97% of firms have been negatively affected by climate change.1 Such an issue affecting nearly all firms across all industries forces businesses to adopt sustainable management practices to remain competitive. Follow the links to see my rationale behind this selection and detailed product benchmarks.

- SAP product carbon footprint analytics

- Emitwise

- SmartTrackers

- Sphera GaBi Software

- Climatiq API

- Normative

- Greenly

- PlanA

- Coolset

- Sinai Technologies

Explore top 10 carbon footprint software which are handy tools for businesses to measure their environmental performance:

Top 7 Carbon Footprint Calculator Software/Tools

SAP product carbon footprint analytics

SAP’s product carbon footprint calculator helps organizations measure their GHG emissions across the entire value chain. This carbon accounting platform integrates with SAP S4HANA’s ERP system, which tracks various business processes, streamlining data collection for a wide range of operations, including supplier activities.

Using SAP’s CO2 monitoring dashboard, organizations can identify activities responsible for the highest carbon emissions, facilitating emission reduction efforts. Additionally, SAP offers complementary tools like truck loading and route optimization software to further support supply chain sustainability efforts.

Emitwise

Emitwise is a carbon footprint software focused on Scope 3 decarbonization for procurement. It helps companies reduce emissions by accessing supplier data, managing supplier engagement, and providing verified emissions calculations. The platform includes scorecards for benchmarking suppliers and integrating carbon reduction into negotiations to drive emissions down at the product level.

SmartTrackers

SmartTrackers is a versatile carbon accounting software that helps organizations map, manage, and improve their emissions. It supports complex calculations, making it easy to track relevant indicators and comply with regulations. The platform saves time and reduces stress during audits by ensuring clear reporting and certification.

Sphera GaBi Software

Sphera’s GaBi software is a carbon accounting solution designed to help organizations accurately measure their carbon emissions. GaBi’s hotspot analysis allows businesses to pinpoint vulnerabilities in their operations, providing valuable insights for emission reduction and risk prioritization.

Climatiq API

Climatiq’s API integrates with your company’s systems to collect emissions data from various databases, enabling precise carbon emissions calculations. This carbon accounting software is ideal for businesses seeking to incorporate carbon management into their sustainability efforts.

Normative

Normative is an all-in-one carbon footprint software that helps businesses automate emissions calculations, streamline reporting, and develop effective reduction strategies. It offers clear insights through carbon accounting, ensuring compliance with regulations like CSRD while tracking ESG metrics. The platform also supports supply chain engagement and provides expert guidance for sustainable growth and decarbonization efforts.

Greenly

Greenly is a carbon footprint software designed to help companies accelerate their climate strategy with ease. It automates data collection, matches emission factors, and provides expert-verified reports to save time. The platform offers customized dashboards for tracking progress and year-on-year comparisons, along with dedicated support and resources to guide users through their sustainability journey.

PlanA

PlanA is a carbon footprint software that helps businesses measure emissions, comply with CSRD, and achieve net-zero goals. It offers certified carbon accounting, decarbonization strategies, and expert support to develop effective emission reduction plans. The platform provides personalized services, science-based solutions, and connections to a community of sustainability experts to drive meaningful change.

Coolset

Coolset is a carbon footprint software that helps businesses measure Scope 1-3 emissions with high accuracy and speed. It provides a TÜV-certified, data-driven approach, ensuring precise calculations from financial records and offering 60% more emission insights. With Coolset, teams can collaborate easily, simulate reduction scenarios, and track progress, all while staying aligned with evolving ESG regulations and maintaining audit-ready compliance reports.

Sinai Technologies

Sinai Technologies is a leading carbon accounting platform that helps companies integrate financial planning with carbon management to reach net-zero targets. It focuses on decarbonization by identifying cost-effective strategies and setting science-based targets for emission reduction. The platform offers tools for carbon budgeting, scenario analysis, and automates GHG inventories, while also engaging the value chain to support overall emissions reduction.

