NFTs in 2024: Marketplaces & Real-Life Use Cases

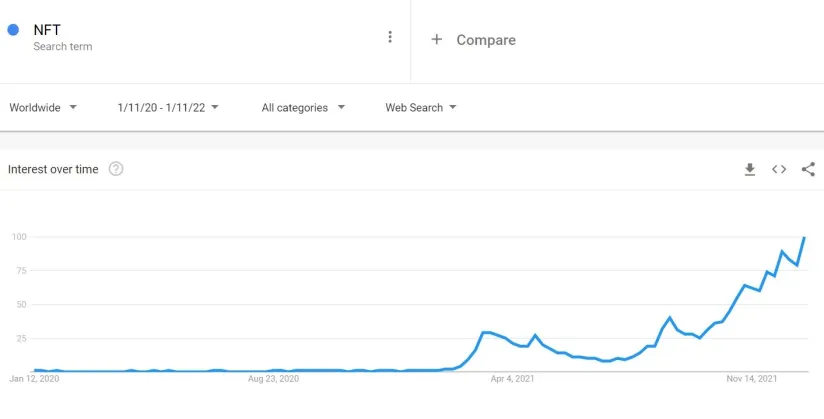

NFTs were the spotlight of crypto markets in 2021. The hype around NFTs caused NFT prices to soar to an unjustifiable level for digital pictures in 2021. When we first wrote this article in April 2021, we wanted to highlight the 2021-2022 tech bubble and explain our view that NFT collectibles are a fad. The market proved us right so far with the NFT market as measured by the Nansen NFT-500 index dropping from its February 2022 peak by 45% by end of May 2022. However, we believe NFTs are here to stay due to their use cases that can provide actual utility to businesses and individuals. In this article we will cover what NFTs are and their different aspects.

What is a non-fungible token?

Non-fungible tokens (NFT) are digital assets stored on a blockchain that certifies their uniqueness and non-interchangeability. NFTs can be in the form of an image, video, audio, or any digital file (e.g. tweet, Facebook post). However, a “minted” token has a unique code connected to a file, which allows the original file to be distinguished from copies floating around online.

Properties of NFTs are:

- They have no tangible form other than digital bits on the blockchain

- They have a unique ID in the blockchain. For example, today you can exchange 100$ with a specific serial number for 72£, or 84€, or even two 50$ bills. The value of the money does not come from the serial number (the unique identifier) on the banknote. However, in NFTs, the value comes from its unique identifier.

- The connected digital asset may or may not be unique. It can be copied and again placed on the blockchain as an NFT but then it would receive a new ID.

What are the issues with NFT collectibles?

NFTs are mostly associated with collectibles such as Bored Ape Yach Clubs and CryptoPunks. Even though that NFTs from these collections have sold for significant amounts there are issues

- Debatable scarcity: NFTs certify a user’s ownership of an instance of a digital file. Though that instance is unique, other unique instances can easily be created. For example, buying Jack Dorsey’s first tweet is like buying a copy of his tweet with a unique and non-alterable ID number. So the owner of the NFT does not own the original tweet.

- Track record of not generating large, liquid markets: Many of the NFTs in some of the top collections have not been sold even once, according to Cointelegraph’s research.

- Carbon impact: A significant carbon footprint is generated by the cryptocurrencies used to buy and sell NFTs

Future of NFT

NFTs use cases

NFTs use cases go beyond JPEG pictures and collectibles that provide no utility. They have B2B and meaningful B2C use cases. They are being used in :

- Supply chain

- Music

- Ticketing industry

- Fashion

To understand more about NFT use cases read, Top 6 NFT Use Cases.

Dynamic NFTs

The new trend in NFTs is the move from static NFTs to dynamic NFTs. Dynamic NFTs are smart contracts that use real time data thanks to oracles. Oracle networks such as Chainlink provide secure input data to smart contracts. The oracle allows the NFT to use external data/systems as a mechanism for minting/burning NFTs, trading peer-to-peer, and checking state. For example, dynamic NFTs can be minted in real-world locations based on user-specific location data. These NFTs can be placed at random or sponsored locations.

Metaverse

The rise and development of the metaverse can impact NFTs growth significantly in the future. Mckinsey expects the metaverse to generate up to $5 trillion in value by 2030. For example, companies such as PwC, JP Morgan, and Samsung have bought lands in form of NFTs in the metaverse.

NFT marketplaces

NFT marketplaces are platforms that allow NFT creators to buy, sell, and auction their digital assets using digital wallets and cryptocurrency. To learn more about NFT marketplaces read our analysis of Top NFT marketplaces article.

NFT market size

According to NonFungible, the NFT market grew by more than %21,000 in 2021. Additionally, NonFungible, which tracks NFT sales, claims that ±$6B has been spent on collectibles, ±0.65B on arts, and ±$0.6B on games in the first quarter of 2022.

How are NFTs created?

NFTs are created or “minted” by creating a file on a blockchain that cannot be edited, manipulated, or deleted. When someone buys an NFT, the token is transferred into their digital wallet. However, the buyer will not necessarily receive copyright privileges for the purchased file.

Token standards

Token standards are a set of rules that allow token creators to build unique tokens which can be distinguished from each other, verify their ownership, and keep track of created tokens. Some of the NFT standards are :

- ERC-721

- ERC-1155

- BEP-721

- SIP-009

For more on NFT standards, read our Top NFT Standard article.

Examples of NFTs

Any digital asset that is unique for which an owner can be identified with certainty can be considered a non-fungible token. The most common NFT implementation requires blockchain as explained above. NFTs can be categorized based on their type as follows:

- Collectibles: For example, a video of LeBron James dunking a basket in a game against the Sacramento Kings sold for $208k.

- Art: A JPG image called “Everydays: The First 5000 Days” by Beeple sold for $69 Million, and was paid for with Ethereum cryptocurrency.

- Domain names: For example, Budwiser bought Beer.eth for almost $95,000.

- Gaming: For example, a land parcel in the Decenterland metaverse was sold for almost $1.6 million.

To understand more about different NFT types, read our Top 14 NFT Types article.

Further reading

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.