33+ Public & Private Quantum Computing Stocks in 2024

There could be between 2,000 and 5,000 quantum computers worldwide by 2030. Tech giants such as IBM, Intel, and Google which are investing in quantum computing technology are providing an entry point for many retail investors to get involved in the quantum area. Before proceeding, please read our disclaimer on investment related topics.

Though, there are public companies investing in quantum computing (QC) and ETFs covering such companies, their exposure to QC is limited. High net worth individuals can buy stocks of companies that are focused on QC to get higher exposure to the QC market growth.

To learn more about quantum computing technologies, companies and stocks:

Quantum computing technology vendor landscape / ecosystem

QC vendors are categorized based on the type of product they provide:

- End-to-end solutions

- Hardware

- Photonics

- Trapped ions

- Superconducting material

- Semiconducting material

- Software

- Research labs

To learn more about QC companies, feel free to read our article QC companies of 2021: Guide based on 4 ecosystem maps

Public companies investing in QC

Most of the companies investing in development and innovation of quantum computing technologies are startups. However, big companies such as Google and Amazon have cloud platforms for quantum computations, whereas Microsoft Azure released their own quantum tools. Other tech companies such as AT&T and NEC collaborated with universities and research laboratories to explore quantum properties, algorithms, and applications.

Public companies with medium to high exposure to quantum computing tend to be sparsely traded companies with a few hundred millions in valuation. Some have grown substantially in value, for example Archer Materials Limited has grown 9x from September 2019 to April 2021.

Here’s a comprehensive list of the public companies investing in QC hardware and software:

| Company | Ticker | Category | Exposure |

|---|---|---|---|

| Alibaba | BABA | Software | Low |

| Amazon | AMZN | Hardware Software | Low |

| Archer | ARRXF | Hardware | Medium |

| AT&T | T | Software | Low |

| Atos | AEXAF | Hardware Software | Low |

| Baidu | BIDU | Software | Low |

| Fujitsu | FJTSF | Hardware | Low |

| GOOGL | Hardware Software | Low | |

| Hitachi | HTHIY | Hardware | Low |

| Honeywell | HON | Hardware Software | Low |

| IBM | IBM | Hardware | Low |

| Intel | INTC | Hardware Software | Low |

| Microsoft | MSFT | Software | Low |

| Mitsubishi | MSBHF | Software | Low |

| NEC | NIPNF | Hardware | Low |

| Nvidia | NVDA | Hardware | Low |

| Quantum Computing Inc. | QUBT | Hardware Software | High |

| Quantum Numbers Corporation | QNC:PUR | Hardware | High |

| Toshiba | TOSBF | Hardware | Low |

Private QC companies

High net worth individuals can invest in private company stocks via private equity exchanges like EquityZen.

Here’s a comprehensive list of private companies investing or focused on quantum computing technologies:

| Company | Category | Funding (M) |

|---|---|---|

| PsiQuantum | Hardware | $509 |

| Rigetti | Hardware Software | $199 |

| D-Wave | Hardware Software | $216 |

| IonQ | Hardware Software | $82 |

| Zapata | Software | $67.4 |

| 1Qubit | Software | CA$45 |

| Xanadu | Hardware Software | $36 |

| Quantum Circuits Inc. | Hardware Software | $18 |

| QC Ware | Software | $15 |

| Q Ctrl | Software | $15 |

| Delft Circuit | Hardware | N/A |

| Huwawei | Software | N/A |

| Quemix | Hardware | N/A |

| Turing Inc. | Hardware | N/A |

Quantum Computing ETFs

There is a single ETF which covers stocks with exposure to quantum computing however most of the included stocks are machine learning or other hardware stocks. Therefore currently, there is not an ETF that is purely focused on quantum computing.

Exchange Traded Funds (ETF) are similar to stocks. ETFs can be traded on exchanges and have unique ticker symbols to track their prices. However, unlike stocks, which represent individual companies, ETFs represent a basket of stocks. For the quantum computing industry, the most significant ETF is the Defiance Quantum ETF QTUM which claims to provide exposure to companies on the forefront of cloud computing, quantum computing, machine learning, and other transformative computing technologies.

QTUM ETF tracks the BlueStar machine learning index and quantum computing, which includes ±70 stocks who develop or use quantum computing technologies, or whose products and services are required for machine learning based on traditional computing.

Are QC stocks worth the investment?

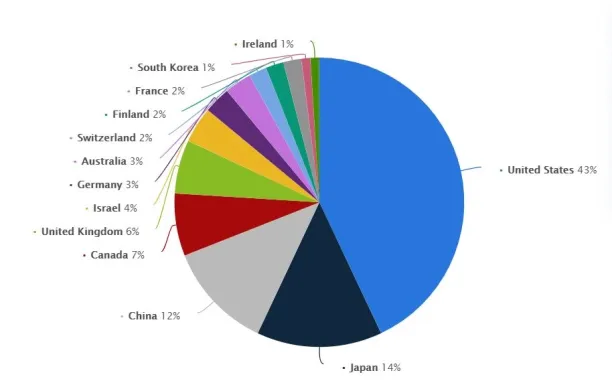

While quantum computing is still in its “theoretical phase”, there is on-going progress in efforts to close the gap between research labs and real world applications. Today, quantum computing technologies have many applications in both research and industry. Applications for quantum computing related patents are increasing steadily each year with the USA in the lead. IBM alone has filed 554 patent applications in 2020, followed by D-Wave and Google.

Therefore, we believe that QC will find more opportunity in the future in real-world applications. However, as with any emerging technology, different companies are following different approaches to commercialize QC. Therefore, the risks are high and many companies will inevitably fail as the approach that they follow may not turn out to be the successful one. A good analogy is the traditional computing market which created immense value after a period of numerous failures and merger&acquisition activities in the early days of traditional computing.

For more on quantum computing

To learn more about QC technology, feel free to read our in-depth articles about the technology, applications, and future:

- Future of Quantum Computing in 2022: in-Depth Guide

- Quantum Cryptography / Encryption in 2022: in-Depth Guide

- Quantum Entanglement: What it is & Why it is important in 2022

You can also check our comprehensive list of quantum computing companies.

If you are considering buying off-the-shelf QC products, let us help you:

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.