Gartner identified generative AI as a top technology trend for the banking and investment industry in recent years.1

Generative AI’s contributions to data privacy, fraud detection, and risk management can be critical to financial services companies. Key use cases include fraud detection, customer service automation, credit risk assessment, and document processing.

Core Use Cases of Generative AI in Banking

1. Fraud Detection

Detecting anomalous and fraudulent transactions represents one of the primary applications of generative AI in banking. Traditional fraud detection systems rely on predefined rules and historical patterns, often missing sophisticated new fraud schemes.

How Generative AI Improves Fraud Detection:

Using generative adversarial networks for improving classification effectiveness in credit card fraud detection. 2 The synthetic data was then compared to the genuine data to see whether the GAN was capable of developing sensitivity to identify anomalous transactions. Finally, it is seen that using a GAN-enhanced training set to detect such transactions outperforms that of the unprocessed original data set.

This improvement occurs because GANs develop sensitivity to identify underrepresented transaction types after training on both real and synthetic fraud patterns. This capability proves especially valuable for financial institutions processing enormous transaction volumes where fraudulent activities represent a small percentage of total transactions.

Real-World Implementation

Swedbank used GANs to detect fraudulent transactions.3 GANs are trained to learn legal and illegal transactions in order to detect the fraudulent ones by creating graphs that reveal their patterns.

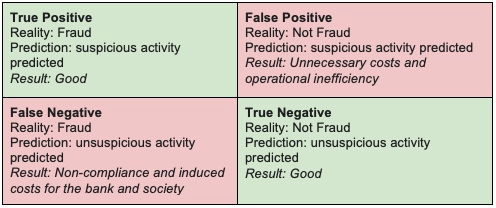

However, employing GANs for fraud detection has the potential to generate inaccurate results (see Figure 1), necessitating additional improvement. Explore machine learning accuracy to learn more.

(Figure 1. Source: “Challenges in modeling fraud as a binary classification problem”)

2. Data Privacy

Banking regulations increasingly restrict how customer data can be used, shared, and stored. Generative AI addresses these challenges by creating synthetic data that maintains statistical properties of real customer data without exposing actual personal information.

Applications of Synthetic Data:

Synthetic customer data enables banks to:

- Train machine learning models without using real customer information

- Share data with third-party vendors for system testing and development

- Conduct stress testing and scenario analysis with realistic but anonymized data

- Develop new products and services using privacy-preserving datasets

Technical Implementation:

Different GAN variants serve specific banking needs:

- Conditional GANs: Generate data based on specific customer segments or product types

- Wasserstein GANs (WGANs): Provide more stable training for financial time series data

- TimeGANs: Specialize in generating realistic temporal transaction patterns

- Deep Regret Analytic GANs: Optimize for specific business objectives

Privacy Benefits:

- Enhanced model training without compromising customer privacy

- Compliance with GDPR, CCPA, and other privacy regulations

- Reduced risk of data breaches involving real customer information

- Ability to share data across departments and with external partners

(Figure 2. Source: “GAN-Based Approaches for Generating Structured Data in the Medical Domain”)

3. Risk Management

Risk management requires banks to model potential future scenarios and assess their impact on operations, profitability, and regulatory compliance. Traditional risk models often rely on historical data and may miss emerging risks or extreme scenarios.

Generative AI Applications in Risk Management:

GANs enable banks to calculate value-at-risk estimations and create economic scenarios useful for predicting financial market futures. These AI-generated scenarios provide assumption-free modeling based on historical data patterns while exploring possibilities that may not have occurred in historical datasets.

Risk Modeling Capabilities:

- Generate thousands of potential market scenarios for stress testing

- Create synthetic economic conditions for portfolio analysis

- Model rare events and extreme market conditions

- Analyze interconnected risks across different business units

Regulatory Compliance:

- Meet Basel III requirements for stress testing

- Generate documentation for regulatory reporting

- Model compliance with evolving regulations

- Assess impact of new regulatory requirements

Business Value:

- More accurate risk assessments and capital allocation

- Enhanced regulatory compliance and reporting

- Better preparation for economic downturns and market volatility

- Improved decision-making under uncertainty

(Figure 3. Source: “Scenario generation for market risk models using generative neural networks”)

4. Generating Applicant-Friendly Denial Explanations

Regulatory requirements and customer experience considerations demand that banks provide clear explanations when declining loan applications. Traditional systems often generate technical explanations that customers struggle to understand.

Transparent Decision Communication:

Conditional GANs generate applicant-friendly denial explanations through a two-level conditioning framework that arranges denial reasons from simple to complex in hierarchical structures. This approach creates more transparent and understandable explanations for customers.

Customer Communication Benefits:

- Clear explanations of denial reasons in plain language

- Actionable advice for improving future applications

- Personalized recommendations for alternative products

- Enhanced customer trust and satisfaction

Regulatory Compliance:

- Meet fair lending requirements for explanation provision

- Document decision-making processes for regulatory review

- Ensure consistent explanation quality across applications

- Reduce regulatory risk and potential discrimination claims

(Figure 4. Source: “Generating User-Friendly Explanations for Loan Denials Using Generative Adversarial Networks”)

5. Customer Service Automation

Generative AI transforms customer service by creating personalized responses, automating routine interactions, and providing consistent service quality across channels.

Personalized Customer Interactions:

Generative AI processes customer data to create tailored interactions by:

- Generating personalized responses based on transaction history and financial goals

- Creating customized product recommendations and financial advice

- Automating routine queries while maintaining personal touch

- Optimizing communication timing and channel preferences

Implementation Areas:

- Chatbots and Virtual Assistants: Handle complex customer queries with contextual understanding

- Email Automation: Generate personalized communications for account updates and product offers

- Call Center Support: Provide real-time assistance to human agents with suggested responses

- Document Generation: Create personalized statements, reports, and correspondence

6. Credit Risk Assessment and Loan Processing

Traditional credit scoring relies on limited data points and may miss important risk factors or opportunities. Generative AI enhances credit decisions by analyzing broader data sets and generating comprehensive risk profiles.

Enhanced Credit Decision-Making:

AI systems determine customer eligibility for credit products by:

- Analyzing transaction patterns and spending behavior

- Assessing repayment capacity using alternative data sources

- Generating risk scores that account for economic conditions

- Optimizing loan terms and pricing based on individual risk profiles

Alternative Data Integration:

- Social media activity and digital footprint analysis

- Utility and rent payment history

- Employment stability and income verification

- Lifestyle factors and spending patterns

The latest regulations require generative AI tools to ensure AI compliance, mitigate AI bias, and other generative AI risks.

FAQ for Generative AI in Banking

Reference Links

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE and NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and resources that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Be the first to comment

Your email address will not be published. All fields are required.