According to Accenture, getting the best price is the top priority for 52% of auto insurance customers, 50% of home insurance customers, and 38% of life insurance customers.1 The study implies that although there are other criteria for customers, determining the optimal price is the biggest competitive advantage for insurance companies.

Read on three main determinants of insurance pricing and ways to optimize insurance pricing:

What is insurance pricing?

Any company aims to set prices to maximize its profits. This is also referred to as optimal pricing. It is not different in the insurance sector. Ideal pricing (or premium in insurance terminology) must cover:

- Variable costs

- Operating expenses

- Profits

Setting an optimal price depends on understanding costs, price elasticities, consumer preferences, and the strategic actions of competitors.

Why is optimal insurance pricing important?

Setting the right insurance premium price gives firms a competitive edge. Pricing, like in any industry, follows the law of demand and supply.

- Customer sensitivity: Insurance customers prioritize getting the best price. Even a small change in insurance premiums prices can cause many customers to switch providers.

- Profit maximization: Optimal pricing helps insurance companies maximize profits and gain market share, especially in more profitable segments.

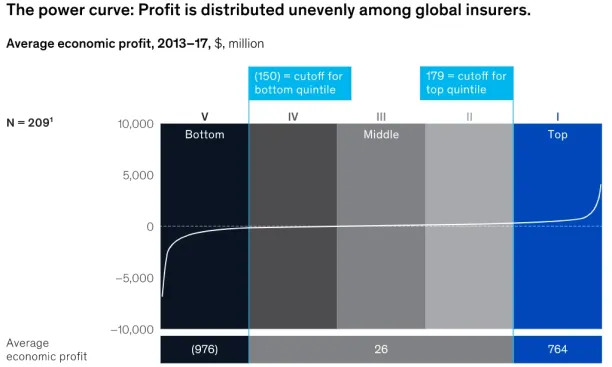

McKinsey’s study supports this argument. As the below chart demonstrates, average profit distribution in the insurance sector varies significantly.2 McKinsey argues that the most profitable insurance companies use technology-enabled underwriting processes to effectively set premiums.

Source: McKinsey3

Top 6 ways of achieving optimal insurance pricing

As mentioned earlier, determining the optimal premium involves minimizing variable costs, operating costs, and optimizing the desired profit margin. For insurance practice, this means:

- Increase the efficiency of the underwriting process (minimizing variable costs).

- Detecting fraudulent claims more effectively (minimizing variable costs).

- Minimizing customer service, rent, and other expenses.

- Realizing the realistic profit margin that does not lead to a reduction in the customer satisfaction. (Respect the law of supply and demand).

Minimizing variable costs

1. Minimizing the cost of risk-bearing service

The most important variable cost for insurance companies is the determination of the insurance coverage and, hence, the cost of risk factors.

Each insurance policy can be described as an exchange of risk for money. Thus, each past claim represents the variable cost of the insurance sector, which is difficult to determine compared to the variable costs of other sectors. For example, in the case of manufacturers, the variable costs, such as raw materials, are fairly certain, which makes it easier to minimize it. In the insurance sector, on the other hand, variable costs are a probabilistic distribution. Therefore, it is challenging to minimize it.

To assess risk, insurers look at various data points, including:

- Subject variables: Information about the person or company applying for insurance (e.g., in car insurance: drivers’ age, driving record, driving habits, or health status).

- Object variables: Details about the insured item (e.g., in car insurance: car model, mileage, or property value).

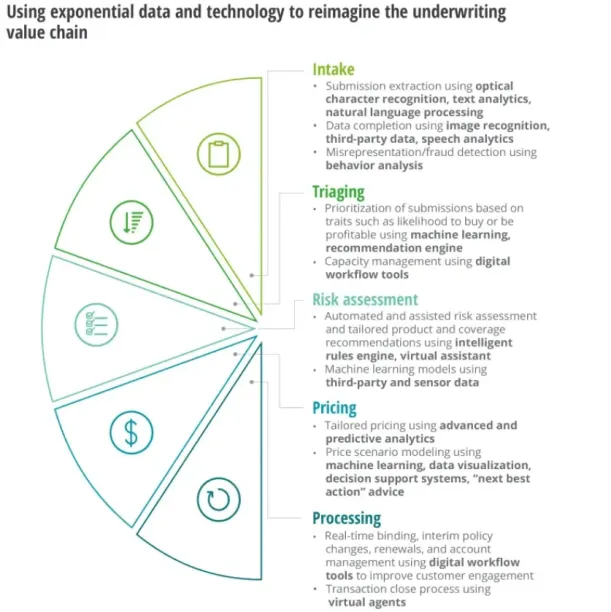

Before AI/ML algorithms, primitive risk assessment models like linear regression and generalized linear model (GLM) were used for interpreting statistics. Nowadays, AI based underwriting assesses risk with more sophisticated analytics. Also, data was scarce before the growth of IoT devices. As a result, the uncertainty in variable costs decreases for companies using these new technologies, helping them set optimal prices and gain a competitive edge.

