A recent survey found that 65% of travel industry leaders see chatbots and virtual assistants as the most significant applications of generative AI.1 Chatbots act as personal travel assistants, helping customers find flights and hotels, offering budget-friendly options, and recommending tailored packages and promotions.

We investigated the benefits of chatbots and their top 8 use cases in the travel industry.T

Top 5 travel chatbots

| Vendor | Key Feature for Travel | Number of Reviews | Rating |

|---|---|---|---|

| Zoho SalesIQ | Unified travel platform | 372 | 4.4 |

| Zendesk Support Suite | Smart chat automation | 9,735 | 4.3 |

| FreshChat | Booking engine sync | 541 | 4.3 |

| Verloop.io | Instant booking updates | 236 | 4.7 |

| Yellow.ai | Smart itinerary planner | 106 | 4.3 |

*Apart from our sponsor, who is at the top of the list, the table is sorted according to the number of reviews taken from G2.

Pricing

The enterprise pricing of the vendors is not publicly available, so you need to contact each vendor for a quote tailored to your specific needs. However, Zoho SalesIQ has a fixed rate. Zoho SalesIQ charges €20 per operator per month, billed annually.

Common features of travel chatbots

Most chatbot solutions offer a core set of functionalities, including:

- Live chat and messaging: Enables real-time text and sometimes voice user interactions.

- Basic AI & natural language processing (NLP): Provides the ability to understand and process user inputs.

- Omnichannel support: Integrates across various platforms, such as websites, mobile apps, email, and social media.

- CRM & system integrations: Connects with customer relationship management systems and other business applications.

- Analytics and reporting: Tools to track user interactions, engagement, and overall performance.

- Automation and workflow management: Automates responses, ticketing, and routing systems for a seamless support experience.

If you think a chatbot doesn’t meet your business needs, but you still want to implement AI, consider checking out our conversational AI guide.

Key benefits of travel chatbots

1. Empathetic and personalized customer experience

Friendly chatbots enhance customer experiences by improving lead generation and retention.

Example

GRT Hotels & Resorts chatbot managed over 175,000 messages in 2.5 months, with 84% of users sharing contact details and 40% indicating intent to book. Integrating with CRM and booking systems allows for real-time personalization and tailored recommendations.

2. Streamlined booking and operational efficiency

Travel chatbots simplify the booking process by handling multiple inquiries simultaneously, reducing wait times and manual errors. This automation saves costs and optimizes human resource allocation. Chatbots also manage bookings, facilitate cancellations and changes, and address luggage inquiries, improving operational efficiency.

Example

Expedia’s conversational trip planner allows users to request destination recommendations and itineraries using natural language queries, enhancing the booking experience.

3. Continuous availability and scalability

AI chatbots provide instant, 24/7 responses across various channels, enhancing customer satisfaction. They can scale during peak times without additional staffing, ensuring consistent service regardless of demand.

Example

Yellow.ai provides AI-driven travel chatbots that deliver 24/7 customer support, ensuring travelers receive prompt assistance anytime. These chatbots manage multiple inquiries simultaneously, effectively scaling during peak travel periods without requiring additional staffing.

4. Multilingual communication and global reach

By supporting multiple languages, AI chatbots eliminate communication barriers, broadening market reach and accessibility for international travelers.

Example

The zIA chatbot, designed for tourists in Italy, supports multiple languages and offers personalized information and recommendations for both Italian and foreign visitors.

5. Real-time updates and proactive communication

Chatbots offer timely updates on flight delays, gate changes, and hotel check-ins, reducing travel-related stress and boosting customer satisfaction.

Example

Instalocate is a flight-tracking chatbot that uses AI to deliver real-time updates on flights, hotel availability, and travel conditions. Users can subscribe to receive alerts about disruptions, such as delays and cancellations, helping to reduce travel stress and enhance their experience.

Top 8 chatbot use cases in travel

1. Search for booking opportunities

Through various platforms like WhatsApp, Slack, and Facebook Messenger, chatbots assist users in exploring booking options by answering questions and filtering options based on specific criteria, such as budget, flexibility of dates, or room preferences.

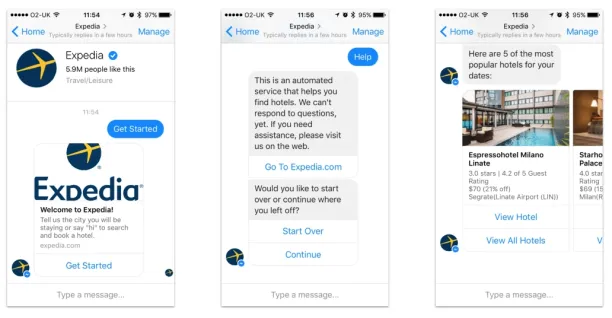

For example, Expedia offers a Facebook Messenger chatbot to enable users to browse hotels worldwide and check availability during specific periods.

