Dynamic pricing is a method used by business leaders, such as Amazon and Airbnb, to optimize their pricing strategy according to market and consumer data in order to attract more customers and increase profit.

In this article, we explore the algorithms underlying dynamic pricing and how to choose the most suitable one for your business.

What is dynamic pricing?

Dynamic pricing strategies, also called surge pricing, demand pricing, real-time pricing or algorithmic pricing is where the price is flexible based on demand, supply, competition price, subsidiary product prices. Price may even change from customer to customer based on their purchase habits. Dynamic pricing enables suppliers to be more flexible and adjusts prices to be more personalized.

What is a dynamic pricing algorithm?

A dynamic pricing algorithm or sometimes called algorithmic pricing is the set of inputs and instructions underlying any dynamic pricing strategy. Dynamic pricing algorithms input data about a product/service and output what would be an optimal price for it within given circumstances in order to maximize the vendor’s profits while maintaining customers.

Dynamic pricing algorithms leverage historical data about:

- Product prices

- Production costs

- Market trends

- Customers’ purchase behavior

Modern algorithms may also include real-time data about competitors’ prices and stocks collected from online websites using:

Sponsored:

Bright Data’s Web Scraper extracts public data about products from targeted websites in almost real-time and delivers it to users on autopilot in the designated format, such that businesses can input this data into their dynamic pricing algorithms.

The following video demonstrates how Bright Data’s data collector can be used to extract travel pricing data from travel agency websites:

To learn how to leverage scraped travel data, check out 5 Common Web Scraping Applications in the Travel Industry

How does a dynamic pricing algorithm work?

Dynamic pricing algorithms work by estimating the dependency of a price on-demand in the following manner:

- Processing historical sales and price data, pricing points, and current market demand (e.g., data about wrapping paper during Christmas)

- Identifying significant parameters that the price depends on. For example, “school opening” is a parameter that affects stationery sales.

- Generating a mathematical model based on significant parameters.

- Rerun the model using new data (when available)

What are the models of dynamic pricing algorithms?

Depending on the mathematical model, businesses can create numerous algorithms that fit their dynamic pricing strategy. Here are a few approaches compiled from research articles:

1. Bayesian model

In a Bayesian model, the user picks a prior value indicating the initial belief about the possible price. Then, whenever a new data point is entered into the algorithm, the initial belief shifts either higher or lower. This type of dynamic pricing model uses historical pricing data as the most important feature to decide on the final price, like a typical pricing algorithm.

2. Reinforcement learning model

Reinforcement learning (RL) is a goal-directed dynamic pricing model which aims to achieve the highest rewards by learning from environmental data. An RL dynamic pricing model analyzes data regarding customers’ demand, taking into account seasonality, competitor prices, and the uncertainty of the market, to achieve a revenue optimal price.

A common method used in RL-based pricing systems is the policy gradient approach. It directly optimizes the pricing policy by adjusting parameters to increase the expected return.

3. Decision tree model

Decision trees are classification machine learning models that output a tree-like model of decisions and their possible consequences, including the possibility of a certain outcome, resource costs, and utility.

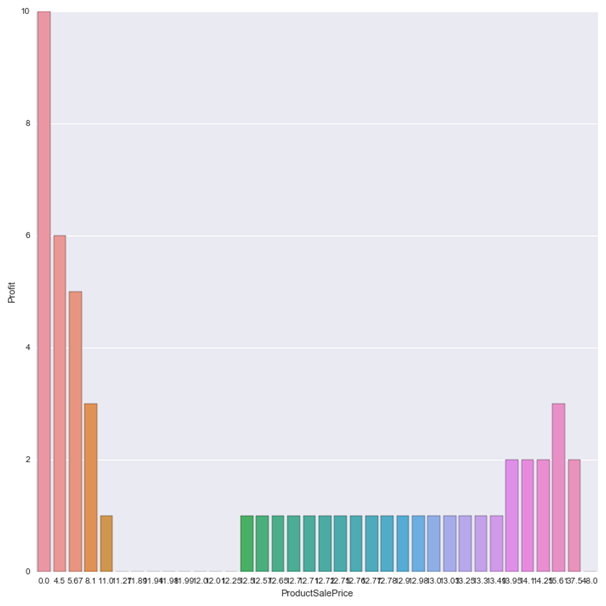

Decision tree dynamic pricing algorithms help businesses understand which parameters have the most effect on the prices and which of these price ranges predicts the highest revenues, and using this information, the algorithm predicts the best price range for each product.

