The cryptocurrency market has grown up to more than $2.5 trillion in 2024.1 However, investing in cryptocurrency can be risky as there can be extreme fluctuations in the market. As the cryptocurrency market does not have a central governing authority, the prices can change depending on the sentiment of the public, natural disasters in a country, global news, crises between countries, etc.2

Explore how sentiment in the reviews is correlated with the price movements of cryptocurrencies, how to do cryptocurrency sentiment analysis, and the challenges of cryptocurrency sentiment analysis together with solutions:

What is cryptocurrency sentiment analysis?

Figure 1. The association of Bitcoin prices with the sentiment in users’ tweets

Source: Medium3

Research reveals that people produce more than 100 MB of data every minute, including insights regarding their feelings and thoughts on various topics.4 Some of these reviews, feedback, social media posts or blog posts include thoughts on the cryptocurrency markets.

The sentiment in consumers’ reviews, feedback, social media posts, or blog posts correlates with market price movements.5 For instance, when Elon Musk added the Bitcoin hashtag to his Twitter biography, Bitcoin prices rose from 32,000 to 38,000 in a couple of hours.6

Figure 2. Elon Musk’s tweets on cryptocurrency and how Bitcoin prices change accordingly

Source: Vox7

So, sentiment analysis can be a great way to find where and when to invest in cryptocurrency, since Analyzing the sentiment in customers’ or thought leaders’ tweets can provide great insights into the association between cryptocurrency prices and public sentiment.

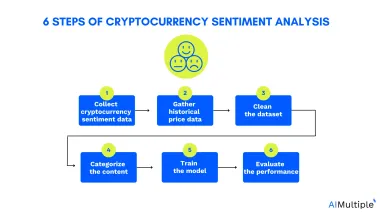

How to conduct cryptocurrency sentiment analysis?

1. Collect data related to cryptocurrencies

Gather a wide range of data sources that reflect public sentiment towards cryptocurrencies. This can include investors’ reviews on forums and websites, news articles, blogs, social media posts (especially tweets mentioning cryptocurrencies), and other relevant texts. Data collection tools and APIs can help streamline this process, ensuring you gather substantial and diverse sentiment-related data.

2. Gather historical price changes of cryptocurrencies

Obtain historical price data for the cryptocurrencies of interest. This information can usually be sourced from cryptocurrency exchanges, financial databases, or specialized cryptocurrency data providers. Historical price data will allow you to correlate sentiment with market movements, offering deeper insights into how sentiment impacts prices.

3. Clean the dataset

Once you have collected the data, it is crucial to clean it by removing any irrelevant or redundant items. This process includes eliminating spam, duplicate entries, advertisements, and any other content that does not contribute to the analysis. Techniques such as natural language processing (NLP) can help in identifying and filtering out non-relevant data.

4. Label the content in the dataset based on emotional tone

The next step involves labeling the collected data based on its emotional tone. This can be done manually or through automated tools. Labeling typically categorizes the content as negative, positive, or neutral. Automated tools often use sentiment analysis algorithms that can efficiently process large volumes of data, although manual labeling can provide higher accuracy for a smaller dataset.

5. Train your model with a labeled dataset

Use the labeled dataset to train your sentiment analysis model. Machine learning algorithms such as Naive Bayes, Support Vector Machines (SVM), or more advanced deep learning techniques like Recurrent Neural Networks (RNN) and Transformers can be employed. The goal is to develop a model that can accurately predict sentiment based on the input data.

6. Evaluate the performance of your model

After training your model, evaluate its performance using various metrics such as accuracy, precision, recall, and F1 score. This step involves testing the model with a separate validation dataset to ensure it can generalize well to new, unseen data. Fine-tuning the model based on these evaluations can help improve its accuracy and reliability.

You can also check our data-driven list of sentiment analysis services.

What are the influential factors on cryptocurrency prices?

There are certain factors influencing cryptocurrency prices:8

- Supply, demand, and mining difficulty

- Market trends

- Macro-economic factors

- S&P 500

- USD/EUR exchange rate

- Political issues in a country (e.g., Venezuela)

- Twitter mentions

- News sentiment

- New regulations by the governments

- Investors’ opinions

To have reliable results in sentiment analysis, it is crucial to determine the right dataset and clean it accordingly. However, this can be challenging considering the noise in the customers’ feedback or reviews.

Challenges of cryptocurrency sentiment analysis

- Models that are not trained in the terminology of the crypto market may yield misleading results.

- Identifying bot accounts can be challenging, especially if the dataset is not labeled manually.

- The number of tweets sent regarding cryptocurrency by bot accounts is estimated to be almost 15%, distorting the sentiment analysis results.9

How to overcome these challenges?

- Generate a holistic approach by combining polarity, emotion, and aspect-based analysis.

- Train a domain-specific model that includes the terminology of the crypto market.

- Detects bot accounts using neural networks and contextualized representations of each text. A recent study shows that neural networks achieve 82% accuracy in identifying bots.10

You can also read our comprehensive article on sentiment analysis challenges and their solutions.

If you need any assistance, do not hesitate to reach us:

This article was originally written by former AIMultiple industry analyst Begüm Yılmaz and reviewed by Cem Dilmegani.

External Links

- 1. Crypto market cap 2010-2025| Statista. Statista

- 2. Sentiment Analysis Benchmark Testing: ChatGPT, Claude & DeepSeek. AIMultiple

- 3. Understanding Cryptocurrencies with Sentiment Analysis | by Sam Couch | Medium. Medium

- 4. Raheman, A., Kolonin, A., Fridkins, I., Ansari, I., & Vishwas, M. (2022). Social media sentiment analysis for cryptocurrency market prediction. arXiv preprint arXiv:2204.10185. Accessed: 17/July/2024.

- 5. Raheman, A., Kolonin, A., Fridkins, I., Ansari, I., & Vishwas, M. (2022). Social media sentiment analysis for cryptocurrency market prediction. arXiv preprint arXiv:2204.10185. Accessed: 17/July/2024.

- 6. Ante, L. (2023). How Elon Musk’s twitter activity moves cryptocurrency markets. Technological Forecasting and Social Change, 186, 122112. Accessed: 17/July/2024.

- 7. Chart: How bitcoin prices move with Elon Musk’s tweets | Vox. Vox

- 8. Kraaijeveld, O., & De Smedt, J. (2020). The predictive power of public Twitter sentiment for forecasting cryptocurrency prices. Journal of International Financial Markets, Institutions and Money, 65, 101188. Accessed: 17/July/2024.

- 9. Kraaijeveld, O., & De Smedt, J. (2020). The predictive power of public Twitter sentiment for forecasting cryptocurrency prices. Journal of International Financial Markets, Institutions and Money, 65, 101188.. Accessed: 17/July/2024.

- 10. Heidari, M., Jones Jr, J. H., & Uzuner, O. (2022). Online user profiling to detect social bots on twitter. arXiv preprint arXiv:2203.05966. Accessed: 17/July/2024.

![Top 4 Methods of Sentiment Analysis in Retail Industry ['25]](https://research.aimultiple.com/wp-content/uploads/2022/08/Methods-of-Sentiment-Analysis-IN-Retail-Industry-1-190x107.png.webp)

Comments

Your email address will not be published. All fields are required.