10 lessons from RPA leader UiPath's IPO in 2024

UiPath, one of the largest RPA players, filed its S-1 on March, 25, 2021 to get listed on the New York Stock Exchange under the ticker PATH. UiPath is expected to raise $1 billion. After 2021 first quarter, UiPath raised their initial IPO range from $43 to $50 per share, to $52 to $54 per share.

Please read our disclaimer about investment related advice before reading our analysis.

UiPath’s initial public offering (IPO) filing includes important information about the company and the market trends shedding more light on how it became one of the fastest growing software companies in enterprise software. We summarized the highlights:

UiPath’s main activities

UiPath has created an end-to-end automation platform enabling customers to build, manage, run, engage, measure, and govern automation programs. Integrated Computer Vision capabilities, an AI platform, low code development capabilities and a free community edition are prominent features in the market for UiPath.

UiPath’s revenue comes from licenses for its proprietary software, maintenance and support, and professional services. License fees are based on the number of its software users and the number of automations running on its platform.

IPO timing

UiPath is expected to go public sometime between June-September 2021.

- The company published its S1 on March, 25, 2021

- Most companies go public within 3-6 months of releasing their S-1. This time is used for addressing SEC’s comments on the S1 (which can take multiple rounds) and 2 weeks for the roadshow. By completing a direct public offering (DPO), the company could shorten the process. However, it seems that the company will follow the traditional IPO route and have an investment bank underwrite its offering

Corporate control

Control will remain with the founder, Daniel Dines, .

Through the fundraising rounds, Daniel has kept Class B shares while investors have picked Class A shares. Due to 35 votes assigned to each Class B and 1 vote assigned to each Class A share, Daniel will be controlling ±%91 of votes.

This is similar to the models followed by Facebook and Google where founders retained control in public companies. So far, this has generated significant value for shareholders in the case of mentioned companies. However, one person rule checked purely by stock market regulations and laws is not a very diversified or democratic model of corporate control.

Finally, even though the company is controlled by a single individual, it has not chosen to get listed as a “controlled company” which would have exempted it from certain requirements about its boards and committee.

Stakeholders

Customers

UiPath is focused on large enterprises. As of January/2021,

- 75% of revenues were from 13% of customers (i.e. 1,002 / 7,968). These customers have an ARR of $100,000+

- 35% of revenues were from 1% of customers (i.e. 89 / 7,968). ARR of these customers was $1.0+ million

Most large enterprises seem to be trying UiPath with limited budgets or using it limited scenarios. Its customer base has exceeded ±8,000 customers including 80% of the Fortune 10 and 63% of the Fortune Global 500. Its large enterprise clients include:

- Adobe

- Applied Materials

- Bank of America

- Chevron

- Chipotle Mexican Grill

- CrowdStrike

- CVS Health

- Deutsche Post DHL

- EY

- Generali

- KDDI

- SBA Communications

- Takeda Pharmaceuticals

- Uber Technologies, Inc.

Most of its revenues (61%) are from outside the US which is not surprising given that was started in Romania.

UiPath also released a version of its software as a community edition which helps with growing its visibility in the market.

Partners

Though we couldn’t find the numbers in the S-1, we expect most of UiPath’s customer relationships to be initiated by its partners.

UiPath has more than 3,700 business partners including BPOs, System Integrators (SIs) and consultants including Accenture LLP, Capgemini SE, CGI Inc., Cognizant Technology Solutions Corporation, Deloitte & Touche LLP, Ernst and Young LLP, KPMG LLP, and PricewaterhouseCoopers LLP.

UiPath also underlined 3 types of tech partnerships:

- Integrations to tech platforms like Adobe, Alteryx built either by these platforms or in partnership with UiPath team

- OCR/ NLP and custom ML and AI solutions

- Cloud tech providers like AWS, Google, Microsoft Azure

Target market size

UiPath’s market potential estimate relies on the revenues of its best performing customers so it seemed optimistic but not surprising for us. Companies tend to overestimate their addressable market to investors.

UiPath estimates its current market potential to be $60 billion. Underlying assumption is that all companies can spend on RPA in similar levels to UiPath’s highest revenue customers. UiPath’s rationale is that these customers have had the time to implement RPA and gain significant benefit from it and that other companies will also achieve the same.