What are some examples of companies using dynamic pricing?

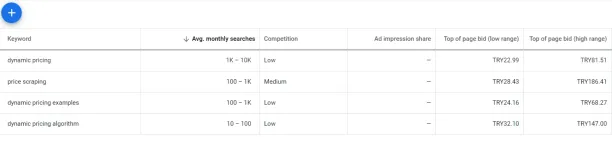

Google Ads

Google leverages dynamic pricing for optimizing the prices of Google Ads. The price for a Google ad changes according to what business competitors are bidding for the keywords, locations, industry, and audiences. For instance, creating an ad targeting competitive keywords or keywords with high bids will cost more than keywords with low competition. However, the potential ROI may also be higher.

Airbnb

Airbnb is one of the most popular home rental marketplaces. To determine stay prices for similar properties, Airbnb’s dynamic pricing algorithm inputs variables such as:

- Seasonality

- Supply and demand

- Day of the week

- Special events and festivals

- Number of days left to book

- Historical performance of users’ listings

- Competitor occupancy and prices

- Number and quality of property reviews

Airbnb offers its own dynamic pricing tool “Smart Pricing” to hosts to help them automate the pricing of their properties in a more profitable manner.

Airlines

Airlines are the earliest adopters of dynamic pricing. A ticket for the exact same flight with the same destination and at the same date can have a number of different prices for different customers.

Because airline sales moved online earlier than other categories and because airlines are expected to charge different prices for the same ticket bought on different days, it was easy and acceptable for airlines to move to dynamic pricing.

e-Commerce

Retailers, especially e-commerce companies like Amazon and eBay use dynamic pricing for personalized pricing. If you consistently buy from Amazon or another e-commerce website, prices will be higher. The dynamic pricing engine calculates the loyalty level of each customer and sets the price lower if a person is a newcomer.

Dynamic pricing is now used for almost every product and service. From the price of a concert ticket to the price of a hotel booking is calculated by dynamic pricing algorithms. Even Uber is using surge pricing.

How to choose the most suitable dynamic pricing algorithm?

To choose the best dynamic pricing algorithm, businesses need to take into account that the algorithm should be able to provide prices that:

1. Maximize revenue and profit

Dynamic pricing algorithms are designed to ensure that prices adjust in real time to dynamic market conditions, enabling businesses to capture maximum revenues and profits.

2. Minimize customer churn

An effective dynamic pricing algorithm should be able to analyze customer behavior and preferences in order to provide personalized prices which help reduce customer churn.

3. Compete with competitor prices and attract their customers

The algorithm should also be able to anticipate competitor prices and adjust your prices accordingly in order to stay competitive and attract customers.

4. Improves customer experience and maintains loyalty

Additionally, a dynamic pricing algorithm should be able to provide customers with personalized prices, discounts, and offers that improve their shopping experience and help build repeat business.

5. Improves customer experience and maintains loyalty

Dynamic pricing algorithms should be able to provide customers with personalized prices, discounts, and offers that improve their shopping experience and help build repeat business.

6. Aligns with business objectives

A good dynamic pricing algorithm ensures that price adjustments are always aligned with corporate goals. For instance, companies known for low prices should therefore define prices in their algorithm that are below the market average.

To explore types of dynamic pricing and different industries’ uses, feel free to read our in-depth article about the 6 types of dynamic pricing and how AI can improve them.

How to collect data to implement dynamic pricing?

The most important metric to a successful implementation of dynamic pricing is data. Businesses need to collect historical and current data about the market, competitors, customers, trends, etc. This data can be obtained by:

- Buying / Generating intent data: Intent data covers data concerning purchasing behavior of individuals or companies such as product reviews, whitepaper downloads, google searches, subscriptions and registrations, and website visits. Some companies generate intent data using buyer intent data tools, whereas others buy intent data from data providers.

- Scraping online data: Business can use web crawlers to automate the extraction of data from online resources about the market and competitors, such as product prices, reviews, customer comments.

Why is dynamic pricing relevant today?

It is difficult to achieve significant financial improvement in a large company. Most large organizations

- move slowly because of multiple levels of hierarchy

- are reluctant to make radical changes as they need to be conscious about the sensitivities of a broad customer base

- need hundreds of millions of additional sales to achieve a significant percentage improvement in profits

- need hundreds of millions of OPEX improvements to achieve a significant percentage improvement in profits. However, OPEX improvements are painful and slow. For example, headcount reductions are demoralizing and severance packages negatively impact financials in the short term.

