Top 5 Finance Workload Automation Benefits & Uses in 2024

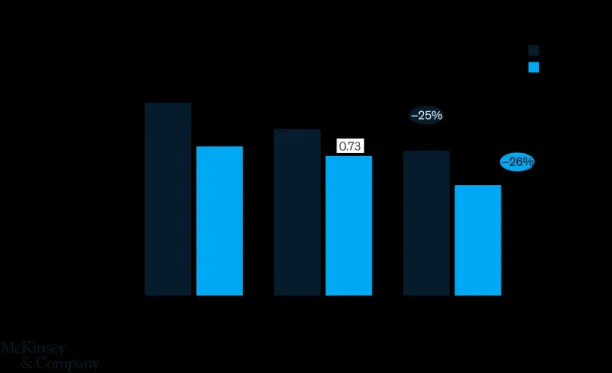

McKinsey’s research found that, in the last decade, finance department costs declined ~25% with the implementation of automation technologies (Figure 1). Automation of finance processes, such as invoice preparation, allowed leading finance departments to focus on more value-added tasks such as capital budgeting or long-term investments.

However:

- A significant gap remains between median and top quartile performers and most businesses can introduce further automation in finance

- As automation capabilities expand, new automation opportunities become available

Hence, we aim to inform finance executives about the benefits and use cases of workload automation (WLA) to assist them in automating time-consuming tasks in finance departments to increase efficiency & effectiveness.

What is WLA in finance?

WLA automates, schedules, and executes business processes via systems and computing environments in an organization. In finance automation, WLA is used for scheduling and execution of business operations such as:

To increase companies’ operating performance, and reduce finance operation costs and human errors.

Top 5 benefits of WLA in finance

- Save time: WLA in finance can reduce the time spent on repetitive tasks such as the preparation of invoices, preparing financial statements, and payroll administration, enabling finance teams to focus on more complex tasks such as financial planning and capital budgeting.

- Focus on high value-added tasks: With the automation and scheduling of repetitive tasks, the finance team can spare more time to focus on researching Capex & Opex strategies and analyzing forecasting reports to boost data-driven decision-making.

- Decrease human errors: WLA can help decrease the human error factor in accounting by scheduling and executing repetitive tasks prone to human error such as calculating tax deductions or preparing cross-check bank reconciliation statements.

- Reduce costs: With the use of WLA tools in finance, businesses can reduce their finance costs such as their data entry costs by about 70%.

- Increase security and visibility: The use of WLA tools can enable finance departments to aggregate the financial data in a single integrated platform which can decrease their exchange of emails to share data in various spreadsheets and increase security and visibility by allowing easy access to all financial data.

Figure 2: Applications of automation in finance.

Top 6 use cases of WLA in finance

1. Reconciling accounts and consolidating books

Global firms require numerous intra-company transfers which are regulated by complex sets of rules depending on which entities complete these transfers.

Finance automation solutions can help reconcile and consolidate these information, helping firms close their books on time.

2. Know Your Customer (KYC) Operations

Banks, hedge funds, and FinTech providers can reap benefits from using WLA in Know Your Customer (KYC)—or Know Your Client operations. KYC operations are guidelines to understand the:

- Identity

- Business practices

- The risk to their (potential) customers.

WLA automation tool can automate the practices of recording and identifying businesses’ existence, their addresses, and financial documents and save time from manually collecting information.

Furthermore, it can assist in cross-checking the collected information with respect to the list of sanctioned individuals and governments (such as the US Department of State’s Sponsor of Terrorism list) information to identify relationships and to decide whether the client passes the risk threshold. In this way, companies can avoid spending time on checking clients with a clean slate and inadvertent mistakes.

3. Client onboarding and off-boarding

WLA technologies can automate the process of client onboarding and offboarding to provide better time management and reduce human risk factors.

During client onboarding and offboarding, finance teams may require sending relevant information about the services that the company offers or confirmation of the documents affirming the client’s leave. Sending these documents and the confirmation of the documents received can be achieved by the use of WLA tools.

Also, during onboarding, a client’s account in the company’s website and their access to certain features such as tracking the state of their investments or password retrieval can be automated by WLA software and during offboarding, the cancellation of these accesses can be automated.

Additionally, enabling the credit cards of onboarding customers and disabling them of offboarding customers can be automated.

4. Loan Processing

WLA can reduce the time spent and human errors in loan processing procedures. Loan processing is the process of lending institutions assessing the necessary steps to extend or reject the loan.

In many cases, the borrower needs to fill out loan application forms. WLA tools can cross-check the information provided in the form, and blanks in the loan forms, and verify the additional documents that have the pre-approved criteria.

Also, WLA tools can ease the monitoring of loan performance by scheduling payment dates with notifications and provide an interface to compare other loanees in similar situations to sort out risk and exposure levels.

Explore loan processing automation in more detail.

5. Fraud Detection

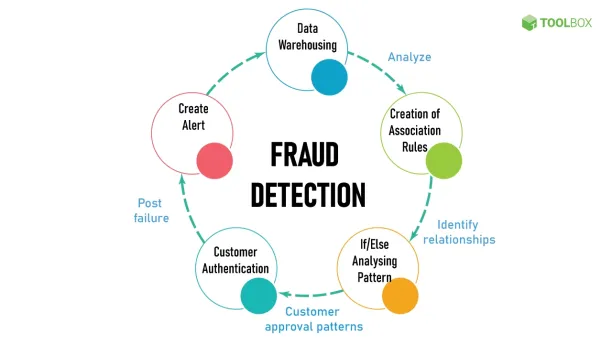

The use of WLA software can offer insights into fraud detection such as new account fraud, transaction fraud, and invoice fraud via machine learning (see Figure 3).

By using machine learning on WLA software, companies can automatically pinpoint suspicious account activities such as using fake identities, unauthorized transactions, and invoice frauds by scanning clients’ history of transactions and relevant records. Thus, they can aim at these accounts to indicate fraud and increase security.

To learn more about how AI is used in fraud detection you can read our How AI Can Improve Fraud Detection & Prevention article.

Figure 3: Fraud detection with WLA tools.

6. Data analytics

Using WLA software can help reduce time in merging financial data from various sources by integrating them on a single platform and enabling finance teams to focus more on forecasting.

ETL enables data analytics and valuable insights coming from multiple sources irrespective of their original format or location. But integrating them manually into a single database is a time-consuming task liable to human error. WLA tools offer higher visibility and operational speed of streamlining the data from various sources and enable finance teams to spend more time producing more exact and easy-to-read reports.

Furthermore, WLA tools enabling the data to be integrated into one platform can increase security because it can decrease the need to send spreadsheets through emails or carry the data in portable data storage devices.

Also, via WLA tools financial planning, analysis, and forecasting can be done, and these analyses can be compared to forecasts to improve forecast accuracy.

Top 4 best practices of WLA in finance

To implement WLA tools efficiently in finance, you may follow the following steps:

- Have clear communication with your finance team to ensure that they are aware of the benefits that WLA tools may bring.

- Determine your weaknesses by gathering information about time-consuming tasks from your finance team through surveys or reports.

- Conduct market research on WLA tools by consulting with your IT or a technology consultant to choose the right WLA tool for your company.

- Communicate with your finance team to determine the potential candidates to become WLA specialists from your finance team.

If you have further questions about workload automation best practices, you can reach us:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.