In 2025, people are projected to consume 1.8 times more resources than Earth generates annually because our economic outlook is based on production, use, and disposal.1 According to the Edelman Trust Barometer, around half of individuals think businesses in the U.S. are not doing enough to address innovations such as green energy.2

All of these trends and my academic researches highlighted the need for a more holistic management perspective and execution than the current management approach.

Explore the sustainable management concept, importance of it and top 10 best practices in depth:

What is sustainable management?

Sustainable management means running a business while thinking about people, the planet, and long-term profit. It’s about making smart choices today so we don’t harm future generations or the business itself.

However, research on corporate sustainability management suggests that many corporations’ profits are based on a lack of understanding of environmental and societal challenges.3 which is not sustainable since

- The Earth’s resources are limited.

- People care about how companies treat the planet and others.

- Environmental lawsuits are becoming more common.4

Sustainable management researches aim to find answers on how we may meet our needs without harming current and future generations’ natural and social resources. Three elements constitute sustainable management:

Long-term profit and economic growth

From an economic standpoint, sustainability management emphasizes the importance of considering long-term growth. Because of the agency issues,5 many businesses focus on short-term gains,6 but sustainable practices encourage organizations to consider future consequences.

A company’s sustainability management plan is integral to managing long-term growth by reducing costs,7 increasing efficiency, and improving profitability over time. This approach benefits both businesses and stakeholders by promoting the sustainable development of financial resources. As most companies have realized, future profitability often depends on addressing sustainability efforts today.

Environmental sustainability

The concept of environmental sustainability emphasizes the need to manage natural resources responsibly, considering that Earth’s resources and waste capacity are finite. To avoid depleting these resources and to mitigate the negative impacts of business operations, sustainability managers and organizations must develop and implement sustainability strategies that address their environmental footprint.

This includes

- Adopting circular economy practices,

- Minimizing corporate carbon footprint and

- Ensuring supply chain sustainability to minimize its environmental burden.

Companies are also tasked with complying with local environmental regulations and focusing on reducing air pollution, including GHG emissions, and energy consumption. By incorporating environmental science and sustainable practices into their sustainability management plans, businesses contribute to environmental protection and address the challenges of climate change and resource conservation.

Societal sustainability management

Sustainability management also includes societal sustainability, which is vital for creating a productive and harmonious workplace.8 Companies should treat their employees fairly and create a culture of respect and inclusion.

Social sustainability means:

- Promoting equality (for example, closing the gender pay gap),

- Supporting employee well-being,

- Measuring social progress.

When businesses focus on people, it builds trust, reduces conflict, and makes both workers and customers happier.

Importance of sustainable management

Corporate life aspects

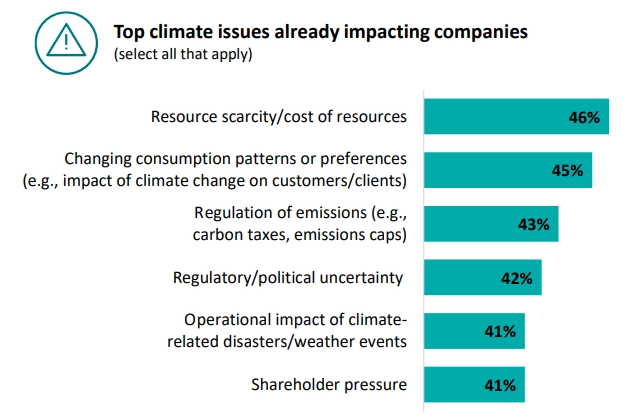

According to Deloitte, almost all businesses are impacted by climate change and environmental issues, either directly or indirectly,9 as a result of:

- Resource scarcity

- Changing consumption patterns or preferences

- Regulation of emissions

- Regulatory/political uncertainty

- Operational impact of climate-related disasters

- Shareholder pressure

Figure 1: Top 5 climate change-related issues that affect businesses

Source: Deloitte10

According to the report, more than 70% of executives feel concerned about climate change, which threatens more than their businesses.

Society aspects

Traditional gender biases affect investor and corporate decisions from hiring to investment.11 From a societal standpoint, nearly half of women consider that a company’s stance on gender issues influences their decision.12

Unfortunately, gender inequality is only one of the social challenges. Almost 60% of the individuals worry about experiencing prejudice or racism, which shows the effect of discrimination in society.13

When we consider job environments that are exclusionary based on race, gender, lifestyle, and other factors, it means that organizations that are less concerned about social problems are missing out on a significant portion of the population as potential employees.

