The use of emerging technologies such as artificial intelligence and RPA is already prevalent among businesses in the financial services industry:

- By 2024, banking will be one of the top industries spending on artificial intelligence.

- About 80% of finance leaders have implemented or are planning to implement RPA, according to RPA stats.

The next step in enterprise automation is hyperautomation.

In this article, we’ll explore why the banking industry needs hyperautomation, its use cases, and how banks can get started with their hyperautomation journey.

Why is hyperautomation important for the financial services and banking industry?

Hyperautomation is a digital transformation strategy that involves automating as many business processes as possible while digitally augmenting the processes that require human input. Hyperautomation is inevitable and is quickly becoming a matter of survival rather than an option for businesses.

There are several challenges specific to the financial services industry that make adopting hyperautomation necessary:

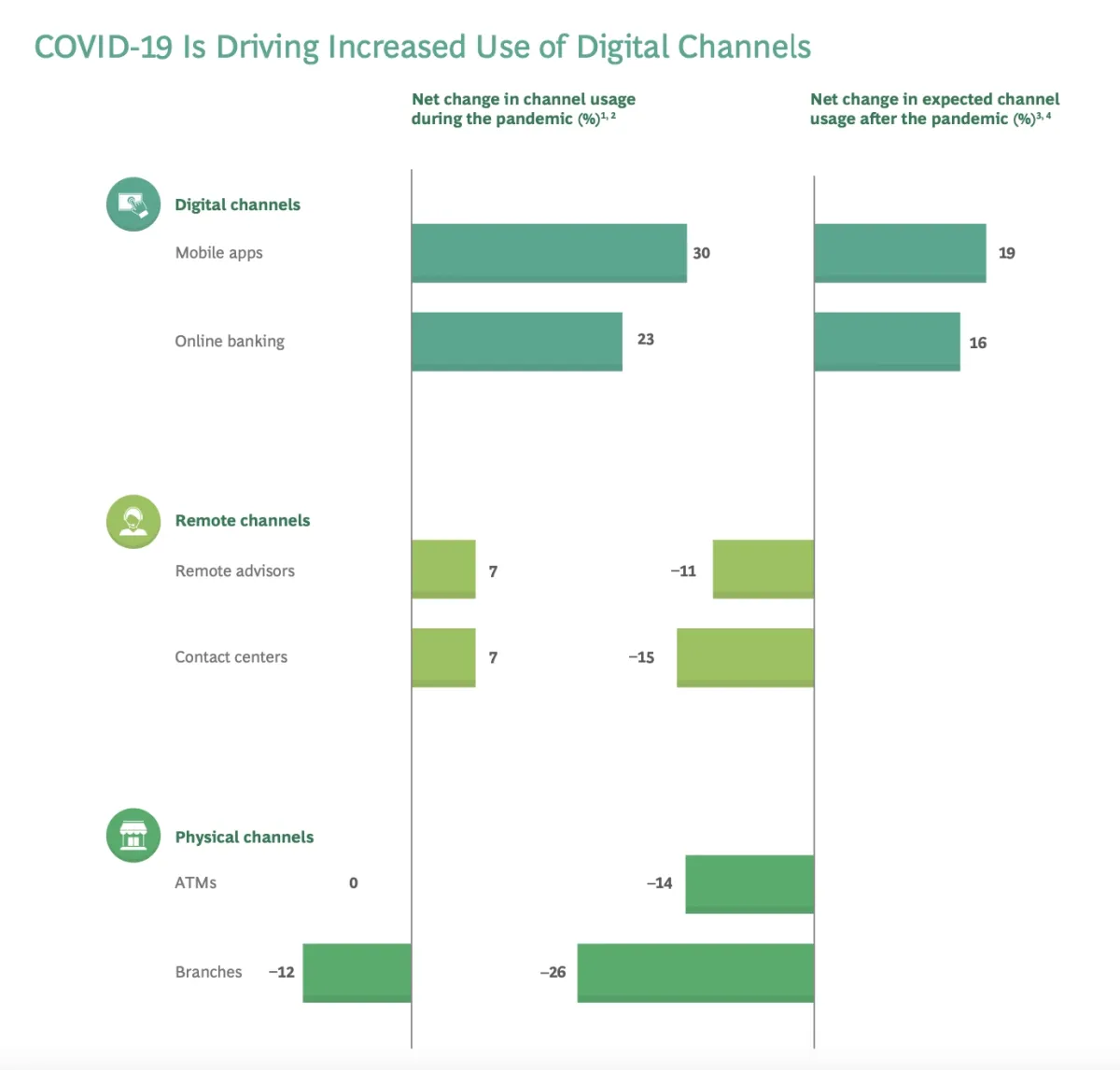

- Consumers increasingly prefer digital channels such as mobile and online banking and expect a more personalized banking experience. The COVID-19 pandemic has accelerated the shift to digital preference (Figure 1). Moreover, nearly half of customers want their bank to provide personalized offers and information.1

Figure 1. COVID-19’s impact on the use of digital channels in banking

- As JPMorgan Chase CEO Jamie Dimon puts it, banks face an “enormous competitive threat” from tech giants such as Amazon, Apple, and Google.2 Since these companies have access to large amounts of customer data and have the tools to make use of it, their entrance into the financial service industry poses a threat to traditional financial institutions.

