Even though the NFT hype has cooled down in recent months, we anticipate that NFTs will continue to be relevant because of their applications in both the virtual and physical worlds.

NFT blockchains have experienced difficulties such as volatile transaction fees and security issues. Stacks blockchain allows the creation of NFTs secured by Bitcoin using the proof-of-transfer consensus mechanism. Unlike Ethereum, which has unpredictable gas prices, Stacks has lower and stabler gas prices than Ethereum.

We have prepared this article for NFT collectors and enthusiasts.

Gamma

Gamma launched in September 2021, and it has the highest volume of NFTs traded on any Stacks-based NFT marketplace.

Gamma is based on three pillars.

- User first marketplace

- Creator first launchpad

- Social platform for connecting collectors and creators in a Web-3 manner.

Gamma provides trading and minting of different types of NFTs such as:

- Collectibles

- Music

- Fine art

- Photography

Features

- Support of crypto domains: Blockchain naming service domains can be used for transferring NFTs instead of long wallet addresses.

- No code smart contracts: Gamma has developed an NFT launchpad that allows creators to deploy their customizable smart contracts which are owned fully by themselves.

- Self-service discord bots: Users can create discord bots for free in under 5 minutes.

- Support of lightning payment for minting NFTs: The lightning network allows fast transactions of Bitcoin.

- Clear guides & help bot: Gamma has an extensive and clear guide on different subjects and functionalities. They are easily accessible by interacting with their help bot

Byzantion

Byzantion is the 2nd largest NFT marketplace on the Stacks blockchain. They raised $1 million in a pre-seed round on the 11th of July, 2022. Even though they are an NFT marketplace on the Stacks blockchains, they focus on creating tools that can be used in the different blockchains.

Features

- Discord bots for tracking NFT collections: Users can create free discord bots that can track sales, listing, and bids for the specified collections.

- No code smart contracts: Similar to Gamma they use no code smart contracts.

- Support of NEAR protocol: NEAR is a proof-of-stake blockchain that facilitates the design of decentralized applications. Byzantion’s support of the NEAR protocol allows them to offer services on a cross-chain basis.

