Latest process mining trends and stats show that 93% of business leaders aim to leverage a process intelligence software like process mining since these tools enabled process improvement by 23%, digital transformation by 25% and automation by 25%.Process mining offers a variety of use cases beyond these broad application.

Explore the most common 44 use cases within their respective 12 categories:

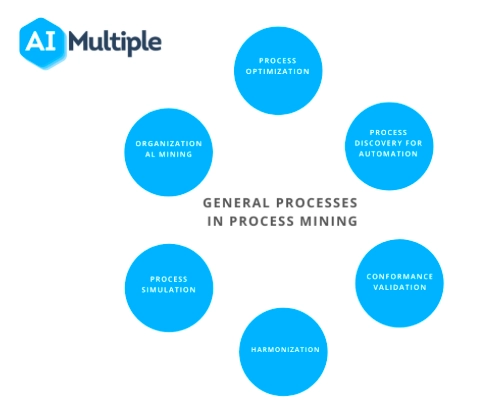

- Process mining use cases by general processes:

- Process mining applications by industry: Finance, automotive, banking, education, healthcare, insurance, logistics, production

- Process mining use cases by business function: Sales, IT service management & customer service

The image above displays share of process mining case studies for these 12 categories. You can see both use cases and real-life case studies:

Process Mining Software use cases with real-life examples

Process optimization

Process discovery

Conformance validation

Process harmonization

Process simulation

Organizational mining

Root cause identification

General Processes

The chart below shows the distribution of case studies across process mining use cases:

1- Process discovery for automation: Automation provides faster and lower-cost solutions. However, companies need to examine their business processes to use automation tools, such as robotic process automation (RPA) efficiently. Process mining vendors claim that their technology can reduce automation implementation time by 50%.

2- Process optimization except automation: Companies can use process mining for faster, more accurate process analysis. Event logs infer performance metrics and models to identify bottlenecks and costly steps for optimization. For instance, we evaluated every benefit of process mining in 51 case studies, revealing a 43% reduction in bottlenecks and a 4% elimination of unnecessary steps

3- Conformance validation: Companies can check if their as is process conform to the given specifications with conformance checks. For example, purchasing decisions need different approvals based on the ticket size and nature of the item purchased.

Nonconforming cases, reasons for deviations and, conformance trends can be analyzed, too. Companies can take action to reduce these deviations and ensure standardized processes.

4- Harmonization: Companies can use process mining to harmonize distinct processes efficiently. Insights from process mining tools enable quick realization of planned synergies. Example: In a process mining case study, Nokia applies process mining to its purchase-to-pay and order-to-cash processes, achieving a smooth customer experience and gaining knowledge on how to conjugate these processes effectively.

5- Process Simulation: Process mining capabilities can include process simulation and predictive analytics. Firms can make future predictions by mining and simulating their processes with the data gained from event logs. Their predictive analysis can be used to inform stakeholders and customers. Real-life example: the customer can receive an accurate estimate of when her loan application will be processed.

6- Organizational Mining: Process logs can identify organizational relationships, performance gaps, and best practices. However, almost all processes have a human component. Process data can be used to understand and improve the human aspects of business processes.

Sales

Lead-To-Order

7- Reduced sales cycle time: Lead-to-order processes can take a long time. This causes the payback time of marketing investments to increase. Companies can uncover the reasons behind this issue and, take action to reduce sales cycle time.

8- Increased conversion rate: Converting marketing strategies into sales is critical for companies. With a process mining tool, companies can discover if they have proper strategies for increasing conversion rates.

Order-to-Cash

Order-to-cash (O2C) encompasses all steps from receiving an order to completing payment and delivery. Process mining can help identify all the little bottlenecks that might exist in the process that hamper a smooth operation.

Read more on how to optimize order-to-cash processes with process mining.

9- Increasing on-time delivery: For customer satisfaction, on-time deliveries are essential. Companies can use process mining to uncover the reasons behind late deliveries.

10- Identifying reasons that hurt monthly revenue: Companies may lose a portion of their earnings during this process due to long-running holds or order cancellations. Process mining tools may point out the root causes of those issues and, companies can minimize those losses accordingly.

11- Locating key regions: With process mining, the companies can detect their high-value customers and critical areas to focus on those areas.

12- Identifying root causes of order changes: Customers sometimes change their orders which causes processes to take a longer time. The unclarity of pre-order stages might cause these order changes. Companies prefer to decrease these order changes to stabilize their processes.

13- Benchmark the amount of returned goods: Companies can discover the value of returned goods by using process mining. According to this insight, they can focus on improving their order-to-cash processes.

Find more details on how to apply process mining to sales processes.