- Lower regulatory barriers facilitate increased competition from fintech startups. A fintech company has lower capital requirements, no liquidity requirements, low cost for compliance, and fewer privacy restrictions compared to a regulated bank.3 These enable fintech startups to adapt to user needs faster.

Hyperautomation can help financial institutions deal with these pressures by reducing costs, increasing productivity, enabling a better customer experience, and ensuring regulatory compliance.

How GenAI transforms hyperautomation in banking

Generative AI (GenAI) is reshaping automation in banking. It goes beyond improving workflows—it introduces intelligence to automation, expanding what banks can achieve.4

Use cases of AI based hyperautomation in banking

1. Expanding the scope of automation

Generative AI (GenAI) is reshaping automation in banking. Traditional automation focuses on predefined workflows, but GenAI brings human-like intelligence to these processes. This expands what banks can automate, improving both efficiency and decision-making.

2. Rethinking hyperautomation strategies

Banks have invested heavily in automation, now known as hyperautomation. With GenAI, executives are reconsidering its full potential. Instead of just automating tasks, GenAI helps redesign entire workflows, leading to greater efficiency and cost savings.

3. Overcoming automation challenges

GenAI enables banks to tackle complex automation issues. Many past initiatives were limited by rigid rule-based systems. With GenAI, banks can create flexible solutions that adapt to new data and scenarios, improving front-to-back operations.

Challenges of merging GenAI and hyperautomation in banking

Integrating Generative AI (GenAI) with hyperautomation presents significant challenges for banks. While both technologies promise efficiency and transformation, their convergence is often slowed by governance issues, organizational silos, and strategic misalignment.

1. Governance and approval barriers

Banks enforce strict governance rules and approval toll gates for automation projects. These controls, while necessary for risk management, often delay the full adoption of GenAI within hyperautomation frameworks. Many organizations hesitate to fully integrate GenAI due to concerns over security, compliance, and regulatory oversight.

2. Lack of awareness and alignment

Many GenAI leaders are unfamiliar with past hyperautomation efforts, making it difficult to align new AI-driven initiatives with existing automation frameworks. This gap creates inefficiencies and missed opportunities, as decision-makers fail to leverage the strengths of both technologies together.

3. Organizational politics and resistance

Merging GenAI and hyperautomation involves multiple stakeholders across departments, each with different priorities and concerns. Internal politics often slow decision-making, as teams struggle to balance innovation with existing workflows and risk controls. This leads to fragmented adoption, where some areas experiment with GenAI while others remain hesitant.

4. Measuring ROI and business value

Both GenAI and hyperautomation require clear metrics to assess their effectiveness. However, many banks lack standardized frameworks to track the impact of these technologies. Without clear ROI models, business leaders may struggle to justify continued investment in GenAI-driven automation.

5. Strategic misalignment between enterprise and business units

Most banks manage GenAI at the enterprise level, while hyperautomation efforts are often led by individual business units. This separation creates challenges in decision-making, as organizations must define clear responsibilities and decision rights when integrating the two technologies.

Overcoming these challenges

To successfully merge GenAI and hyperautomation, banks must:

- Streamline governance processes to enable faster adoption.

- Bridge knowledge gaps between GenAI and automation teams.

- Align stakeholders through clear communication and shared goals.

- Establish strong ROI measurement frameworks for automation investments.

- Define roles and decision-making structures across enterprise and business units.

By addressing these challenges, banks can fully unlock the potential of GenAI-driven hyperautomation, leading to smarter, more efficient, and cost-effective operations.

Key Opportunities for Banks

- Enhancing AI-Driven Automation – GenAI can generate insights that feed into automation tools, making processes smarter and more efficient.

- AI-Powered Development – Many hyperautomation platforms now include GenAI-based copilots, accelerating solution development.

- Improved ROI Tracking – Banks need better frameworks to measure the impact of automation and GenAI investments together.

What are the use cases of hyperautomation in banking?