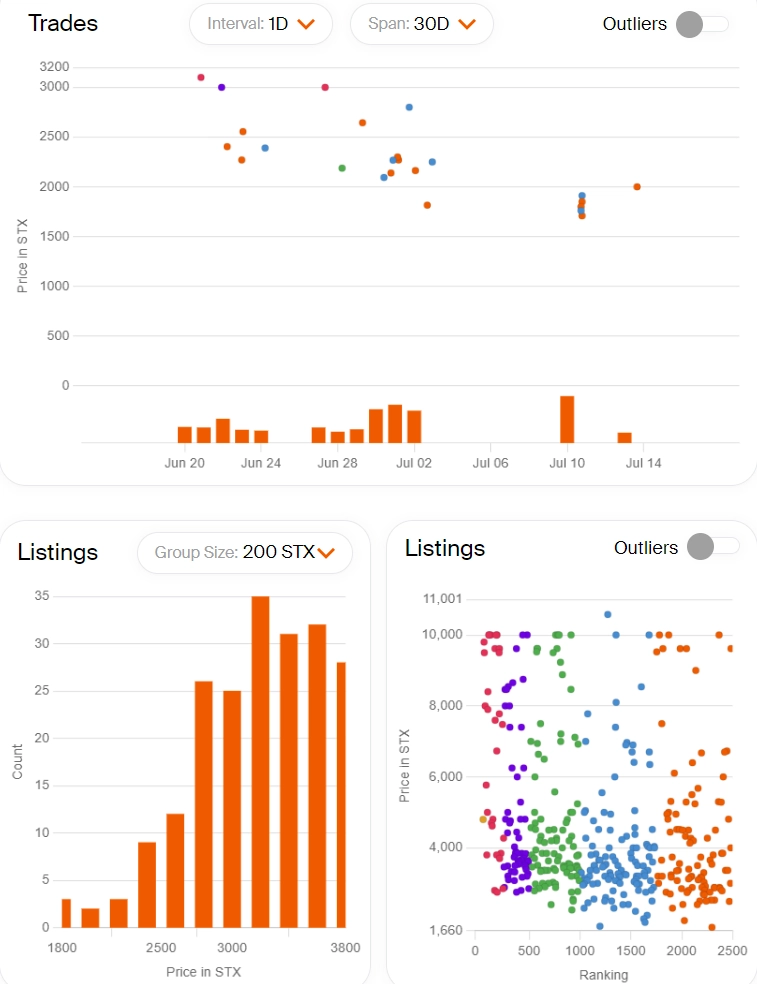

- NFT collections trader view: The trader view tab for collections offers a detailed and visual overview of different statistics related to the collection. (see Figure 2)

Figure 1. Byzantion trader tab

Source: Byzantion

Superfandom

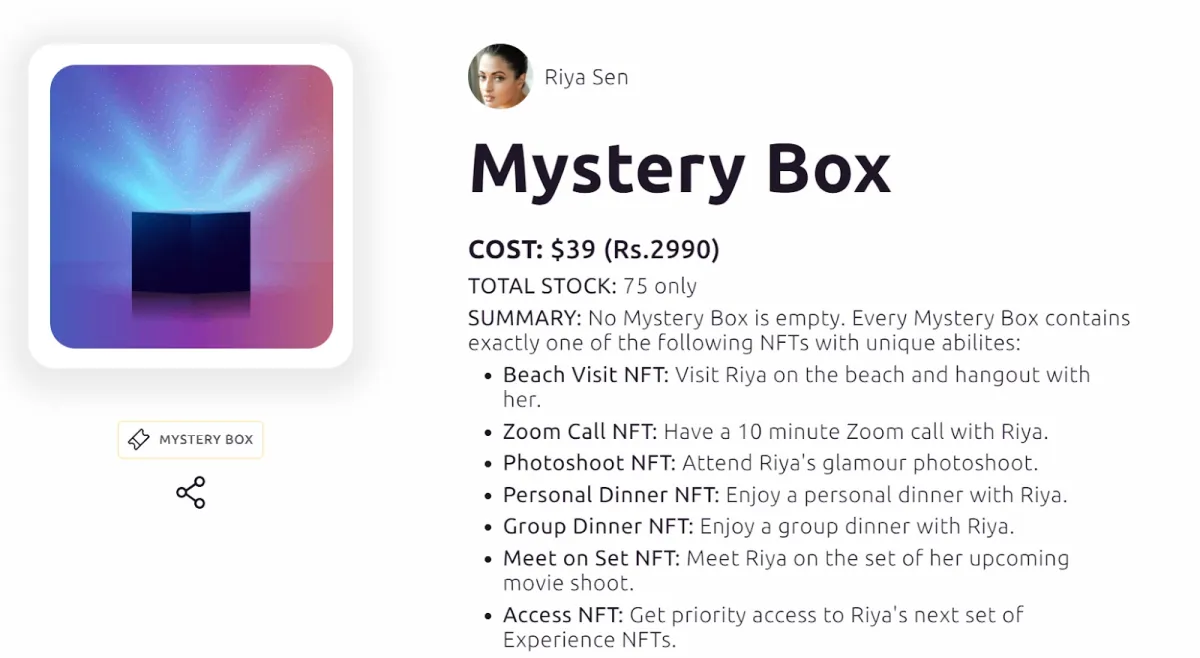

Superfandom is an NFT marketplace focusing on connecting artists and creators to their fans. Unlike most other NFT marketplaces that focus on digital arts and collectibles, Superfandom has aimed to establish a platform for different types of creators, such as actors and youtube personalities, to issue community NFTs for their fans. Super fandom’s NFTs currently are not tradable on secondary markets, but they are planning to introduce and integrate with other secondary marketplaces.

Features

- Community NFTs: NFTs provide privileges such as a dinner with the creator or a zoom call.

- Mystery boxes: Opening a mystery box guarantees one NFT from a set of predetermined NFTs that have different characteristics. (see Figure 2)

Figure 2. Mystery boxes on Superfandom

Further readings

You can reach us if you need more information regarding NFT marketplaces that use stacks blockchain.

Comments

Your email address will not be published. All fields are required.