IT Service Management

14- Reduced risk in ERP related developments: In Lassila & Tikanoja’s process mining case study, the company has implemented a new ERP system by employing process mining. The company achieved their goal to reduce the risks by increasing visibility to the ERP system and operational processes.

15- Reduced costs in ERP maintenance, development and support: Process mining can pinpoint mistakes or gaps in the IT systems, such as SAP. The same process mining case study (Lassila & Tikanoja) showed that the company reduced their implementation costs along with the risks of ERP deployments even though it was not primary goal of the project.

16- Delivering higher first-time resolution: IT systems may not provide the correct solution at their first try. Process mining tools can produce data-driven insights to increase the first-time resolution rate.

17- Discovering root causes of delays: Long-running tickets is a common issue. Companies can mine their processes to understand why those tickets are open for long. From the results gained from process mining tools, companies may discover shortfalls in their IT systems.

18- Automating for faster resolution times: IT service management is another field that is open to automation. Companies can use process mining to find areas to automate and provide faster resolution times. Some case studies claim that process mining tools decrease resolution times by 65%.

Find out 10 reasons to leverage process mining for IT service management.

Finance

Here we cover applications of process mining in the finance function of companies (not financial services industry specific applications):

Purchase-To-Pay

19- Identifying manual steps to automate: Mistakes and manual interventions in purchase-to-pay processes increase lead time. By analyzing processes, process mining uncovers automation potential that boosts accuracy and cuts rework. In some process mining case studies, process mining tool can increase automation by 35% and decrease rework time by 52%.

20- Eliminate maverick buying: Companies can mine their purchase-to-pay processes to reduce maverick buying. If companies have a specific problem on maverick buying, they may find certain areas to improve the use of frame agreements with process mining. Process mining vendors claim that they can detect maverick buying by following the rules below:

- A receipt shouldn’t be generated before a purchase order is created

- All invoices should be created after a PO

- PO without a contract should not exist (especially if the order is large in quantity and happens regularly)

Uncover how to deploy process mining for P2P processes.

21- Uncovering root causes for delays: Process mining enables companies to pinpoint which suppliers, products or departments cause delays. By taking relevant actions, they can achieve more on-time deliveries internally.

Accounts Receivable

22- Discover actions to encourage on-time payments: Customers don’t always pay on time. Companies can’t collect their receivables on-time in the end, and this might affect other processes. Process mining can identify the causes of this problem and find appropriate solutions.

23- Quicker invoicing: Billing your customers is another process that can become expensive and complicated from time to time. Process mining discovers the bottlenecks in the invoicing process and may find ways to automate it. As a result, it is possible to diminish invoice costs and provide quicker invoicing.

Accounts Payable

24- Reducing late payments: Companies can mine their business processes to uncover the reasons for their late payments. By fixing these inefficiencies, companies can diminish late payments and improve cash discounts.

25- Identifying real reasons behind incorrect invoices: Mistakes on the invoices or duplicate payments are common issues that cause extra workload. Companies can identify the reasons for these cases with process mining. It is stated that process mining software can reduce customers’ duplicate payments by 67%.

Audit

26- Compare “before” and “after”: When a company makes a change in its process, verifying the improvement may be a challenge. For consultants, process mining enables consultants to relate “before” and “after” of the processes.

27- Improve response time: While traditional process discovery may take months, process mining is faster. As a result, consultants like EY can complete end-customer process analysis within days using process mining tools

28- Risk identification: Process mining assures data-based information to consultants. With insights, consultants can identify risks and advise companies accurately.

Discover top use cases of process mining in finance in-detail.

Automotive

29- After-sales services: After-sales services refers to the customer support services to vehicle owners to improve their experience with the company while obtaining feedback over the product and service. Automotive manufacturers can deploy process mining to drive insights from the after-sales tasks and operations. These insights can improve after-sales services.

Read more on process mining in automotive industry.

Banking

Banks also benefit from process optimizations as most banks’ processes still include legacy systems and paper-based documentation. Process mining tools can help identify bottlenecks and automation opportunities improving customer satisfaction and efficiency. Processes to optimize include:

30- Mortgage: Mortgage is the most complicated B2C loan process and there are opportunities to improve it in most cases. Using process mining, banks can visualize mortgage workflows to spot delays caused by repetitive actions. This helps reduce customer waiting time and improve collaboration across different units.

31. Other loans

32. Card operations

Process mining supports banks in analyzing card operations to identify inefficiencies and delays.

Customer Service

33- Cross-channel analysis to identify anomalies: Process mining software can help analyze process steps across different channels to identify compliance issues and inefficiencies

34- Map customer journey: Process mining tool can illustrate the customer journey in a given channel by extracting data from CRM and ticket systems). By doing so, process mining facilitates tracking customer experience, challenges that customers face, and interactions between responsible agents and customers.

