Local solutions are still important. Local languages, customs, and laws increase the need for local partnerships.

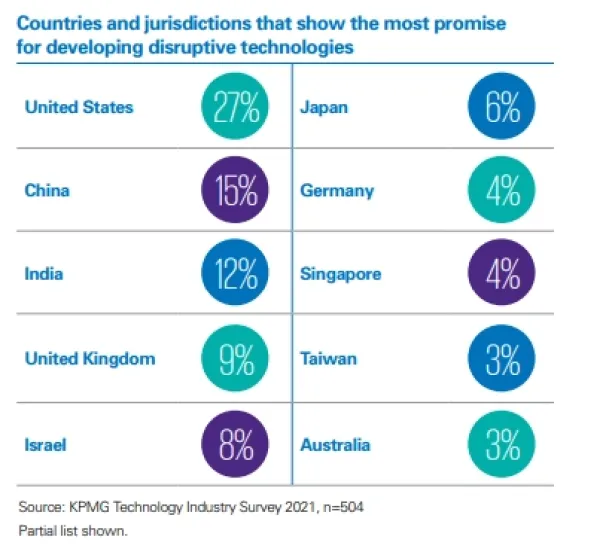

Analyzing the number of B2B tech companies from each country, we have ranked countries in terms of the number and capabilities of B2B solution providers in that country. United States and UK emerge as B2B technology leaders.

| AIMultiple | WIPO* |

|---|---|

| United States | Switzerland |

| United Kingdom | Sweden |

| India | United States |

| Canada | United Kingdom |

| Australia | Singapore |

| Germany | Finland |

| France | Netherlands |

| Netherlands | Germany |

| Israel | Denmark |

| Spain | South Korea |

*Source: WIPO1

How does AIMultiple rank countries in terms of innovation?

We use every available data from sources like social media, search engines, online reviews and measure the popularity, presence, and momentum of companies in each country. Feel free to check our methodology.

Top innovative countries according to AIMultiple

United States

Cities such as San Francisco, New York, and Seattle, where the world’s largest technology companies are located, are also some of the top global cities for innovation according to the number of companies in that cities on AIMultiple database as well.

Bloomberg Concentration Index report highlights smaller cities have a high density of technology, engineering, and math professionals. 2

United Kingdom

The United Kingdom has a large number of technology companies and is known as one of the technology centers of the world. One of its most innovative cities, East London is also called Tech City and the Silicon Roundabout.

As in most other countries, there has been a steady increase in the number of employees in the IT, software, and computer services economy of the United Kingdom (UK) between 2011 and 2022, as well as in the number of tech companies.3

India

According to KPMG’s 2021 Technology Innovation Hubs report, Bengaluru has taken its place in the list of top 10 cities seen as tech innovation hubs. 4

The report also highlights India as the third most promising country for developing disruptive technologies.

Canada

Canada is one of the countries with the most productive technology ecosystem with $8 billion in business R&D spending. 5 Many workers in the tech industry choose to pursue a career in Canada due to the restrictive US immigration laws and Canadian living conditions and tech salaries.

After Amazon expanded to Vancouver in 2018, Google, Facebook, and other tech giants began opening offices in Toronto, Vancouver, and Montreal.6

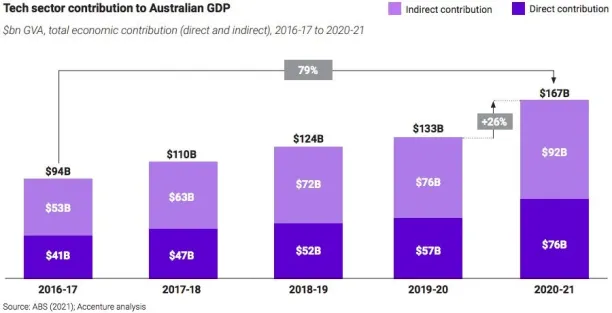

Australia

According to Australia’s Tech Future report, Australia implemented a new strategy to improve digital technologies and benefit the economy and society. 7 The implemented strategies are as follows:

- Individuals’ roles to implement the strategy:

- Positioning themselves at the level of educated and talented individuals essential to Australia’s technology future

- Increasing the use of digital technology

- The Government roles to implement the strategy:

- Enabling citizens and businesses to take advantage of available digital opportunities

- Increasing investments to develop digital infrastructure

- Increasing security in relation to digital activities

- Providing secure and fast digital government services

- Businesses Actions:

- Investing in digital infrastructures to support their competitiveness and productivity

- Providing financial support to help employees develop their digital skills

- Taking measures and investing in protecting customers from cybercrime and data breaches

- Making plans and investments for a more digital future

Germany

According to the 2020 Bloomberg Innovation Index, Germany ranked number one as the most innovative nation in the world. 9 The criteria used in the research include:

- Research and development spending

- Manufacturing capability

- The concentration of high-tech public companies

Germany is one of the countries that devote the majority of its economic earnings to research and development. Investments made in R&D are one of the most important reasons that Germany is at the top of the list of innovative countries. 10

France

According to our database, France is the 7th most innovative country based on the popularity of high-tech companies. Also, it ranks 7th on the top 25 economies in the world list too. 11 The five main R&D investment sectors are:

- IT and information services

- Cars

- Aircraft & spacecraft manufacturing

- Pharmaceuticals

- Scientific and technical activities

Netherlands

In 2019, the Dutch government arranged the Strategic Action Plan for AI. 12

In this plan, the government focuses on three goals, which are to:

- Make small, medium-sized and large corporations be key players for innovation and the country’s global competitiveness.

