstructured in terms of data.

SAP automates general ledger entries, thereby freeing staff from:

- Validating different invoices data,

- Putting it onto a spreadsheet,

- And then entering those entries onto the general ledger.

SAP allows users to create an RPA bot whose job will be to constantly monitor the company’s email inbox for sales invoices, for instance, from different sales channels.

Because the RPA bot can further be augmented by OCR and NLP, it will be able to read the invoice and extract useful information, such as the invoice amount, the name of the counterparty, the date, description, etc.

Once the data is extracted, the RPA bot can automatically validate the data by cross-checking it with predefined rules. Once that is approved, the entries will be automatically made onto the sub-ledger, as well as on the general ledger that’s on the financial accounting system.

Automating general entries reduces manual effort, increases the accuracy of entries, and leaves a digital footprint as to where each entry has come from.

2.2. Intercompany reconciliation

Identification and verification of transactions between parent company subsidiaries are called intercompany reconciliation. During the financial close process, such transactions should be removed from the parent company’s balance sheet because they may cause exaggerated accounting or tax liabilities for the parent company.

However, reconciliation between companies might take a while, particularly for big corporations. SAP enables businesses to build rule-based frameworks that RPA robots can use to instantly recognize, record, and remove intercompany transactions from the parent company’s accounts.

The RPA bot accomplishes this by highlighting uncleared transactions and determining whether they match the balance sheet mismatch. If so, the bot automatically records all of these transactions in a separate file, deletes them from the balance sheet, and sends a notification email to the finance department of the relevant subsidiary, notifying them of the specific transactions that are theirs and have to be accounted as such.

2.3 Payment reconciliation

Payment reconciliation is matching the incoming and outgoing transactions that show up on the bank statements with internal accounts. For instance, the bank statement might indicate that $100 had been paid to a plumber when there are no internal invoices or memos mentioning anything about it.

Reconciling payments is about ensuring that your accounts are not compromised/hacked (i.e. no one else is making payments on your company’s behalf), as well as double-checking that all contractual debts are received and receivables are accounted for.

But manually going through all rows within a bank statement might result in some falling through the crack. Businesses can leverage SAP that uses its RPA bot to:

- Download bank statements from different banks as they arrive in the company’s email inbox every month.

- Read the information and transform them onto a spreadsheet for cross-matching them with submitted invoices.

- Flag exceptions as such.

- Look for receivables/payables that should have been received/paid based on the invoices on the database. Overdue transactions are then flagged.

- Notify the accounting team of all exceptions for them to follow up on.

3. Financial planning and analysis

SAP enables users to use the solution on top of existing legacy accounting applications in order to pull financial data from various financial applications and establish a single source of truth for financial planning and analysis.

Intelligent RPA integration means the bot can be programmed to, automatically, and at the end of each fiscal period, extract the financial data from different accounting applications and accounts, such as revenues, expenses, etc., and generate an “as-is” overview of the company’s financial health.

Some various metrics, such as profit margin, operating expenses, or the leverage ratio, are automatically calculated and displayed on the visible dashboard of SAP Analytics Cloud Planning.

The main benefit of this feature is that the dashboard will act as a single source of truth upon which the next period’s financial planning and analysis can be based upon.

4. Accounts receivable

Accounts receivable is the money your business is owed and should accordingly be paid. Failure to accurately calculate your receivables and days sales outstanding (DSO) could result in short-term liquidity shortages. Another possible negative of manually keeping track of receivables is that vendors might forget to pay, and the accountants might forget to follow up on it. So a receivable might turn into bad debt.

With SAP’s RPA-powered solution, companies can automate their accounts receivable processes. As we mentioned, in the financial close period, the accounting teams balance and close the account. And during the reconciliation sub-process, the bot can be programmed to flag unmatchable transactions and inform the staff about them.

If an unreconciled transaction is discovered to be an uncollected debt, the accountant can create a workflow in which the bot automatically extracts the unpaid invoice amount, drafts an email (with pre-approved, generic wording), and sends it to the customer.

If payment had not been made by the extended deadline, the bot can then create a ticket dispute, with which the company can now go to the bank and take legal action.

On the other hand, if a payment is made within the timeline, the bot will reconcile the bank statement with the payment invoice, make the entry into the (next period’s) ledger, and settle the deal.

Use cases in retail

5. Dynamic pricing

Dynamic pricing is retail stores following a flexible pricing model based on what competitors are charging for similar products to marginally improve their profits. Especially in deep and wide markets of e-commerce, such as electronics commodities, undercharging competitors can increase your market outreach. Or you could lose your customers to your competitors if your price is marginally higher than theirs for the same good.