Education

35- Online learning platforms: Process and task mining can reveal details on how users navigate on learning platforms to improve user experience for students. For example, process mining can show the potential root-causes behind students’ exit rates from the given platform, such as the length of videos or organization of materials.

Discover applications of process mining in educational settings.

Healthcare

36- Administrative processes: Process mining discovers event logs that contain information about healthcare processes including the personnel in-charge, steps, and cost of processes and identifies areas for improvement.

37- Clinical pathways: serve for standardizing healthcare practices and detect issues that might lead to wrong treatments or delays which are crucial for many patients (e.g. cancer). Process mining can be used to identify clinical pathways and track bottlenecks and anomalies.

Learn about the growing role of process mining in healthcare organizations.

Insurance

38- Risk assessment: Insurance firms calculate risk to set premiums. Overestimating risk can lose customers, while underestimating it can lead to losses. Process mining helps by analyzing actual or historical data to map underwriting steps and identify risk factors. This allows insurers to monitor and improve the underwriting process for better decision-making.

39- Quote-to-bind ratio: Insurance companies try to reduce their quote-to-bind ratio which measures the conversion rate of quotes to the binding policies. Process mining offers insights to streamline operations by addressing inefficiencies and automation opportunities.

Explore more use cases, benefits & best practices of process mining for insurance.

Logistics

40- Reducing warehousing costs: It is hard to identify which warehouses cause logistics problems. Making mistakes in inventories also causes extra warehousing costs. Process mining provides full transparency in warehouse management. Thus, companies can locate problematic warehouses, diminish warehousing costs and save up to 40% of their warehousing costs.

41- Widening geographic range: Companies can widen their geographic reach by optimizing the locations of their warehouses. Process mining vendors claim that companies using their tools can increase their geographical reach by up to 20%.

42- Identifying the root causes of delays: Logistic delays may cause late deliveries and reduce the expected revenue. Process mining can discover the root causes of these delays. Companies can focus on these issues to avert possible revenue losses. Some companies claimed that they have increased their on-time delivery by 18%.

Learn the benefits of process mining for logistics/ supply chain.

Production

43- Reduced cycle time: To improve the output, reducing the production cycle time is a smart solution. Process mining can show the inefficiencies within the production processes. Companies can reduce their cycle time by fixing these inefficiencies. It is estimated that the throughput time can be shortened by 22% in the production processes.

44- Reduced rework in production: Companies can reduce their reworks by creating in-process alerts. As the manufacturing deviates from the standard, the process mining software can report to the relevant units in real-time. The benefit is that it provides companies with better quality products.

Read 6 use cases of process mining in manufacturing.

Software industry

45.Tracking the life cycle activities: The software development life cycle (SDLC) refers to the required stages while developing software (See Figure 2). Process mining can help track the entire software development life cycle by discovering and mapping the actual process model. This way, developers and project managers can identify if any steps are skipped.

46. Monitoring and managing software projects: Process mining can map the entire project flow, allowing every party in the software development team to monitor and manage the project while identifying issues and risky areas. Also, process mining illustrates process KPIs (e.g., cost and time), resources and parties involved in the given process.

Real-life example

For example, a BPM software provider company in Australia applied process mining to manage their customer project journey. With the help of process mining, the firm identified and solved compliance and performance problems.

47. Quality assurance: QAs control for software’s usability, accuracy, maintainability and portability. Process mining offers conformance checks and automated root cause analysis, which can help testers oversee their QA processes. This way, testers can ensure the efficiency and effectiveness of the QA process with process mining.

Real-life example

In a case study, researchers deployed process mining in a software development process dataset provided by a Brazilian software house with more than 2,000 cases (See Figure 3). In their conformance analysis, researchers pointed out that:

- 90% of the cases follow the order of execution defined in the formal process

- 25% of the processes skipped the planning stage

- 44% of projects were not documented.

48. Incident management: Incident management Incident management addresses unplanned activities that affect service quality. Process mining improves incident management by identifying automation and optimization opportunities. Predictive process mining and monitoring capabilities help developers, testers, and managers forecast potential incidents and intervene before they occur.

Real-life example

In a case study, researchers applied process mining to software development processes (See Figure 4) and identified that:

- 3 users in the support team were responsible for reworking items the most

- The analysis step in the model was skipped in real applications

- 50% of entities for which an analysis is not performed a required reworking.

FAQ

Further Reading

For more details on process mining, explore our articles covering use cases, software options, and case studies.

- How you can benefit from process mining

- A list of process mining case studies including project results

If you believe your business can benefit from process mining tools, you can check our data-driven list of process mining software and other automation solutions.

Be the first to comment

Your email address will not be published. All fields are required.