Companies conduct online research to understand their customers better, and customers who have internet access can participate in surveys conducted online. However, gathering online data is more difficult than it appears. According to one study, the average response rates for online surveys in the US, the UK, and the Netherlands are 46%, 36%, and 33%, respectively.

To help business leaders and researchers improve their survey response rates, in this article we review the top 11 challenges of conducting online surveys and propose solutions to overcome them.

11 online survey challenges

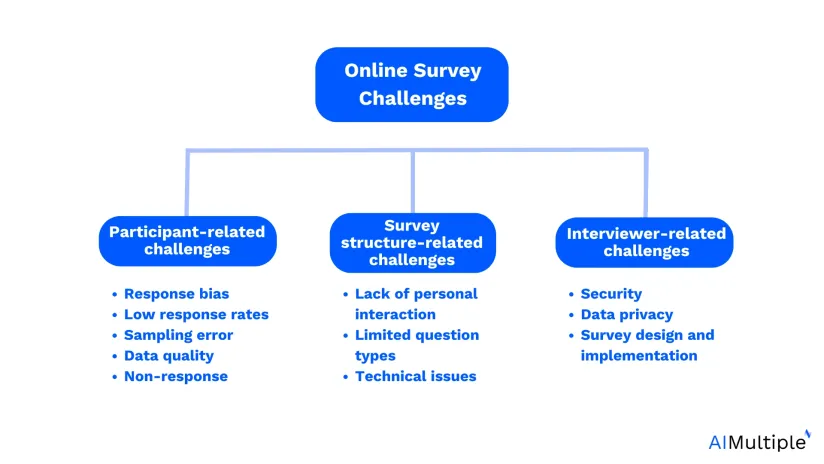

Online survey challenges are broadly grouped into three categories: challenges related to participants, survey structure, and the interviewer’s approach. Understanding these challenges is essential for gathering reliable data when conducting surveys online, and for leveraging the full advantages of online survey methods.

Participant-related challenges

1- Response bias

One of the major online survey challenges is response bias, where participants may either abandon the survey or fail to answer questions truthfully, potentially distorting survey results and affecting data validity. Ensuring respondents provide honest answers is crucial for reliable data collection.1

2- Low response rates

Low response rates are another common challenge in online data collection, as it can be difficult to motivate respondents to complete the survey in full. This can lead to an unrepresentative sample and compromise the statistical significance of the findings.2

3- Sampling error

Online surveys often rely on self-selection, which can lead to sampling bias, particularly if certain segments of internet-based populations are either overrepresented or underrepresented. Addressing this bias is important for obtaining data that accurately represents the target audience.

4- Data quality

Data quality can suffer when participants intentionally provide incorrect responses or rush through the survey, resulting in low-quality survey data. Errors from human participants, either through misunderstanding or deliberate misinformation, may impact the overall reliability of the survey.

5- Non-response

Non-response is a frequent issue in online survey research, as some participants may leave the survey incomplete or ignore certain sections. This lack of complete responses can disrupt the consistency and completeness of the collected data, leading to biased survey results.

Survey structure-related challenges

6- Lack of personal interaction

Unlike in-person interviews or focus groups, online surveys limit the ability for interviewers to interact directly with respondents. This can restrict the depth of insights gained, as there is no opportunity to ask follow-up questions or clarify responses based on body language or other cues.

7- Limited question types

Web-based surveys often rely on structured questionnaire formats, including multiple-choice or Likert scale questions, which may not be effective for capturing complex or qualitative insights. In comparison, traditional methods like paper surveys and focus groups offer more flexibility for exploring nuanced responses.

8- Technical issues

Technical challenges, such as slow internet connectivity, website crashes, or mobile compatibility problems, can prevent participants from completing surveys online. This highlights the need for robust online survey tools that ensure smooth data collection across various online channels.

Interviewer-related challenges

9- Security

Security is a significant concern in online survey research, as survey data collected online may be vulnerable to hacking or unauthorized access. Ensuring the integrity and confidentiality of survey responses requires secure online technology and adherence to strict data protection protocols.

10- Data privacy

Web surveys frequently involve collecting personal or sensitive information. Compliance with data privacy laws, such as GDPR, is essential to protect participant confidentiality. This can involve using consent forms and limiting the sharing of survey data to safeguard participant privacy.

11- Survey design and implementation

Effective survey design and implementation are vital for minimizing response bias and achieving a representative sample. The structure of online questionnaires must be carefully crafted to ensure questions are easy to understand and the survey flow engages participants effectively, avoiding survey fatigue and maximizing response rates.

These challenges underscore the importance of thoughtful planning and the use of reliable online survey tools to optimize data quality and overcome the limitations inherent in conducting surveys online.

Solutions for improving online survey research

1- Partner with crowdsourcing agencies

You can transfer the burden of the challenges to a third-party service provider. Crowdsourcing agencies handle the challenges of web surveys by

- providing participants with incentives

- improving the user experience

- enhancing the survey design

- using multiple channels to reach participants (e.g., social media, in-app notifications)

- providing secure data collection and storage

- maintaining compliance with data privacy

- offering participants technical assistance

These strategies help to minimize response bias, increase response rates, and ensure accurate and representative survey results.

For those interested, here is our benchmarking study on survey participant recruitment services.

2- Implement qualitative survey research techniques

Figure 1. Types of qualitative research methods

Source: HubSpot3

Figure 1. Types of qualitative research methods

Incorporating qualitative survey research techniques into online surveys can boost their quality by improving survey design, increasing data accuracy, and allowing for a more nuanced interpretation of the results. This results in a more accurate and representative picture of the population under investigation.

3- Use big data and AI technologies

Big data and AI technologies can greatly improve online surveys for corporations by:

- analyzing large amounts of data

- overcoming sample size limitations

- improving data quality

- improving and automating data analysis.

These technologies can aid in producing more accurate and representative results, lowering the risk of sampling error and response bias while also informing business decisions for growth.

Here is also our data-driven vendor list of survey participant recruitment services.

External Links

- 1. Callegaro, M., & Manfreda, K. L. (2017). et V. Vehovar,«Web survey methodology». Revista española de investigaciones sociológicas, 157, 165-169.

- 2. Bowling, A., & Windsor, J. (2008). The effects of question order and response-choice order on responses to a questionnaire. Journal of Public Health, 30(2), 199-204.

- 3. 5 Qualitative Research Methods Every UX Researcher Should Know [+ Examples] .

Comments

Your email address will not be published. All fields are required.