However, with many market players out there, it can be difficult to constantly keep track of their prices in order to adjust yours.

SAP allows retail executives to scrape the web to get the competitors’ prices for similar products and alert them of the discrepancy. The solution does this through an RPA bot, which can also be scripted to automatically adjust the price without human intervention if the adjustment is within a pre-approved margin.

But if a competitor’s price falls outside the range that the bot had been programmed to match, then a notification would be sent to a human staff to intervene.

The benefit of the automated pricing model is that businesses can quickly and automatically catch onto profitable margins.

6. Product information query

We’ve discussed chatbots’ use cases in customer service before, specifically about how they can, for instance, answer FAQs on behalf of the employees to save valuable time.

But a less discussed use case of RPA-chatbot integration is what if a customer has a very specific question about a specific product? For instance, a customer wanting to purchase a wristwatch might want to know the lug width of the watch case. He/she can ask the chatbot, “What is the case lug width of X brand watch, model Y?”

The web scraping integration into the RPA chatbot that we’ve mentioned above can also help in this scenario: the scraper will go onto the product’s web page, look for the keyword “lug width,” and thanks to NLP and OCR read the numerical measurement (e.g. 16mm, 18mm, 20mm, etc.) and relay it back to the customer.

The main benefit of this capability is that it won’t be a live agent getting this information across but rather a bot. The other benefit is that the bot will be functioning within a rule-based framework, and so won’t be spreading misinformation.

7. Customer service

Intelligent automation has grown in adoption recently. Chatbots, for instance, are a useful tool for handling large volumes of time-consuming and repetitive tasks, such as answering FAQs, shipping timelines, operating hours, guaranteeing coverage, and more.

Companies can create RPA-enabled chatbots for their customer service departments via SAP. The chatbot can be connected to the company’s different legacy systems and databases for extracting data and answering customers’ queries quickly.

For instance, for an airline agency, the chatbot can access a traveler’s ticket information and the flight’s seat reservation layout to change their seat booking for instance. Or it can access the passenger’s mileage and travel history to upgrade their seat level from economy to business class.

Chatbots can also provide users with payment gateways, and be connected to financial accounting software, to automatically log in the sales entries (thanks to RPA integration) as they arrive in real-time.

To learn more about travel chatbots, click here.

Use Cases in human resources

8. Resume screening

We’ve previously talked about how AI technologies assist in recruiting. Companies often receive numerous resumes for job openings, leading HR to invest significant time in the initial screening process to ensure candidates meet basic criteria like age, education, and work experience.

If companies can automate the first stage of screening, not only would the second phase start sooner, but also all those who make it to the second round are made sure to comply with the criteria.

SAP-RPA integration allows for the creation of bots that monitor the company’s email address to flag “applicants’ resumes” as such automatically. The bots can then download the file and start assessing based on pre-defined rules.

For instance, through OCR and NLP, they can look through the resume to find the applicant’s age and education and compare it with the knowledge base (“if age >35, FALSE”) to make a decision.

The list would then be sent to the HR staff for the second round of assessment, as well as an email to be delivered to the candidate notifying them.

And to avoid rash decisions (e.g. rejecting an applicant if they meet all requirements bar one) the bot can also be programmed to refer the specific cases to the HR staff for a judgment call to assure fairness and make sure that the company does not miss out on talent only because the applicant’s age is higher/lower than what is specified.

Learn more about AI in resume screening.

9. Salary CAP declaration

Salary CAP declaration is a form to be filled and sent to each industry’s financial governing authority to show that the salaries you pay your employees are within the bounds of your financial power (in soccer, for instance, Financial Fair Play regulation sets each club a salary cap on the percentage of their revenue that they can spend on salaries).

For companies with multiple subsidiaries and employees on varying contracts (full-time, part-time, freelancing, etc.) it can be time-consuming to make sure the employees are still employed and that their salaries have been paid and processed (for instance, a board of directors member should not be declared to be receiving a salary, but rather a dividend), and then to add the amount up and fill it into the form.

A conglomerate was able to use SAP-RPA capability to automatically cross-check the employee’s contract from the HR database, authenticate the paid wage from the invoice, and input all this data onto the ERP system.

After that, the total amount was automatically filled onto the form and uploaded to the governing body’s database. This process that involved manual checks and email exchanges, and took 480 hours to complete, was now done in less than 7 hours.

For more on ERP

To learn more about ERP and intelligent automation integration within it, read:

And if you believe your business processes could benefit from adopting an ERP solution, head over to our ERP hub to see a data-driven list of vendors.

Comments

Your email address will not be published. All fields are required.