Ordinal inscriptions have taken the Bitcoin network by storm. Since being released by Casey Rodarmor in January 2023, more than 50M k Bitcoin ordinals have already been inscribed. 1

In this article, we guide you on how to create bitcoin ordinals. We will provide a list of ordinals wallet that you would need to hold your Bitcoin NFTs. Then, we will showcase some no-code platforms where you can create your ordinal inscriptions.

Clarification:

We will be using the terms ordinal inscriptions, Bitcoin NFTs, ordinals, digital artifacts, and inscriptions interchangeably.

Step 1: Use an ordinals-compatible bitcoin wallet

You need an ordinal address to transfer your to-be-inscribed satoshi. You need cryptocurrency wallets to store, manage, and transact cryptocurrencies such as bitcoin, ethereum, etc. But because the Ordinals protocol is new, only a limited number of wallets currently support it.

Our list of ordinals-compatible wallets include no-code and code-based wallets. We recommend using a no-code wallet because they are user-friendly and don’t require programming to set up. So without running a full bitcoin node/bitcoin core to interact with the bitcoin chain, you can start making bitcoin transactions right away.

1. No-code wallets

1.1 Hiro wallet

Hiro Wallet is a non-custodial, web wallet, accessible on desktop and as a browser extension. You can send/receive bitcoins. It is SegWit-native, so it processes transactions quicker and cheaper. Lastly, it supports Taproot addresses, which are important for sending/receiving Bitcoin NFTs.

The video below demonstrates how to create ordinal inscriptions using Hiro Wallet:

1.2 Xverse wallet

Xverse is a custodial mobile/web wallet developed by the Stacks team. You can trade bitcoin NFTs and bitcoins on Xverse. It does support Taproot, but not SegWit.

The video below demonstrates how to create ordinal inscriptions using Xverse:

1.3. Ordinals wallet

Ordinals wallet is the newest wallet on our list, having gone live on February 16. Curated specifically for trading Bitcoins NFTs, it’s currently in beta mode. So it’s only web-based, and you can currently only receive ordinal inscriptions.

2. Code-based wallets

2.1 Sparrow wallet

Sparrow wallet is a code-based cryptocurrency wallet that you can modify to make it suitable for trading Bitcoin NFTs. Ordinals’ creators have a step-by-step guide to setting up your Sparrow wallet to receive ordinals.

Step 2: Inscribe a Bitcoin NFT

There are currently 2 ways of creating your own ordinals:

2.1. Using a no-code inscription tool

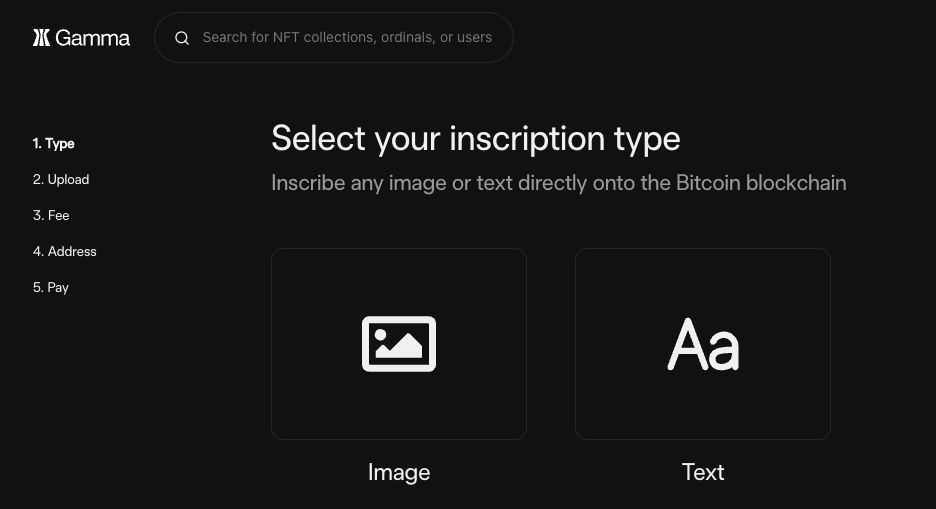

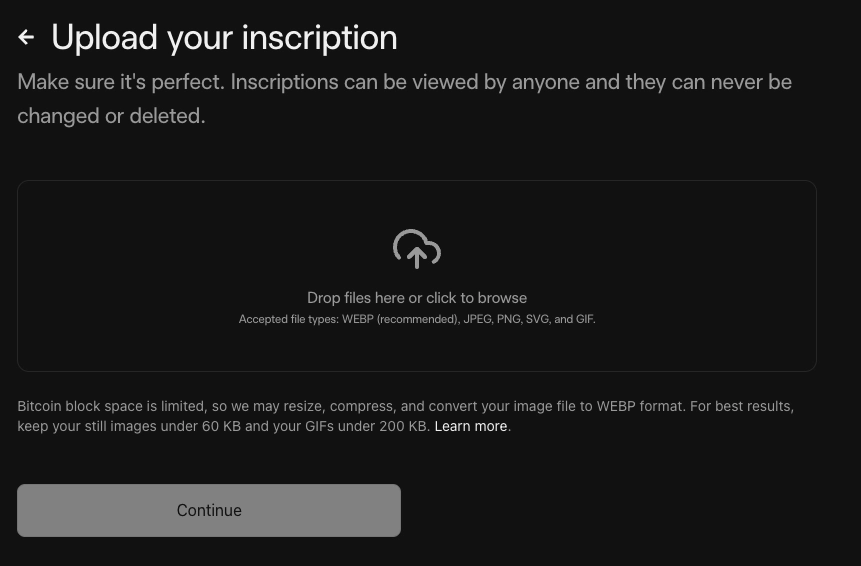

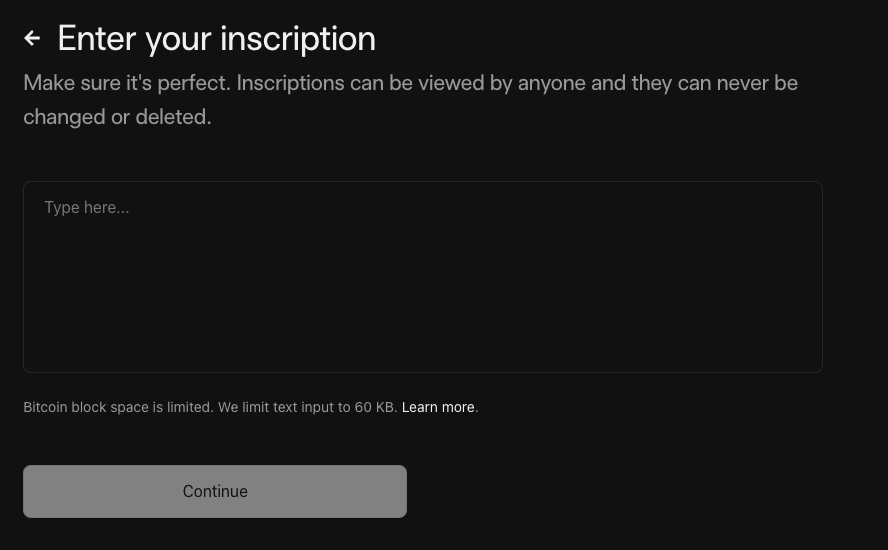

Note: We are using Gamma’s tool to showcase how NFT enthusiasts can inscribe ordinals and create their own Bitcoin NFTs:

- Select your inscription data type (i.e. image/text). Note that the size for text/images is limited to 60kb, and for GIFs it’s 200kb.

- If it’s an image, upload it.

- If it’s a text, write it out.