- Provide the necessary conditions for the adaptation of artificial intelligence in the economy and society, in order to facilitate access to innovation for startups which invest in education and research programs.

- Identify appropriate legal and ethical frameworks for people and companies to ensure that AI will be used with care. Thus, ensuring that companies and public organizations use ethical guidelines (European and other) for AI applications.

Businesses investing in The Netherlands benefit from robust government support and low operating costs. In addition, the government allocates a significant budget for R&D studies every year. 13

Israel

Israel is the “start-up nation” with 2,000 new ventures, 3,000 small and medium-sized enterprises, and high-tech companies, and 300 multinational companies’ R&D centers established in the last ten years. 14 The same report also touches upon the world’s leading companies operating in Israel through foreign direct investment (FDI). Google, Microsoft, Motorola, Facebook, Siemens, Toshiba, Philips, IBM, GE, HP, Intel, and Apple (three R&D centers) are some of them. Israel ranks second in the world in terms of per capita R&D expenditure.

With the Technology Incubator program established by the Israeli Government in 1990, the government finances approximately 85% of the early-stage costs of companies. At the same time, the budget allocated to artificial intelligence technologies among the total investments made in high technology in 2019 reached 42%.

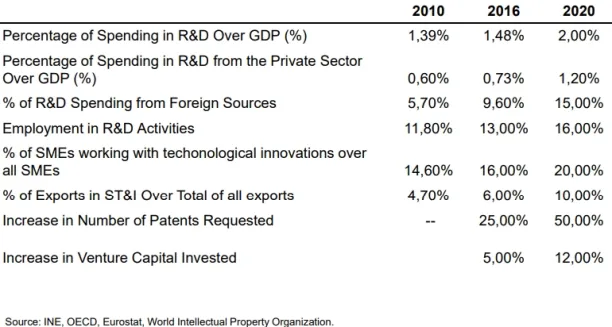

Spain

Spain is a leader in many different industries such as biotechnology, industrial machinery, renewable energies, and civil engineering, and produces innovative and advanced solutions. 15 The country is determined to gain expertise by concentrating on technology and innovation-based industries.

Spain’s strategy for the period of 2013-2020 includes:

- Promoting talent in the fields of R&D&I

- Providing support to accelerate scientific and technical research, and assistance for the growth of small innovative companies

- Strengthening the connection between Spanish research and global innovation networks

- Promoting the initiation of public-private partnership agreements with new technology-based initiatives

How do other sources measure innovation per country?

Different organizations have different measurements for innovation and this affects the result. Here are the methodologies from two other sources:

Iberdrola ranking methodology

Data used

The economies of 200 countries were evaluated under various categories with data obtained from many institutions such as the World Bank, the Organization for Economic Cooperation and Development (OECD), the International Monetary Fund (IMF).

Methodology

Countries were examined and ranked under seven main categories, countries that did not meet the required thresholds in at least six of these seven sub-categories were eliminated. The final list was created by ranking the 60 most innovative countries among the remaining ones. These seven main categories are:

- Investment in R&D

- Patent activity

- Investment in higher education

- Added value in the industry

- Productivity

- The density of high-tech companies

- Researcher concentration

For more details, the team shares a detailed methodology.17

World Intellectual Property Organization ranking methodology

Countries were evaluated and scored according to various categories. These metrics used in the study include:

- Institutions (political, regulatory, and business environments)

- Human capital and research (education, research and development (R&D) investments)

- High tech companies

- Knowledge and technology outputs

- Research personnel

For more details, the team shares a detailed methodology.18

If you have questions, we would like to help:

External Links

- 1. “Global Innovation Index 2023“.WIPO. Retrieved 28 May, 2024.

- 2. Top US Tech Hubs 2019: Boulder, San Jose, Washington, San Fran - Bloomberg. Bloomberg

- 3. UK: computer programming employment 2023| Statista. Statista

- 4. Holt, A. “Technology Innovation Hubs“KPMG. Retrieved 28 May, 2024.

- 5. Digital Technologies/ICT.

- 6. Nixing Silicon Valley, US companies now tapping Canada for tech talent. CNBC

- 7. “Australia’s Tech Future report” Retrieved 28 May, 2024.

- 8. 10 charts on Australia’s fast growing technology sector. Consultancy.com.au

- 9. Bloomberg Innovation Index: Latest Global Rankings - Bloomberg. Bloomberg

- 10. List of sovereign states by research and development spending - Wikipedia. Contributors to Wikimedia projects

- 11. The Top 25 Economies in the World. Investopedia

- 12. Netherlands, Strategic Action Plan for AI (2019) - OECD.AI.

- 13. The Top 25 Economies in the World. Investopedia

- 14. The Israeli technological Eco-system | Deloitte Israel.

- 15. Buisán, M. “Innovation and Technology in Spain“Trade Commission of Spain. Retrieved 28 May, 2024.

- 16. Buisán, M. “Innovation and Technology in Spain“Trade Commission of Spain. Retrieved 28 May, 2024.

- 17. Which are the world's most innovative countries? - Iberdrola. Iberdrola

- 18. “Global Innovation Index 2023“WIPO. Retrieved 28 May, 2024.

Comments

Your email address will not be published. All fields are required.