Their methodology is:

- Identification of number of companies with minimum 200 employees in all sectors

- Grouping those companies into three segments according their total number of employees

- Multiplication of the companies in each segment with their estimated revenue potential. To estimate this, UiPath team segmented their own customer base into three segments as described above. Then, for each segment, they take the 90th percentile of customer Annual Recurring Revenue ARR as of December 31, 2020, among customers with at least $10,000 in ARR. They take this ARR to be representative of the market potential for that segment

- Summing the results from each of these segments

UiPath is active in the below markets and based on their total, we estimate their current market to be worth $2-3 billion in 2020:

- RPA including AI enabled RPA applications: Current market size is expected to be $1.9bn by Gartner

- Process mining: Less than $1 billion since in 2018 this market was still estimated to be ±160 million.

We did not estimate the market potential since it not a measurable figure.

- Before new companies adopt RPA, there will be alternatives to RPA which will be preferred by some of these companies.

- The companies that have the potential to implement RPA will also be growing along with the overall economy.

Due to the dynamic nature of this, we do not find market potential to be informative. Market size and estimated growth rates are more relevant for estimating growth of industry participants. While the market growth is harder to estimate, UiPath grew its total revenue from $336M in 2019 to $608M in 2020, achieving 81% annual growth*.

Financials

Profitability

The company significantly reduced its operating loss from $517M to $110M in 2020*. Keeping losses at these levels, the $1 bn that is planned to be raised would give them a 10 year runway. However, the company will probably want to increase its losses and expand its revenues since it can raise funds relatively easily as a public company.

The reduction in operating loss was mostly driven by

- $272M increase in revenues

- $103M reduction in sales & marketing spend mainly due to reducing headcount via restructuring and limited conference related costs

- $21M reduction in R&D

- $18M reduction in G&A

Revenue growth

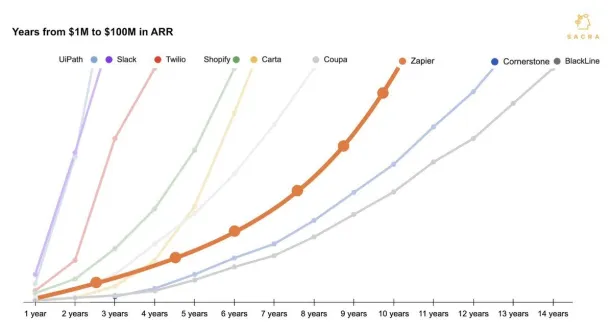

UiPath is one of the fastest growing companies in the history of enterprise software. It took them ±13 years to reach 1M ARR and just 2 years to reach 100M ARR.

Future

UiPath has been expanding the scope of its offering while other players have been making acquisitions. We expect more activity in the industry since this is still a fast growing industry which attracts the interest of numerous tech giants

UiPath has made acquisitions including these:

Other acquisitions & partnerships in the RPA space include but are not limited to:

- Service Now’s acquisition of Intellibot in 2021

- Microsoft’s acquisition of Softomotive in 2020 and its launch of Power Automate as part of its Office 365 offering

- Google Cloud & Automation Anywhere partnership

- SAP’s acquisition of Contextor in 2018

Impact of Covid-19

As any other automation company, UiPath claims that the pandemic accelerated the adoption of automation and created more opportunity for RPA market. This is hard to confirm quantitatively because the company

- was already in a high growth phase at the time of the pandemic. In such cases, impact of events like pandemics are harder to observe when compared to companies more stagnant financial growth.

- did not share quarterly revenues before 2019 Q4.

However, based on the available data, it seems that pandemic has not significantly accelerated UiPath’s already impressive growth. As seen above from their S-1, they have quadrupled (i.e. from 700+ to 2,800+) their number of customers in a year (2018-2019) before COVID-19. However, post-pandemic, they have doubled their number of customers in a similar timespan (from 2019 to 2020). However, it is also worth noting that as companies get larger, their growth rates dwindle as it is harder to grow a larger company. Therefore, it is not clear whether the pandemic had a positive or negative impact on UiPath’s growth.

To see all RPA companies, feel free to check out our prioritized, data driven list of RPA companies.

For more info on RPA:

* These are 2020 and 2021 fiscal year figures. Their fiscal year ends in January 2021 and they call that as fiscal year 2021 revenue. We simply called it as 2020 revenue since 11 months of that fiscal year was in 2020.

Sources:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.