Carbon Footprint Software

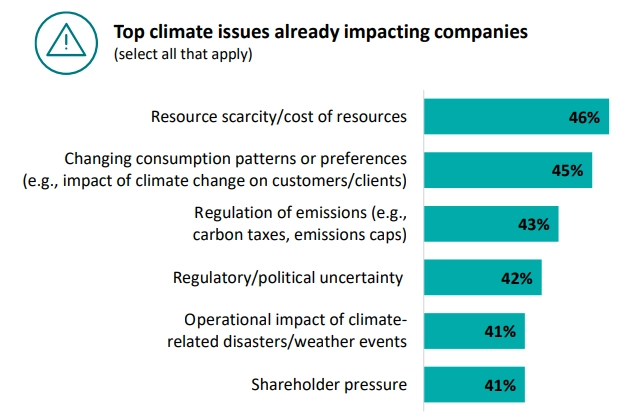

Business executives express that their firms are affected by climate change due to:2

- Resource scarcity

- Changing consumption patterns or preferences

- Regulation of emissions

- Regulatory/political uncertainty

- Operational impact of climate-related disasters

- Shareholder pressure.

Figure 1. Main reasons why climate change negatively affects corporations

Source: Deloitte3

These figures disclose a need for the transformation towards a more sustainable supply chain and management via sustainability initiatives. The progress of a company’s green initiatives must be periodically assessed using a variety of metrics, and these metrics must be publicly disclosed in ESG reports to convenience investors, consumers, and regulators. The corporate carbon footprint and greenhouse gas emissions are some of the most significant indicators in this regard.

However, calculating a product’s or corporation’s carbon footprint is a laborious and error-prone operation. Carbon footprint software helps businesses measure, track, and reduce their environmental impact, improving sustainability efforts while ensuring regulatory compliance and enhancing corporate reputation via proper sustainability reporting.

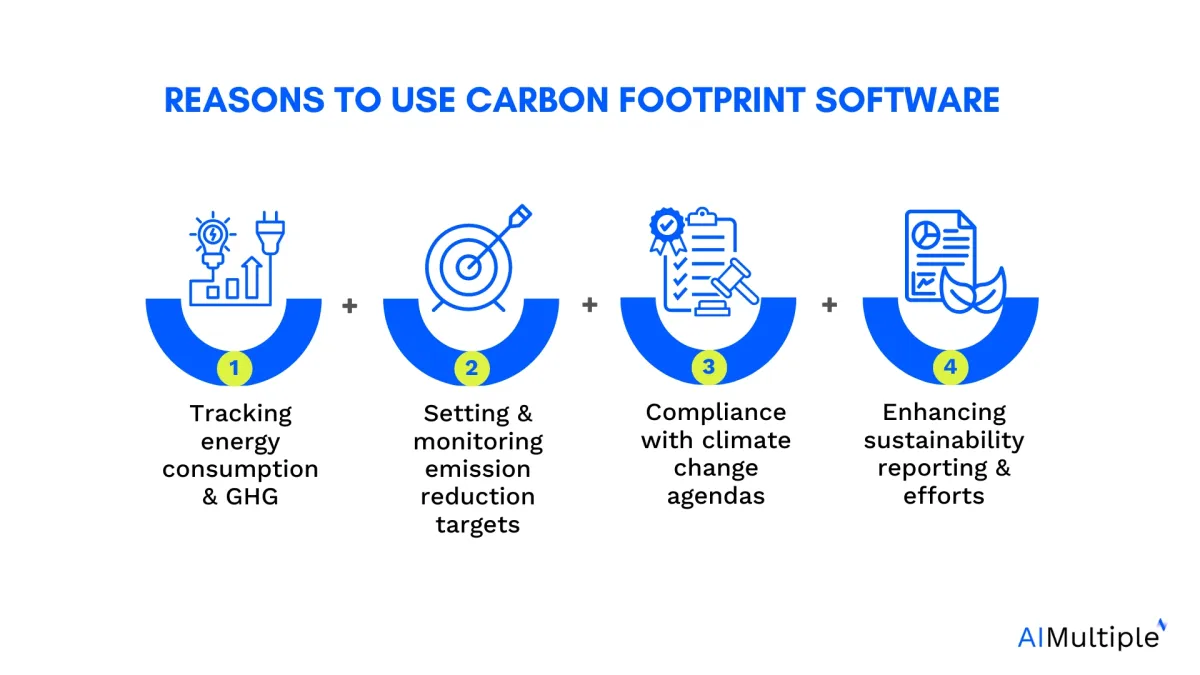

Reasons to use carbon footprint calculator tools

The use of carbon footprint software provides comprehensive tracking of carbon emissions throughout a company’s operations, including both direct emissions and indirect emissions from the entire value chain. These tools allow businesses to adopt carbon accounting processes that accurately calculate their company’s carbon footprint, contributing to better decision-making around emissions management.