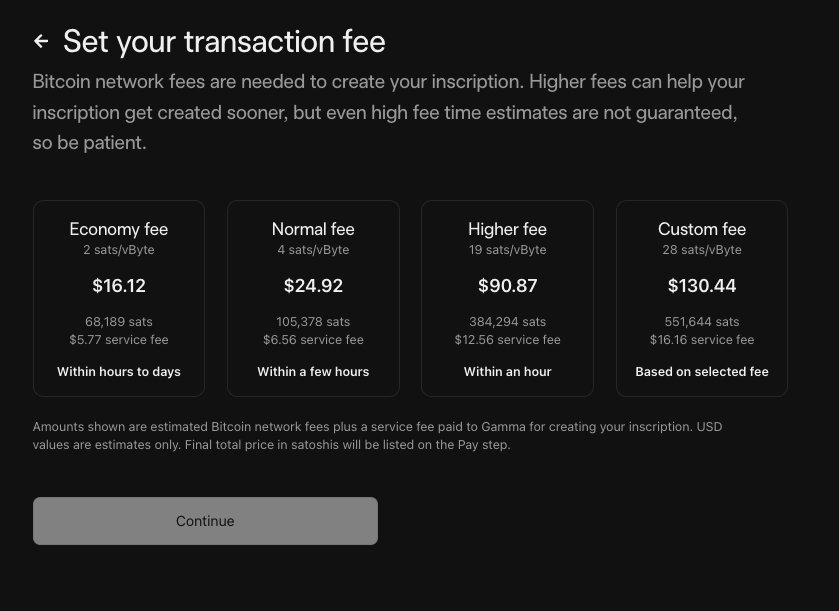

- Choose a transaction fee. We uploaded a 440 kb image for reference. Higher transaction fees lead to quicker inscriptions.

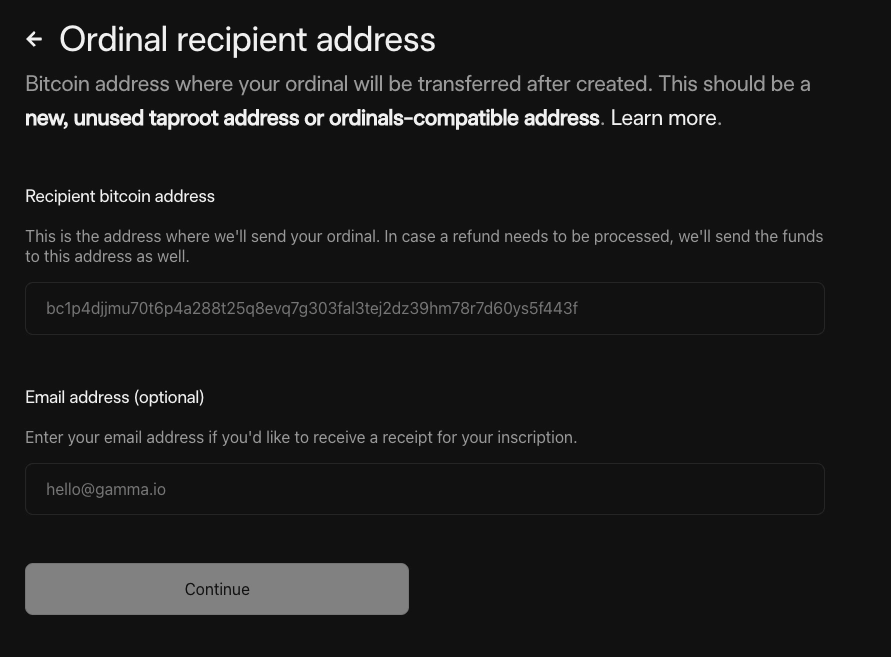

- Enter the ordinal recipient address. Gamma only sends the Bitcoin NFT to a Taproot address. That’s why we’d emphasized that your BTC wallet address should support Taproot addresses.