Figure 1: Expedia’s Facebook Messenger chatbot conversation2

2. Manage inquiries

Before making travel plans, users may have questions regarding travel insurance, requirements, restrictions, estimated road tolls, and more. Chatbots can address frequently asked questions and manage these inquiries without needing a live agent.

Real-life example

Zoho SalesIQ offers AI-powered chatbots to handle travel inquiries efficiently. These chatbots answer common questions about travel insurance, requirements, restrictions, and road tolls, reducing the need for live agents. By using advanced natural language processing, they interpret user inputs and provide accurate information, helping travelers make informed decisions while enhancing customer satisfaction and streamlining support for travel businesses.

Figure 2. Zoho SalesIQ advertisement3

3. Complete reservations

When users finalize the details of their travel plans, such as selecting a flight or booking a hotel, the chatbot can prompt them for important information, including ID or passport details and the number of children traveling with them. Additionally, the chatbot offers a payment gateway for travelers to complete their payments, thereby finalizing their reservations. Once the payment is processed, it sends an electronic itinerary via email or message and provides a secure channel for credit card transactions.

Real-life example

HotelPlanner.com introduced AI travel agents capable of engaging in realistic conversations in 15 languages. In their first month, these AI agents managed 40,000 inquiries, generating £150,000 in revenue, demonstrating their effectiveness in processing bookings seamlessly

Figure 3. Hotelplanner’s AI hotel booking assistant4

4. Cross-sell

AI-enabled chatbots can analyze user behavior to identify opportunities for cross-selling. They can offer packages that include flights, hotels, car rental options, and discounts on tours and activities. Additionally, these chatbots can recommend restaurants or cafés that partner with the travel agency and provide related coupons. This strategy benefits both companies and users: it enhances the user experience while boosting business revenues by promoting hidden gems and unique experiences at travel destinations.

Real-life example

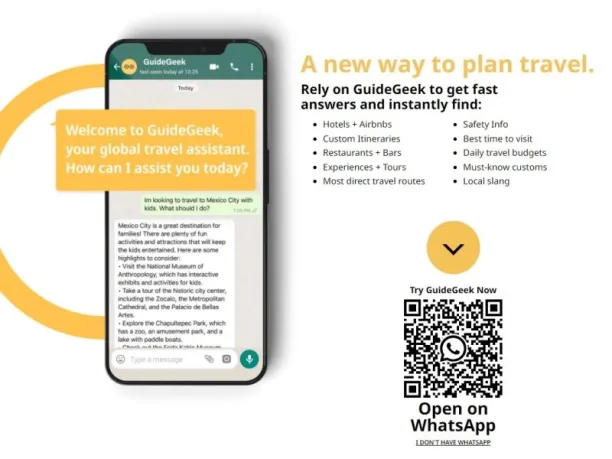

GuideGeek, an AI-powered travel assistant, provides personalized recommendations for accommodations, dining, and activities based on user preferences, thereby enhancing the travel experience and encouraging additional services.

Figure 4. GuideGeek’s chatbot advertisement5

5. Manage bookings

Chatbots streamline booking management tasks, such as online check-ins, changing dates, seat selection, or arranging special accommodations like wheelchair access, significantly reducing user effort.

Real-life example

Virgin Australia’s AI system, Rapid Rebook, suggests the best alternative flights when a passenger’s original flight is disrupted, based on factors like the traveler’s route and trip duration.

Figure 5. Virgin Australia’s Rapid Rebook advertisement6

6. Manage cancellations

Chatbots can facilitate reservation cancellations without handovers to live agents. The chatbot will ask for the customer’s information and reservation codes or passenger name record (PNR), and it then can cancel the user’s reservations, recommend substitutions for canceled flights or hotels, provide information about refund and return policies, and create claims for those refunds.

Real-life example

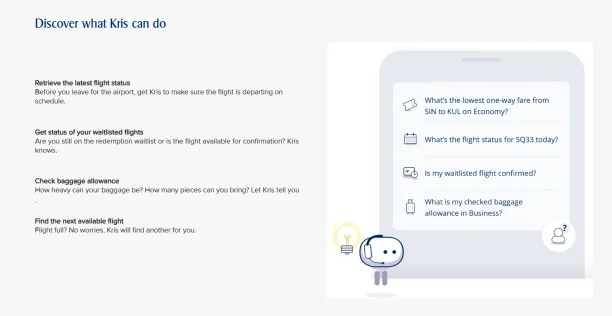

Singapore Airlines’ chatbot, Kris, simplifies the management of flight cancellations and changes. When passengers need to cancel or modify a booking, Kris efficiently processes the request by locating the reservation, initiating refunds, or suggesting alternative flight options. This automation offers travelers prompt and accurate assistance during disruptions.