1. Tracking energy consumption and greenhouse gas emissions data

Measuring and managing the energy consumption of your company is possible with carbon footprint software

With carbon accounting software, businesses can monitor greenhouse gas (GHG) emissions, ensuring adherence to the greenhouse gas protocol and measuring emissions from various sources, including carbon dioxide emissions and other indirect emissions. This helps in accurately assessing a company’s environmental impact.

Calculating a carbon footprint requires knowledge of numerous specific emission factors. The formula for carbon footprint is multiplying units of business operations by certain emission variables. To calculate corporate carbon footprint or product carbon footprint, Businesses have to know numerous, specific emission factors, such as:

- Kilowatt-hour emission factor for power use. This varies from one place to another and from one time to another because the weight of green energy generation within the total energy supply changes accordingly.

- Emission factor for a metric cup of natural gas consumption.

- Emission factors of a kilogram of raw materials you use for production, etc.

Firms can use open databases such as EPA,4 Defra,5 Higg Index,6 etc. to get these specific emission factors. But it’s a time-consuming task since such information is already available on carbon footprint calculators’ data-set.

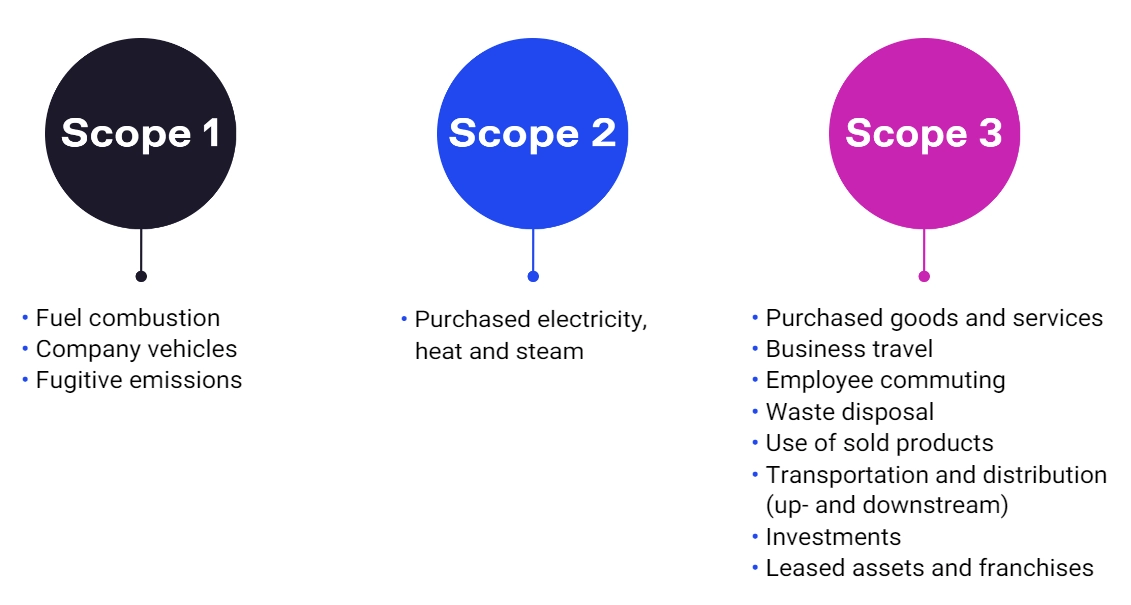

Measuring scope 3 GHG emissions is easier with carbon footprint software

Carbon emissions from supply chain operations in the upstream and downstream fall within scope 3 GHG emissions. For instance, if you utilize intermediary goods in your manufacturing, suppliers’ energy use for production and the delivery of intermediary goods will have an impact on your carbon footprint.

Figure 2. Supply chain scope 1, 2 and 3

Source: Carbon Trust7

As you can notice, it is difficult to calculate this indirect GHG emission because you need data from your suppliers and clients. Carbon footprint calculators can help with this problem by:

- A few carbon footprint software (like SAP’s) can integrate with ERP platforms. These ERP systems give your businesses access to your upstream and downstream supply chains if your clients and suppliers use these management tools, and let you see their data.