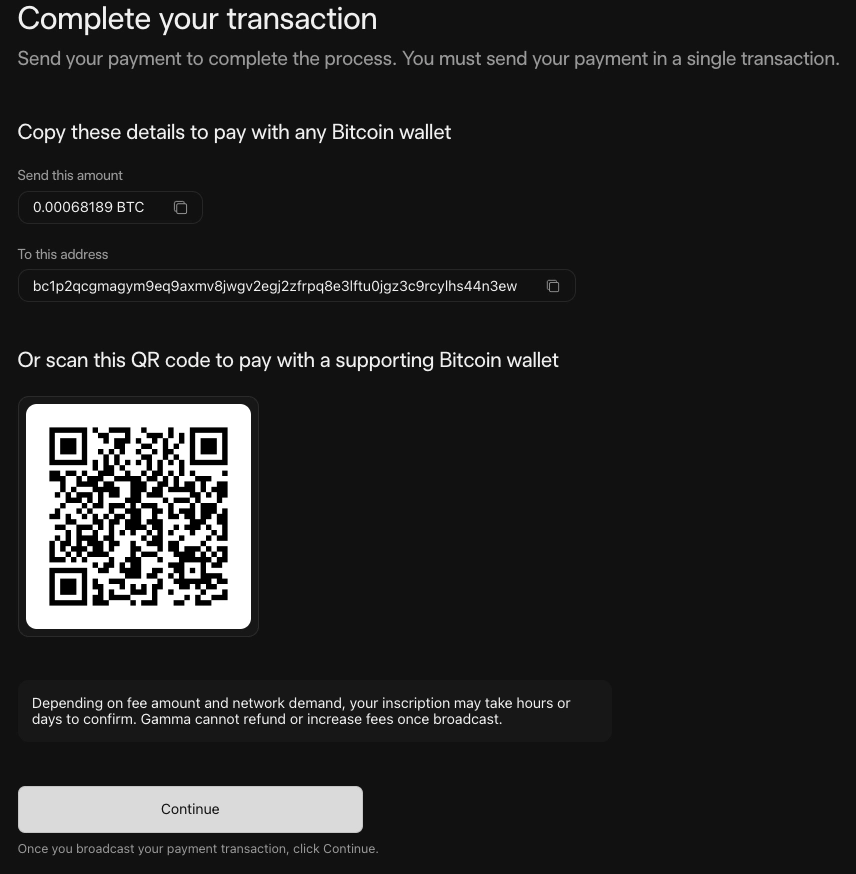

- Pay the transaction fee with any bitcoin wallet. We chose their “Economy” package and had to pay $16.12, or 0.00068189 BTC. To send the money to their wallet address, you can either scan the QR code or copy-paste the address manually.

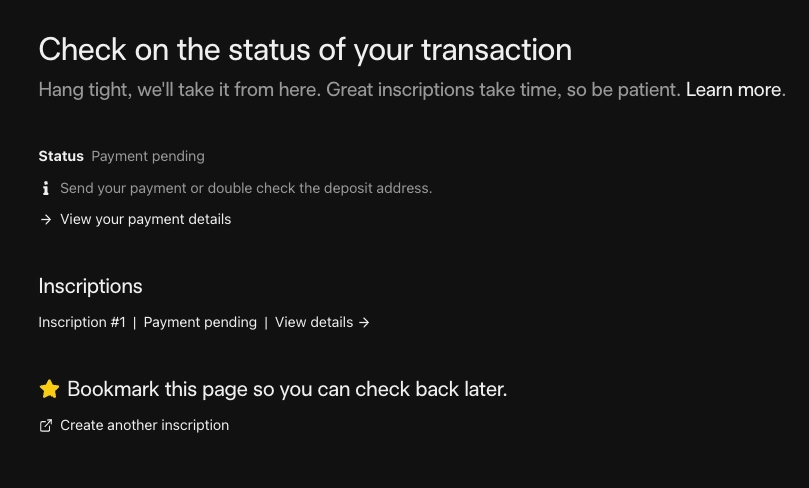

- The status of your inscription/payment will be communicated to you via the email address you provided. If everything goes well, your satoshi will be inscribed and sent to your wallet address.

- Note that depending on your fees and network congestion, it can take up to a few days for an inscription to be completed.

2.1. Use Ordinals Bot

Ordinals Bot was created by Satoshibles, who refer to themselves as creators of “NFT for Bitcoin enthusiasts.”

On Ordinals Bot, you can only make image inscriptions, as opposed to Gamma where you can inscribe a text or an image. Another difference: Gamma asks for a wallet address immediately. With Ordinals Bot, you could add the address after your inscriptions are created.

UI-wise, both platforms look similar. Their no-code/low-code interface pushes all the programming duty to the back end and only leaves you pressing buttons. Interactive-wise, the only difference between the two platforms is that you can go through all the steps on Ordinals Bot on a single page, whereas Gamma breaks it into separate screens.

The main difference is pricing. Ordinals Bot is more expensive. Their quote for the same 440kb image we uploaded on Gamma was $42.36 as opposed to Gamma’s $16.12.

This article was originally written by former AIMultiple industry analyst Bardia Eshghi and reviewed by Cem Dilmegani.

Sources

- “Which Bitcoin wallets are compatible with ordinal inscriptions?” Gamma.io Support. February 2023. Retrieved on March 14, 2023.

- Larson, Greg. (February 17, 2023) “Bitcoin NFTs? Ordinals Inscriptions Explained (Finding, Buying, & More)” NFT Now. Retrieved on March 14, 2023.

- James Beyer, Eric. (March 1, 2023). “Bitcoin Ordinals Wallets Have Arrived.” NFT Now. Retrieved on March 14, 2023.

Comments

Your email address will not be published. All fields are required.