However, dynamic pricing is one of the few approaches that can lead to quick results in large companies and make the responsible team heroes.

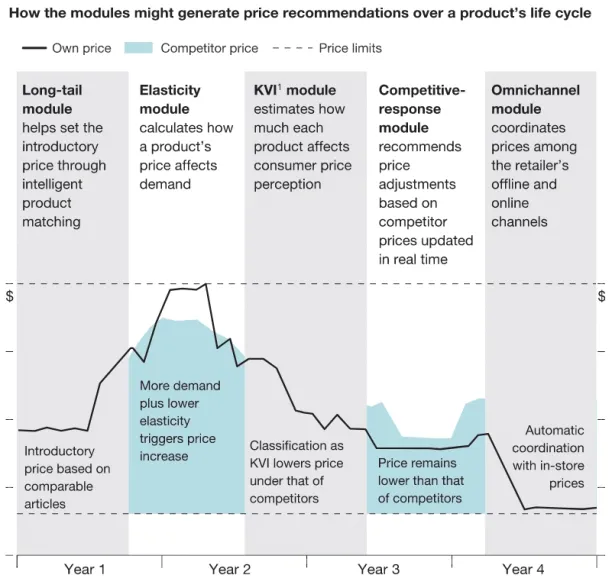

Different Modules of Dynamic Pricing

Because of the complexity of a successful dynamic pricing strategy, different modules are sometimes used for different product categories and market responses to manage complexity. In this section, we discuss those dynamic pricing methods or modules.

| Module name | Purpose |

|---|---|

| Long Tail | Price new or low-data products using data from similar items. |

| Elasticity | Estimate how price affects demand, factoring seasonality and cannibalization. |

| Key Value Items (KVI) | Focus on consumer perception by managing prices of popular products. |

1. Long tail module

This module is for new products or long-tail products with little or no historical data. Main challenge for this module is to use product attributes to match products with little purchase data with products that have rich purchase data so prices can be informed by rich data.

2. Elasticity module

Elasticity module calculates the impact of price on demand considering seasonality and cannibalization.

A leading Asian e-commerce player built an elasticity module based on a multi-factor algorithm that drew on ten terabytes of company’s transaction records. Data included product price, substitute price, promotions, inventory levels, seasonality, and competitors’ estimated sales volumes.

Though price recommendations were generated real-time, category managers made the final pricing decisions. Pilot led to an increase of 10% in gross margin and 3% in GMV.

3. Key Value Items (KVI )module

Key value items are popular items whose prices consumers tend to remember more than other items. KVI module aims to manage consumer price perception by ensuring that items that strongly impact customer’s price perception are appropriately priced.

This is important for resellers like grocery companies. Because they are not selling their own products, they need to make sure that customers see them as the lowest cost option. A leading European nonfood retailer built a sophisticated KVI module statistically scoring each item’s importance to consumer price perception on a scale of 0 to 100.

This scale guided pricing decisions and company was willing to lose more on KVIs to retain and improve the customer price perception about their company.

4. Competitive-response module

This module leverages granular pricing data from competitors and impact of those prices on company’s customers to react to competitors’ prices in real-time.

5. Omnichannel module

Companies manage prices between channels both for price discrimination and also to encourage customers to visit less costly channels. Omnichannel modules ensure that prices in different channels are coordinated.

6. Time-based pricing module

Online retailers may charge customers more or less at the specific time of the day due to the following reasons:

- seasonality of products

- retailers charge more between 9 AM-5 PM since most online retail customers shop more during weekly office hours

- if customers want a same-day delivery or shopped right before end of the working hour, retailers are eager to charge more

- if the product has an expiration date, as time goes by, the price of the product decreases.

7. Conversion rate pricing module

If most leads (which are the views of the website in retail terminology) aren’t turning into sales for specific products, then retailers may lower the price to increase conversion rate.

Further reading

If you want to explore dynamic pricing implementation and case studies, feel free to read:

- Top 5 Price Monitoring Tools: Vendor Selection Guide

- Top 10 Competitive Intelligence Tools & Selection Guide

- eCommerce Price Benchmarking

If you believe your business will benefit from a dynamic pricing tool, feel free to check our guide Dynamic pricing: what it is, why it matters & top pricing tools. And if you’re looking for tools to collect data for your business, check out our data-driven lists of web crawlers, and pricing software.

Comments

Your email address will not be published. All fields are required.