APIs have proven to be beneficial for companies as they :

- Increase access to data

- Increase integration among different companies & devices

- Increase innovation

- Improve customer experience

However, the financial sector has been slow to adopt API as part of its digital transformation (see Figure 1).

We provide use cases and examples to illustrate the possible investment areas of APIs in finance. Then we discuss the difficulties in implementing APIs and provide solutions to these challenges.

Figure 1. API traffic.

Source: Google Cloud

1- Banking

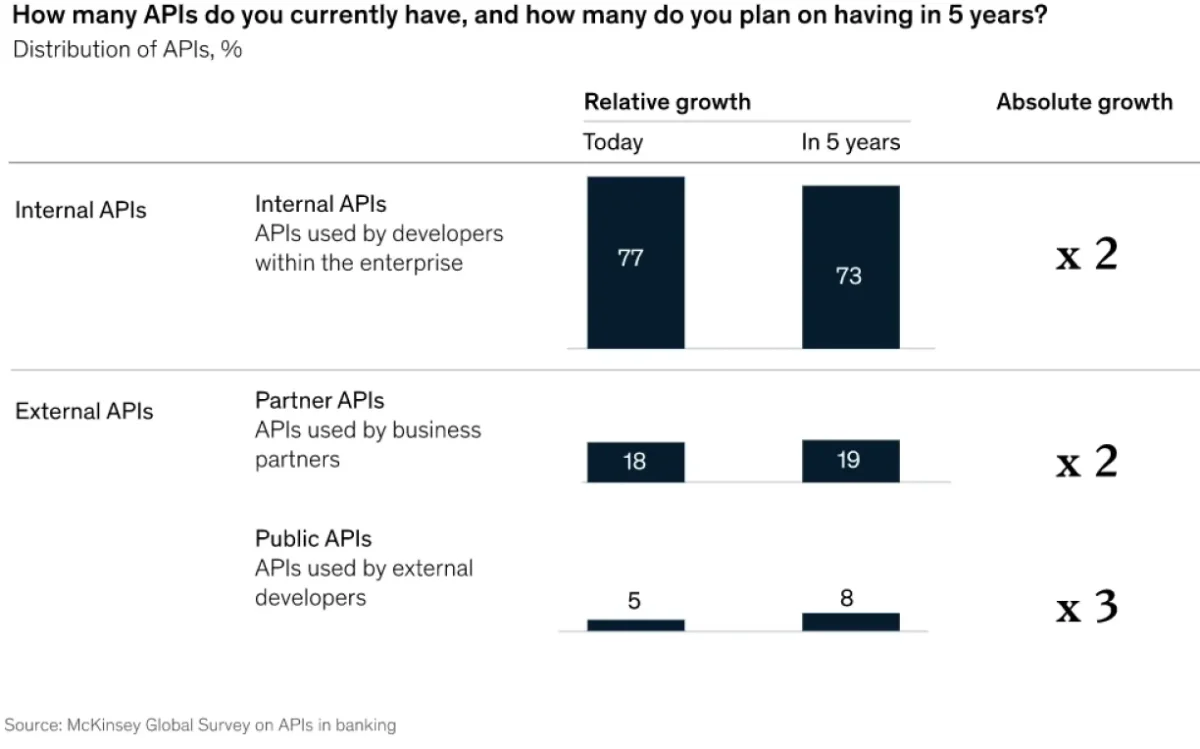

The number of APIs used in banking is expected to double by 2027 compared to 2022 levels (see Figure 2). 1

Figure 2. Relative and absolute growth of APIs in the banking industry.

Source: McKinsey

APIs can benefit banking by:

- Increasing integration between banks and other applications

- Improve the bank’s digital transformation by increasing connectivity

- Removing unnecessary bureaucratic banking procedures

- Provide products that are personalized for customers

The use of open API has led to the creation of open banking. Open banking is the usage of open APIs, which lets outside developers create programs and services based on the financial institution. The usage of open banking has increased considerably in the past few years.

To understand more about open banking, read Open Banking APIs: Benefits, Opportunities & Applications.

BBVA APIs

BBVA provides different banking-related APIs such as:

- Mortgage API: This API enables offering mortgage financing to customers without them leaving your digital platform.

- Auto loan API: This API allows auto loan financing integration for car dealerships and brands in their platform.

- Business collection API: This API enables real-time payment confirmation, which can streamline collection processes.

2- Private equity & venture capital

Private equity and VC firms can use APIs by:

- Retrieving information about current or historical holdings, which can be categorized based on industry and/or geography.

- Retrieving information about realized investments

- Retrieving information about new and historical purchases of other PEs.

- Gathering investment from retail investors

All this information can be gathered quickly and efficiently in a standardized format such as CSV or JSON.

