Top 10 Crypto Exchange Platforms in 2024

Please read our disclaimer on investment related topics before proceeding.

Cryptocurrency has been a staple for digital investors since first being traded in 2010. If you’re a veteran in the domain, you’re already familiar with crypto exchanges, platforms where you can buy, sell, and trade cryptocurrencies like Bitcoin, Ethereum, and others.

But if you are a newcomer, it must be overwhelming to navigate the different cryptocurrency exchanges, each with their own set of features, security exchanges, trading fees, and supported cryptocurrencies.

In this article, we’ve explained why you should be using a crypto exchange platform, what features to look for when choosing one, and a list of the top ones.

Where to buy cryptocurrencies?

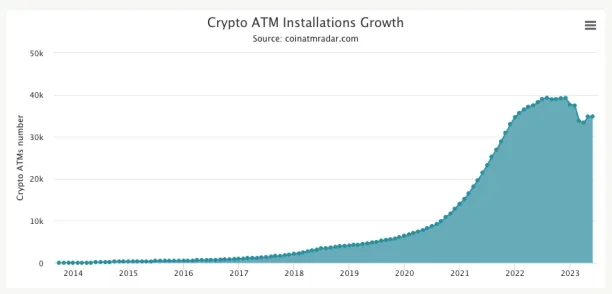

You can purchase cryptocurrencies from crypto ATMS. There are now almost 35K1 ATMs globally. Crypto ATMs are attractive for users because they:

- Are easy to use, especially for beginners

- Are quick and straightforward, same as regular ATMs

- Do not rely on internet connection for crypto trading

The other alternative is online crypto exchange trading platforms. These are online hubs for trading and selling crypto currencies. Benefits of crypto exchanges over ATMs include, but aren’t limited to:

1. Liquidity & trading volume

Online cryptocurrency exchanges have higher liquidity and trading volumes compared to crypto ATMs. This allows large orders to be fulfilled easily and quickly

2. Supported coins

Crypto exchange platforms support more cryptocurrencies. While an ATM might only accept Bitcoin or a few other popular coins, online exchanges often list hundreds of different coins.

3. Fees

Crypto exchange fees are usually higher at ATMs than on online crypto exchange platforms. One reason is machine maintenance and rent of space to house the ATM at. Online cryptocurrency exchanges don’t have this issue.

4. Accessibility

Online Online exchanges can be accessed from anywhere with an internet connection; a cryptocurrency ATM requires you to be physically present.

5. Advanced trading features

Online exchanges often offer advanced trading features, such as limit orders, stop orders, futures trading, and margin trading, which are not available at ATMs.

6. Storage

Online exchanges also often provide a digital wallet for storing crypto.

What to consider before choosing your crypto exchange?

With almost 6002 crypto exchange platforms, it is difficult to choose the best crypto exchange. These are the features you should look for in an exchange platform:

1. Security

As with any financial service, security and privacy are non-negotiable. You should ensure that your crypto exchange offers the following security features:

- Custody of funds: By depositing funds into an exchange, you’re entrusting it with the security of your digital assets. Many exchanges store the majority of users’ funds in offline or “cold” storage to reduce hacking risk.

- Account security: Crypto exchanges often offer features like two-factor identity verification process for withdrawals to enhance account security, as well as biometric authentication features.

- Transaction security: Crypto exchanges should have end-to-end encryption to prevent interception.

- Audits and compliance: Although you’re dealing with decentralized exchanges, they are still audited by central authorities to ensure the security of their systems to protect user funds. So before purchasing anything from the provider, learn about the regulation authority (can be Financial Conduct Authority (FCA) in the UK or Financial Crimes Enforcement Network (FinCEN) in the US) that regulates the exchange provider.

- Insurance: Some crypto exchanges offer insurance policies that cover depositors in the event of a security breach.

In our research, we found these crypto exchanges to be the most secure:

- Binance

- Kraken

- Coinbase

- Gemini

2. Trading volumes

Trading volumes is another important metric to identify the reliability of exchange platforms. We recommend choosing a provider with a transaction volume of +$1B in the last 24hr.

A cryptocurrency exchange platform with a high trading volume shows their suitability with handling large sums of money and requests. Platforms that handle most of the transaction volume in the crypto market are:

- Bianance

- Coinbase

- FTX

3. Ease of use

Ease of use is a critical factor when choosing a cryptocurrency exchange platform, particularly for those new to the world of cryptocurrencies.

Cryptocurrency transactions can be complex and overwhelm newcomers. An intuitive, user-friendly interface can make the process more accessible, allowing users to navigate the platform efficiently, make transactions confidently, and manage their investments effectively.

Moreover, an easy-to-use platform reduces the risk of user errors, which can be costly when dealing with cryptocurrencies. Misplaced decimal points or accidental transactions can lead to significant losses. So a clean, simple UI can prevent such mishaps.

4. Number of coins & fiats

Although Bitcoin is the most popular and valuable currency, it’s not the only one available for crypto trading. Other Bitcoin alternatives include Etherium, Ripple, Litecoin, Stellar, Tether, Cardano, and Polkadot.