Sustainability management system

A Sustainability Management System (SMS) helps companies manage their impact on the environment and society. It brings together tools, processes, and data to track, measure, and improve sustainability performance.14

An SMS makes sustainability part of everyday business. It helps companies:

- See what resources they use and how to reduce them,

- Find where they can cut pollution or emissions,

- Ensure social fairness and improve workplace conditions,

- Make decisions based on facts, not guesswork.

With this system in place, companies are better equipped to meet both today’s needs and tomorrow’s challenges.

The goal is to help companies make better decisions that support both their business and the planet over the long term.

Top 10 sustainable management best practices

1. Take a holistic approach

Look at the entire system. Can your waste be someone else’s raw material?

Real-life example:

Waterhaul sources its sunglasses from ghost nets in the ocean.15

2. Track key metrics periodically

Use clear numbers to measure your impact: carbon footprint, natural resources use, pay ratios, etc.

3. Focus your efforts

Start with your biggest issues. For example, if your emissions are high, tackle that first.

4. Create a roadmap

Design a plan that fits your industry and goals. Your strategy should guide every step.

5. Work with others.

Team up with sustainable partners. A supplier code of conduct can help you avoid bad practices.

Real-life example:

Starbucks faced backlash for sourcing from a supplier using child labor.16

6. Update hiring practices

Hire people with sustainability backgrounds. Use blind hiring to avoid bias.

7. Build a supportive corporate culture

Offer training and awareness programs. Everyone should understand why sustainability matters.

8. Use a product-as-a-service model

Rent or lease products instead of selling them. This extends product life and saves resources.

9. Support carbon offsetting

You can assist green initiatives through carbon offset credits while your company works toward achieving the appropriate degree of sustainability. You can nudge your customers to be part of your carbon offset strategy.

Real-life example:

KLM’s passengers can pay an extra fee for supporting KLM’s reforestation initiative.17

10. Get international 3rd party certificates

Many businesses engage in greenwashing (i.e. using sustainability in their marketing without changing their business practices). ISO, GRI, SAAB, etc., provide international certificates that verify sustainability achievements of your business from a 3rd party perspective and ensure that you work towards globally accepted sustainability goals.

You can read our article on sustainability case studies to see real-life implementations of sustainable management.

You can also read our Top 7 Carbon Footprint Calculator Software/Tools for Businesses to find a tool for automating your carbon footprint assessment.

External Links

- 1. Earth Overshoot Day – Geneva Environment Network.

- 2. 2024 Edelman Trust Barometer | Edelman.

- 3. Bocken, N. M., & Short, S. W. (2021). Unsustainable business models: Recognising and resolving institutionalised social and environmental harm. Journal of Cleaner Production, 312, 127828.

- 4. Global trends in climate change litigation: 2024 snapshot - Grantham Research Institute on climate change and the environment.

- 5. Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency cost and ownership structure. Journal of Financial Economics, 3, 305–360.

- 6. Graham, John R., Campbell R. Harvey, and Shiva Rajgopal. 2005. The economic implications of corporate financial reporting. Journal of Accounting and Economics 40: 3–73.

- 7. Hart, S. L. 1995. A natural-resource-based view of the firm. Academy of Management Review, 20: 986- 1014.

- 8. Rezapouraghdam, H., Alipour, H., & Arasli, H. (2019). Workplace spirituality and organization sustainability: a theoretical perspective on hospitality employees’ sustainable behavior. Environment, Development and Sustainability, 21, 1583-1601.

- 9. Deloitte 2024 CxO Sustainability Report | Deloitte.

- 10. Deloitte 2024 CxO Sustainability Report | Deloitte.

- 11. Adams, S., A. Gupta, D. Haughton and J. Leeth (2007). Gender differences in CEO compensation: evidence from the U.S., Women in Management Review, 22, 208–224.

- 12. The 3 Things Women Want In The Workplace In 2021.

- 13. 2022 Edelman Trust Barometer Global Report. Edelman Trust Institute.

- 14. https://majorsustainability.smeal.psu.edu/sustainability-management-systems/

- 15. Recycling Ocean Plastic & Ghost Fishing Gear into sustainable products– Waterhaul. Waterhaul

- 16. Children as young as eight picked coffee beans on farms supplying Starbucks. The Guardian.

- 17. Why we support nature regeneration projects and how to help - KLM Germany. KLM Royal Dutch Airlines Germany

![Top 6 Circular Economy Best Practices for Businesses ['25]](https://research.aimultiple.com/wp-content/uploads/2022/02/Circular-Economy-Best-Practices-1-1-190x107.png.webp)

Comments

Your email address will not be published. All fields are required.