Source: Deloitte4

2. Detecting fraudulent claims

According to the Coalition Against Insurance Fraud, fraudulent claims cost the U.S. $80 billion per year.5

Fraud is a factor that increases the costs for insurance companies and thus increases the premium prices. Therefore detecting fraudulent claims more effectively can be used either to increase profits or market share. Fraud detection may be enhanced by using AI/ML models:

- Using behavioral analytics increases the probability of foreseeing some fraudulent claims before they occur. For instance, analyzing customers’ habits, companies can determine whether their behavior is consistent or not. If there is any suspicion, companies can investigate further.

- Automation of claim processing with chatbots that direct policyholders to capture streaming video of damage can reduce fraudulent claims by providing evidence to support the claimant’s description

Using NLP and computer vision technologies to detect fraud more efficiently. For example, fraudulent documents can be identified using computer vision techniques

For more, you can check our article on insurance fraud detection.

Minimizing the operating expenses

Various business expenses such as customer service, rent and other expenses can be decreased thanks to technological advancements. This can help insurers give more flexibility in pricing. Some examples of operational efficiency improvements include:

3. Optimizing customer service

Insurance chatbots and omnichannel engagement with clients can significantly reduce customer service-related expenses and increase customer satisfaction due to:

- Optimized customer care response times.

- Engaging with customers via variety of platforms such as

- Mobile App

- Website

- Task automation.

- Allocating workforce to tasks that yield greater value.

Also, predictive analytics, can assist insurance companies to prioritize their customers who need immediate claims processing, which in turn lowers operating expenses.

4. Reducing rent expenses

Millennials and urbanites generally demand less physical interaction, and this process has accelerated following the Covid 19 pandemic.6 Thanks to digital technologies and applications insurance companies and brokers can benefit from this recent market trends and reduce the number of branches. This means lower expenses and more room for maneuvering in terms of pricing strategy.

5. Reducing other operating expenses

One of the cost drivers in commercial insurance is inspections. Plants and equipment need to be inspected to validate their current status and identify relevant risks. Companies can outsource these inspections, lowering their costs.

6. Determine a realistic profit margin

Jeff Bezos famously said “Your margin is my opportunity”. This is definitely relevant in the insurance industry as identified in surveys. Venture funded companies are embracing that paradigm to set aggressive prices and gain market share. Their goal would be to dominate the market and set more profitable prices in the future when they have achieved substantial scale.

Therefore, insurers need to take various factors in the account while pricing:

- Competitors’ pricing, including some irrational moves by competitors.

- The fact that market is mature.

- High price elasticity.

It is important to note that while price is the greatest priority, it is not the only important factor that pulls the customers. Claims processing speed and effectiveness, customer service, consumer friendly digital interfaces etc. are all important factors for consumers picking an insurer. Therefore, success in these areas may help charge a higher profit margin for your products.

Further readings

You can check our selection of 3 articles on the use of digital technologies in the insurance sector:

- Ultimate Guide to Cloud Computing in the Insurance Sector: Rapid change requires effective measures. Cloud-based solutions from insurtech companies help incumbents to adopt to the new era of insurance.

- Insurtech Guide: What it is, Trends, Technologies & Challenges: This article is an introduction to the major transformation the insurance sector is experiencing thanks to the proliferation of new technologies and insurtechs.

- AI in Underwriting: Efficient & Data-driven Insurance Operations: Underwriting and risk assessment are at the heart of insurance. In this article, we highlight technological improvements that can help insurers underwrite more effectively.

You can also check our top insurance suites and top pricing software lists.

If you need more information regarding the latest in insurtech and identify top vendors, we can help.

External Links

- 1. Insurance Blog | Accenture. Accenture

- 2. Pricing strategy for P&C insurers post COVID-19 | McKinsey. McKinsey & Company

- 3. Pricing strategy for P&C insurers post COVID-19 | McKinsey. McKinsey & Company

- 4. The future of insurance underwriting | Deloitte Insights. Deloitte

- 5. Fraud Stats - InsuranceFraud.org . InsuranceFraud.org

- 6. COVID-19 Pandemic Shifts InsurTech Investment Priorities | Deloitte US.

Comments

Your email address will not be published. All fields are required.