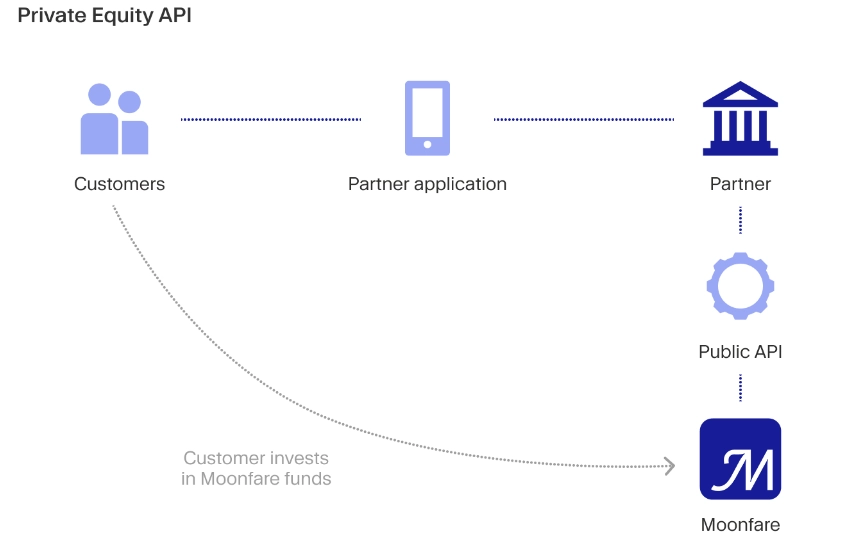

Moonfare private equity API

Moonfare, a DTC digital PE platform, offers an API that integrates with the fintech company’s infrastructure and user interface, allowing them to invest in private equity funds (see Figure 3).

Figure 3. Moonfare private equity API

Source: Moonfare

3- Insurance

APIs can facilitate digital transformation in the insurance industry. They can be used to:

- Increasing efficiency in claim management by improving internal and external system integration that can lead to faster claims processing.

- API can improve partner integration as insurance companies can provide access to their APIs, improving data sharing.

- New technology integration is possible with API. IoT in insurance industry is used often. For example, IoT devices can provide information about an accident to the insurance provider using API.

Lemonade insurance API

Lemonade is an insurtech company. Its API allows different types of application service providers to integrate insurance alongside their main product, such as:

- E-commerce,

- Property management companies,

- IoT providers,

- And financial advisor applications,

Developers can integrate Lemonade insurance in 2 different ways. :

- Adding one line of code which adds a widget to your page, enabling the Lemonade insurance bot to collect and handle the process

- Using lemonade REST API to have full control over the workflow.

You can find our data-driven list of insurance APIs here.

4- Trading

API can be used to make trades:

- Automatable: The trades can be made automatically when the predefined conditions are met. This result in faster execution and removes human emotion from the trade.

- Customizable: API can be customized for different trading strategies, and actions such as stop loss can be programmed into it. Additionally, trading strategies with API can be backtested and optimized for the best risk-to-return ratio.

Interactive Brokers Trader Workstation (TWS) API

Interactive Brokers(IB) TWS API allows for automated trading strategies. Real-time market data and account balance can be requested using this API. Developers can connect their trading applications to this API. You can watch the following youtube video to understand more about IB TWS.

Challenges of financial APIs

Security

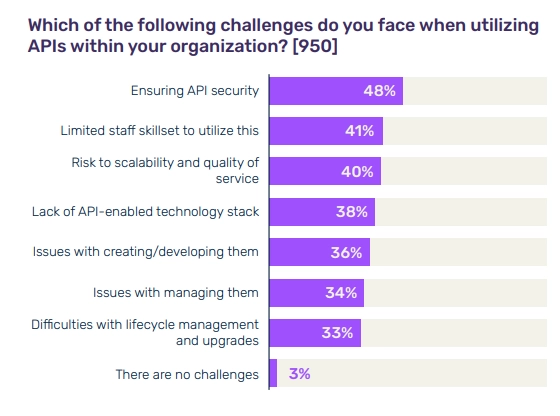

Security is the top concern regarding API development among IT executives ( see Figure 4).

Figure 4. Challenges in API utilization

Source: Fintech Future

Recommendation: Conduct API security testing to find and prevent bugs and defects that can lead to security breaches.

Lack of unified standard

Even though the API has become more common, they are not standardized across the industry. There is no standard like ISO20022 when it comes to API development for the financial sector. This has led to different naming conventions and field sizes.

Recommendation: The lack of standardization might improve in the coming years, but until it reaches a unified state, financial companies can use 3rd party service providers for integrating API data. Additionally, if your organization is looking to develop its own API, it is better to follow the guidelines provided by the banking industry architecture network (BIAN) as they are trying to make a unified standard for banking infrastructure.

If you are looking to integrate API into your business, you can reach us :

Comments

Your email address will not be published. All fields are required.