Figure 6. Singapore Airlines’ Kris information ad7

7. Manage luggage inquiries

Chatbots usually have access to real-time data from airports or departure stations. This allows travelers to inquire about the luggage claim area upon arriving at their destination and to find out which carousel their baggage will be on. Additionally, in the event of lost luggage, chatbots can help create a luggage claim using the user’s information and ticket PNR.

Real-life example

Changi Airport Group in Singapore has been testing AI and machine learning to expedite hand luggage screening and improve the efficiency of luggage handling processes.

Figure 7. Changi Airport’s Baggage Tracker advertisement8

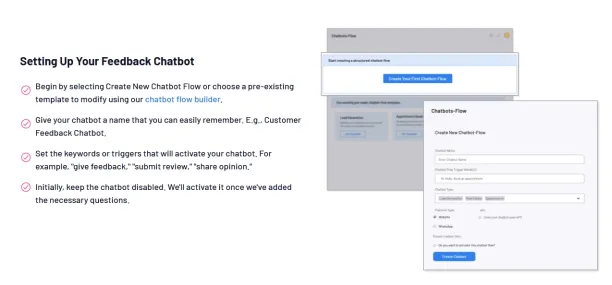

8. Collect customer reviews

Chatbots effectively collect customer feedback after services by engaging users in conversational surveys, which helps improve service quality through actionable insights. Once a reservation or service is completed, the chatbot can ask users questions about their experience, such as, “On a scale from 1 to 10, how satisfied are you with this travel agency’s services?” or “Would you recommend this agency to a friend?” Additionally, it can prompt users to comment on how the services can be enhanced.

Real-life example

Robofy’s travel chatbot is designed to enhance customer engagement and streamline operations for travel businesses. It stands out by collecting and analyzing customer feedback after their travels. The chatbot gathers valuable insights into customer satisfaction and preferences by engaging travelers in conversational surveys. This enables businesses to better understand their clients and improve their services accordingly.

Figure 8. Robofy’s feedback flow creation process9

Future of travel chatbots

Thanks to investments in the chatbot industry, chatbot success is increasing daily. However, training and testing chatbots accurately is the key to avoiding chatbot failures. The future of travel chatbots is characterized by increasing user acceptance, significant investments, and technological advancements.

Growing user acceptance

Recent survey statistics show a rising comfort level among consumers with AI-driven travel planning tools. For instance, a survey conducted in November 2024 revealed that 40% of consumers worldwide reported using AI-based tools for travel planning.

- Additionally, a 2024 MoneyLion survey found that approximately 70% of respondents are currently using or planning to use AI for trip planning, with this figure increasing to 81% among those traveling with children.

These statistics indicate a growing enthusiasm for AI chatbots in the travel industry, enhancing customer experiences and streamlining the planning process.

Adoption by major travel companies

Leading global brands have integrated AI chatbots to improve customer interactions:

- Expedia utilizes AI chatbots to assist users in finding destinations, planning itineraries, and discovering activities, thereby simplifying the travel planning process.

- HotelPlanner.com introduced AI travel agents capable of engaging in realistic conversations in 15 languages.

FAQ

How do travel chatbots enhance the booking experience?

AI-powered chatbots streamline the booking process by instantly handling customer inquiries, completing reservations, and providing personalized recommendations based on previous interactions and user data points. This saves time and ensures a seamless customer journey.

How do AI-powered chatbots use artificial intelligence to personalize trip planning?

AI-powered chatbots analyze chat history and previous interactions to deliver highly personalized recommendations tailored to individual users’ travel styles and preferences. Through seamless integration with booking systems, they enhance user engagement by providing tailored travel tips, improving the overall traveler experience.

What features make a chatbot user-friendly for travel businesses?

A user-friendly chatbot typically features a drag-and-drop interface for easy customization, supports seamless payments directly through the chatbot conversation, and allows customers to manage bookings without app switching. These chatbots also offer instant support across various communication channels, creating smooth transitions between automated and human support when complex issues arise.

Can AI chatbots entirely replace human agents in a travel business?

While AI-driven chatbots efficiently handle routine tasks and customer inquiries, human agents are essential for addressing complex issues that require a personal touch. The effective integration of chatbots and human support teams ensures smooth transitions and personalized interactions throughout the traveler experience.

Further reading

External Links

- 1. Travel market: top Gen AI implementations worldwide 2024| Statista. Statista

- 2. https://cdn-gcp.new.marutitech.com/expedia-chatbot-1.png

- 3. Zoho SalesIQ | Die Plattform zur Kundengewinnung und -pflege für Ihr Unternehmen.

- 4. AI Hotel Booking Assistant by HotelPlanner (World's First).

- 5. https://guidegeek.com/

- 6. Rapid rebook.

- 7. Kris the Chatbot | Singapore Airlines.

- 8. Baggage Tracker.

- 9. Chatbot for Feedback Collection | Collect & Analyze Customer Feedback Instantly .

Comments

Your email address will not be published. All fields are required.