NFTs require some level of standardization at their creation to be compatible with their blockchain.We explore some of the NFT standards.

What is an NFT standard?

Non-Fungible Token (NFT) standards outline how to create NFTs on a particular blockchain. The smart contract and the properties of the token it issues are defined by a token standard.

NFT Standards

Ethereum

Ethereum is the most used blockchain for NFTs. Different standards have been developed for Ethereum, such as:

ERC-721

ERC-721 was first used in the CryptoKitties game. Tokens created from this standard are unique because the token ID and the contract address pair must be unique. The downside of ERC-721 is that bulk transfer of NFTs is not possible. If an account wants to send 10 NFTs, they have to make 10 smart contracts. ERC-1155 has tried to solve this issue.

ERC-1155

ERC-1155 is a multi-token standard that allows the transfer of multiple tokens of different types in a single, smart contract. NFTs and fungible tokens can be transferred in a single transaction, saving time and reducing costs by 90%. ERC-1155 was designed by Enjin with the idea of using it in games. In games, there are fungible assets such as gold and wood and non-fungible items such as a rare sword or armor. ERC-1155 allows the transfer of both types of items in a single transaction.

ERC-998

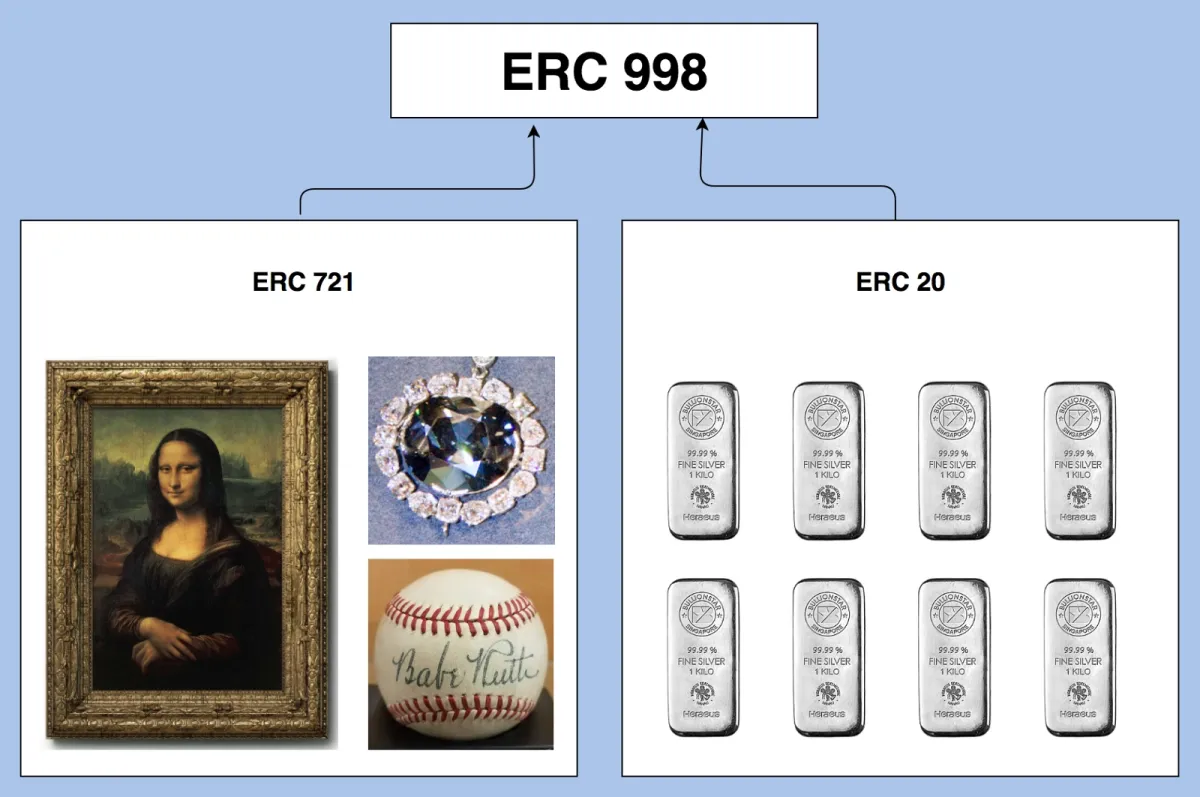

ERC-998 is an extension of ERC-721. It is compostable, allowing the ERC-988 token to manage other tokens within itself. It can hold ERC-721 and ERC-20 (standard for fungible tokens). This enables standard assets to be combined into complicated compositions that can be transferred in a single transfer.

The main difference between ERC-998 and ERC-1155 is that ERC-998 merges NFTs and fungible tokens into one NFT, while ERC-1155 registers NFTs and fungible tokens into a single, smart contract. ERC-998 can be considered a portfolio of tradable assets.

Figure 2. A hypothetical example of ERC 998

Source: Hackermoon

Binance smart chain

Binance smart chain (BSC) is compatible with the Ethereum blockchain, which allows porting applications between them. The public wallet address is the same on BSC and Ethereum blockchains.

BEP-721 & BEP-1155

BEP-721 & BEP-1155 are extensions of ERC-721 and ERC-1155, respectively. They function similarly to their Ethereum counterparts. The main differences between them are:

- Transaction costs are lower in BSC compared to Ethereum.

- BSC processes transactions 4.3 times faster than Ethereum.

Stacks blockchain

Stack is a blockchain that is anchored to the Bitcoin blockchain. It enables the use and creation of smart contracts, NFTs, and DeFi applications that are secured by Bitcoin.

SIP-009

SIP-009 is the standard that is used by Stacks blockchain to create NFTs that are secured by Bitcoin. SIP-009 outlines standard features that NFTs must have to be compatible with Stacks wallets.

Comments

Your email address will not be published. All fields are required.