We’ve explored the use cases of individual hyperautomation technologies in banking and financial services, such as:

- Artificial intelligence (AI)

- Intelligent automation

- Robotic process automation (RPA)

- Process mining

- Chatbots

Combining these technologies enables hyperautomation to achieve end-to-end process automation. Use cases include:

Back-office operations

On average, retail banks have between 300 to 800 back-office processes to manage and monitor, such as:5

These processes often involve time-consuming and redundant manual tasks.

Leveraging process mining and digital twins can help banks to gain process intelligence and identify back-office processes to automate. AI and NLP-enabled intelligent bots can automate these back-office processes involving unstructured data and legacy systems with minimal human intervention.

Real-life example

IBM’s case study shows how global specialty finance company Credigy leveraged RPA to automate over 25 business processes and was able to:6

- Process account-based documents by email, media download, or other types of automation and automatically load documents into an internal system that users can easily access by account.

- Forward suspicious emails for URL scanning and alert users if URLs appear malicious

- Support compliance by automatically downloading updates from a variety of sites and loading data into specific tables for review.

- Automate IT audits including password strength tests. If a user’s password fails a strength test performed by the robot, the user receives an email requesting a password update that complies with password rules.

Automating repetitive tasks enabled Credigy to continue growing its business at a 15%+ compound annual growth rate. Check our article on back-office automation for a more comprehensive account.

Customer service

Hyperautomation can help financial services organizations improve customer experience in various ways:

- Streamlining back-office tasks will reduce friction in customer service operations. For instance, banks can accelerate their Know Your Customer (KYC) processes using intelligent document processing to extract relevant data from customer documents and identify risks with ML models. This will help banks achieve rapid customer onboarding.

- By reducing the need for manual labor and using process intelligence, hyperautomation improves employee productivity and reduces operational costs, as we discussed in our article on hyperautomation benefits. This will enable banks to spend more time on developing customer-centric products and services.

- Banks can also leverage bots with conversational AI capabilities that offer 7/24 customer service, answer customer queries and FAQs, and help human customer service reps during their interactions with customers.

How to get started?

As we discussed in the introduction, financial services companies extensively use AI and RPA, so chances are your business already has several automation initiatives. However, hyperautomation requires a coordinated and company-wide effort to achieve scalability and agility. Therefore, businesses should:

Establish an automation center of excellence

An automation CoE is a business unit consisting of technical and business experts to guide and oversee the hyperautomation initiative in your organization. An automation CoE will:

- Bridge the gap between business decision-making and automation implementation,

- Identify processes to automate,

- Create an implementation roadmap for the hyperautomation initiative,

- Create a unified vision and standardized practices within the organization.

You can also check our articles on AI CoE, RPA CoE, and digital CoE.

Develop a change management strategy

A strong company culture for hyperautomation is as important as selecting the right tools and technologies: the cultural deficit is one of the top reasons why digital transformation initiatives fail. Organizations should:

- Create opportunities for reskilling and upskilling for employees. 33% of job skills present in an average job posting in 2017 were not needed in 2021.7 As hyperautomation becomes prevalent in an organization, this trend is expected to continue. Providing digital training programs can help mitigate this problem.

- Improve top-down communication about why hyperautomation is needed, what will change, and what employees should expect.

For more, check out our article on the importance of organizational culture for digital transformation.

Collaborate with third parties

Collaborating with third parties such as:

- Fintech companies can help financial service organizations to be able to develop innovative products and services. Fintech companies often leverage big data, AI, and automation to develop solutions that fulfill the niche needs of customers. Partnering with fintech companies can help traditional banks discover new ways of using hyperautomation technologies to improve customer experience.

- Non-banking organizations create a data ecosystem can help financial services companies gain a deeper understanding of their customers and improve their analytical capabilities, which are crucial to hyperautomation.

Feel free to check our article on intelligent automation strategy for more.

Further reading

If you have other questions about hyperautomation and its applications in the banking industry, we can help:

External Links

- 1. Digital Banking Articles & Insights from J.P. Morgan.

- 2. JPMorgan Chase CEO Jamie Dimon: Why fintech is a big threat to banks. CNBC

- 3. https://www.capgemini.com/wp-content/uploads/2022/03/Top-Trends-in-Retail-Banking_2022-1.pdf

- 4. Gen AI and hyperautomation in banking: PwC .

- 5. The benefits of hyper-automation for banking | Fintech | Waracle Ltd..

- 6. “Intelligent automation for customer finance solutions.” IBM. Revisited on May 9, 2023.

- 7. https://www.gartner.com/ngw/globalassets/en/human-resources/documents/trends/top-priorities-for-hr-leaders-2021.pdf

Comments

Your email address will not be published. All fields are required.