- Therefore, you can effortlessly calculate scope 3 GHG emissions.

- Since carbon calculator tools are used by numerous companies across numerous industries, they have vast databases for showcasing the relationship between carbon footprint, and factors such as:

- The industry the company is active in.

- The company’s number of employees.

- The country in which the company is active,

- The delivery method and distance of intermediary and final products, and more.

Thus, they can estimate your Scope 3 emission with more confidence and accuracy than if you were to do it manually.

2. Setting and monitoring emission reduction targets

Companies can use the best carbon accounting software to establish and track their emission reduction targets. Carbon footprint calculation tools offer data analysis and emissions measurement, helping firms to forecast future emissions and strategize for net zero emissions.8

3. Compliance with climate change agendas

“Taking urgent action to combat climate change and its impacts” is one of The 2030 Agenda for Sustainable Development goals of the UN.9 To meet global climate targets, firms need comprehensive carbon accounting software that helps manage compliance with climate policies.

As part of their carbon agenda, organizations need to measure carbon dioxide equivalents and other emissions data, ensuring that they meet reduction targets laid out in national and international regulations.

4. Enhancing sustainability reporting and efforts

Carbon accounting software platforms integrate with existing management systems to improve sustainability reporting. This helps firms communicate their sustainability initiatives to both internal and external stakeholders, showcasing their efforts to reduce emissions and achieve a lower corporate carbon footprint.

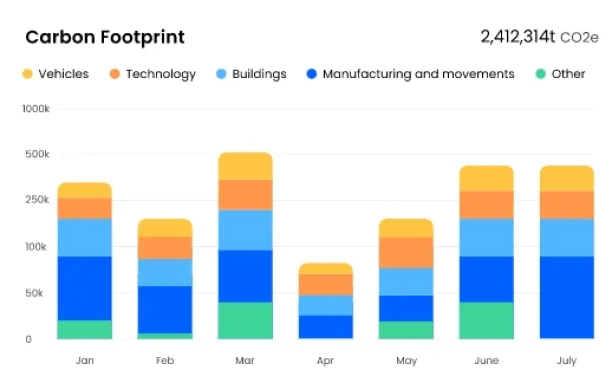

After calculating the company’s carbon footprint, you can analyze it to identify areas that need improvement and take steps to address them to reduce your carbon footprint. Thanks to the data visualization feature, this carbon accounting software can help businesses. Thus, you can more effectively decide investment strategies towards net zero.

Figure 3. Example of how carbon footprint calculators visualize data

Source: Net010

Moreover, some carbon accounting tools have AI capabilities that can suggest green recommendations as they interact more with inflows of data.

For more: Sustainability Case Studies and Success Stories.

FAQs

What are some of the benefits of footprinting software?

Footprinting software offers key benefits like precise carbon emissions calculations and greenhouse gas accounting, using leading carbon accounting platforms. It enables data collection, emissions measurement, and analysis of carbon data, helping businesses accurately measure their carbon footprint, including indirect emissions.

These tools integrate with financial accounting and risk management software, supporting sustainability efforts by enabling emission reduction targets and carbon management. Choosing the right carbon accounting software ensures better compliance with climate regulations, promotes business growth, and enhances safety and liability reduction.

External Links

- 1. Deloitte 2024 CxO Sustainability Report | Deloitte.

- 2. Deloitte 2024 CxO Sustainability Report | Deloitte.

- 3. Deloitte 2024 CxO Sustainability Report | Deloitte.

- 4. Data | US EPA.

- 5. Department for Environment, Food & Rural Affairs - GOV.UK.

- 6. Tools Higg Index | Worldly. Worldly

- 7. What are Scope 3 emissions and why do they matter? | The Carbon Trust.

- 8. Bhatia, M., Meenakshi, N., Kaur, P., & Dhir, A. (2024). Digital technologies and carbon neutrality goals: An in-depth investigation of drivers, barriers, and risk mitigation strategies. Journal of Cleaner Production, 451, 141946.

- 9. TRANSFORMING OUR WORLD: THE 2030 AGENDA FOR SUSTAINABLE DEVELOPMENT. United Nations. Accessed: September/11/2024.

- 10. Net0 | Enterprise AI Platform for Corporate Sustainability.

Comments

Your email address will not be published. All fields are required.