Scraping tools for finance can be divided into four types based on your programming expertise and the scope of your project:

- Pre-collected Datasets: Offer limited flexibility, require minimal maintenance, and are ideal for small-scale projects.

- Pre-made Templates (No-code): Very user-friendly, visually extract data using ready-to-use scraping templates without any coding.

- Web Scraper APIs: Easier to use than scraping libraries but still require basic programming knowledge. The service provider handles proxy management and anti-detection techniques for data extraction.

- Web Scraping Libraries: Demand programming skills and provide more control over the scraping process (e.g., fetching and parsing). You’ll need to manage issues like IP blocks or CAPTCHAs on your own.

What are the best tools for extracting financial data?

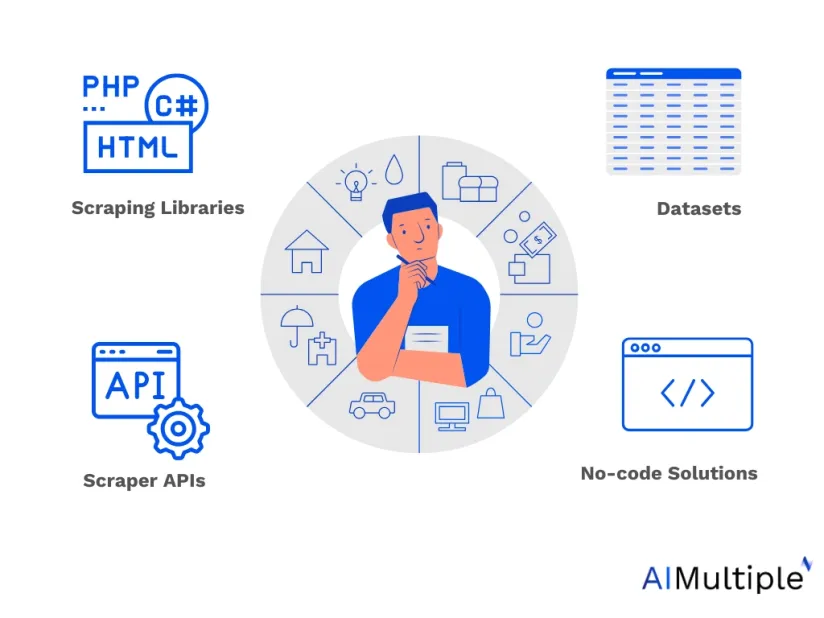

| Vendors | Pre-collected datasets | Pre-made templates | Scraper API | Price/mo | Free trial |

|---|---|---|---|---|---|

| Bright Data | ✅ | ❌ | Dedicated (Yahoo) | $500 | 7 days |

| Smartproxy | ❌ | ❌ | General-purpose | $50 | 7 days |

| Oxylabs | ❌ | ❌ | General-purpose | $49 | 7 days |

| Nimble | ❌ | ❌ | General-purpose | $150 | 7 days |

| ParseHub | ❌ | ✅ | ❌ | $189 | Free plan |

| Octoparse | ❌ | ✅ | ❌ | $99 | 14 days |

| Scraper API | ❌ | ❌ | General-purpose | $49 | 7 days |

| Zyte | ✅ | ❌ | General-purpose | $100 | $5 credit |

Table features explained:

- Pre-made Templates: Offers a no-code interface that makes the scraping process easier with a visual, point-and-click design.

- Scraper API: There are specialized scraper APIs for specific sites, such as the Yahoo scraper API, as well as general-purpose APIs that work with any website.

- Price: The starting price for the scraper API is listed in the scraper API column.

What kind of financial data can be collected via web scrapers?

Below are various types of data that can be extracted using scraping methods:

- Stock Data: Real-time or historical prices of companies listed on major stock exchanges like the NYSE and NASDAQ.

- Company Financials: Financial reports, including earnings statements, and key metrics such as earnings per share (EPS), revenue, and net profit.

- Financial News: Updates on mergers, acquisitions, and corporate restructurings from financial news sources such as Bloomberg, Reuters, and CNBC.

- Cryptocurrency Data: Real-time or historical price information for cryptocurrencies like Bitcoin, Ethereum, and Litecoin, as well as data on initial coin offerings (ICOs) or token sales.

- Foreign Exchange (Forex) Data: Currency exchange rates for major pairs such as USD/EUR and USD/JPY, along with rates for less widely traded currencies.

- Alternative Data: Web traffic statistics, supply chain insights, and geographic or spatial data.

What are the best web sources for financial data?

Each finance section may target a different source to extract the desired data relevant to their purposes. However, for a general view of the financial market and investment opportunities, you can target the following financial websites:

- Stock market data: Yahoo Finance, Google Finance, Investing.com, Alpha Vantage, Finnhub

- Economic data (macroeconomic indicators & reports): Reuters, Bloomberg, Financial Times (FT), Investing.com

- Company financials (balance sheets, income statements): SEC EDGAR Database, Morningstar, Finnhub

- News and market sentiment: Bloomberg, Investopedia, Forbes, Wall Street Journal

- Commodities & futures: Investing.com, MarketWatch, Bloomberg, Quandl

- Cryptocurrencies & forex: Alpha Vantage, Finnhub, Investing.com

Why is web scraping important in finance?

The finance sector relies heavily on web scraping to optimize their investment strategies by:

- Analyzing the current status of the financial market

- Uncovering market changes and trends

- Monitoring national and global news which may affect stocks and economics

- Evaluating consumer sentiment and behavior.

Additionally, web scraping is the #1 source of alternative data, which is one of the most important sources of insights for asset managers about market trends and investment opportunities.

What are the use cases of web scraping in finance?

Web scraping tools automate the extraction of finance-related data from the web, which can be used for:

1. Equity research

Equity research is the process of aggregating and analyzing the data about a business or company in order to make a data-driven decision about investing in their shares. Web scrapers gather data about businesses and companies such as market prices, inventory data, clients’ portfolios, product data, product reviews, company news, etc. to be used for analysis by an equity researcher.

2. Credit ratings

Credit rating is the process of evaluating the credit risk of a prospective debtor (an individual, business, company, or a government), in order to predict their ability to pay back a debt, and predict the possibility of a debtor defaulting. Most public companies publish their finance data such as financial statements, size of the company, funding, revenue, tax liens, etc. Web scrapers can aggregate data about a business’ financial statements from company online resources as well as online public records in order to calculate a data-driven credit rating score which is especially useful for institutional investors, banks, and asset managers.

3. Venture capital funding

Venture capitalists can leverage web scraping to create start-up lists and collect data about their funding from websites such as TechCrunch or CrunchBase. This data can be valuable to track market trends, discover industry niches, and reveal investment opportunities.

4. Compliance

Government and news websites are a crucial resource for financial regulatory requirements and changes. Scraping government and news outlets (e.g. websites, social media accounts, telegram channels) enables financial institutions to keep track of regulations and policy changes to ensure compliance.

5. Market sentiment analysis

News about the financial market can be found on news websites, social media, blogs, and forums. Automating the extraction of relevant data using web scrapers provides businesses with constant updates about the general population’s sentiment about specific products or brands, and enables financial leaders to predict the success or failure of certain stocks or ETFs in the market.

Additionally, most web scrapers integrate proxies to extract web data about specific geographical regions. This can be useful for businesses to analyze the financial market in a targeted region and optimize their financial strategies accordingly.

Comments

Your email address will not be published. All fields are required.