Prior to trading, you should choose a platform that offers the highest number of altcoins. Exchanges that offer the most number of coins are:

- Gate.io

- Huobi Global

- KuCoin

The other determinant factor is the variety of fiat currency that the crypto exchange platform offers. Although most platforms accept deposits made with USD, EUR and GBP, if you want to pay the exchange platform with your local currency you should consider exchange platforms with a wider variety of deposit options. Platforms that support +45 different fiat currencies are:

- Binance

- Huobi Global

- KuCoin

5. Commissions

Exchange platforms make their money from trading fees, withdrawal fees, and deposit fees. You should individually check how much commission your platform charges. The lowest trading commissions are offered by:

- Binance

What are the best cryptocurrency exchange platforms?

We’ve already named some platforms that performed well in areas like security, volume, altcoins availability, and commission rates. The table includes the top 10 cryptocurrency exchanges for easier assessment.

We shortlisted top cryptocurrency exchange platforms that perform better in some observable metrics such as volume, ratings, popularity, flexibility etc.

Disclaimer: The links are affiliate links. They allow us to earn affiliate fees, at no extra cost to you. So we recommend you to use our codes. The list is sorted with the list’s sponsor at the top, followed by other exchanges sorted by their number of monthly visitors.

| Exchange Platform | M monthly visitors (*) | $bn Volume (24 h) | # of Coins | # of fiats supported | Deposit Options (**) | Withdrawal Options (**) | Trading Commissions |

|---|---|---|---|---|---|---|---|

| PrimeXBT | 0.6 | TBD | 41 | 18 | TBD | TBD | TBD |

| Binance | 66.7 | 8.5 | 386 | 12 | Bank Transfer (Wire, SEPA, ACH), Credit Card (3.5%) | Bank Transfer (International Wire ($35), Wire ($15), ACH, SEPA (€0.8)) | 0.10% |

| Coinbase | 32 | 1.154 | 244 | 3 | Bank Transfer (Wire ($10), ACH), Credit Card (3.99%) | Bank Transfer (International Wire ($25), ACH) | 1.49% |

| Huobi Global | 11.4 | 0.395 | 619 | 50 | Bank Transfer (Wire, SEPA), Credit Card (%3.5) | Bank Transfer (Wire ($20)) | 0.20% |

| Gate.io | 12.1 | 0.55 | 1,735 | 2 | Only Crypto transfer is possible | Only Crypto transfer is possible | 0.05%-0.2% |

| KuCoin | 9.4 | 0.53 | 854 | 48 | Bank Transfer(Wire,SEPA),Credit Card(3.00%) | Only Crypto transfer is possible. | 0.0125%-0.1% |

| OKX | 9.4 | 0.978 | 342 | 46 | N/A | N/A | 0.10% |

| Kraken | 5.7 | 0.58 | 229 | 7 | Bank Transfer (Swift, FedWire, SEPA) | Bank Transfer (Swift ($4-35), FedWire ($4-35), SEPA (€0.09-1)) | 0.26% |

| Bitfinex | 2.4 | 0.76 | 197 | 4 | Bank Transfer (Wire (0.10%)) | Bank Transfer (Wire (0.10%)) | 0.20% |

(*) Number of visitor data was provided by similarweb.com and updated on 05.31.2023

(**) Payment options that do not have any value inside parentheses do not charge any commission during the transaction.

FAQ

What is a cryptocurrency?

A cryptocurrency is a virtual currency that is protected by cryptography, which prevents it from being double-spent and counterfeited.

Why do cryptocurrencies rise in value?

(1) People seeking speculative investments, (2) growing popularity of decentralized finance, (3) and non-inflationary nature of some of the currencies, because of halving.

This article was originally written by former AIMultiple industry analyst Izgi Arda Ozsubasi and reviewed by Cem Dilmegani

External Links

- 1. “Bitcoin ATM Installations Growth.” Coin ATM Radar. Retrieved on May 31, 2023.

- 2. “Top Cryptocurrency Spot Exchanges.” CoinMarketCap. Retrieved on May 31, 2023.

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow onNext to Read

What are Crypto Derivatives? Types, Features & Top Exchanges

DeFi: What it is, dApps, DEXs and Top 10 DeFi Exchanges in '24

Thank you for the clear blog on the cryptocurrency topic. I loved it. It was very easy to understand. Keep Going.

Hi, Arunkumarji. We’re glad you enjoyed the article.

Thank you for your succinct and clear, yet thorough articles! I find them very helpful. Note though: do you periodically refresh the table of exchanges? It does not seem up to date. For instance, OKCoin/OKX appears in some other of your articles, but not here, or trading volumes for instance are quite different from those other articles’ tables – which brings some confusion I think. Thank you!

Hello, Caroline. Thank you for your feedback. No, we do not update our tables frequently, but rather periodically. Could you please provide us with the other articles’ URLs that have contradictory volume numbers?

Thanks for the info.

Very useful and helpful.

Thanks for your concise article on this subject of crytocurrency.

It is really insightful

thanks for your comment!

Is there a way to add an exchange to the list, I think it’s not full?

Please write to us: https://research.aimultiple.com/contact-us/, this is not a comprehensive list but we can make additions.

wrong. the number 1 criterion is customer service yes or no. It’s very complicated and confusing opening a crypto account. Either they help you or they don’t.

Thank you. I think it depends on the user though.

I love the way you explain cryptocurrency in their processes. It’s user-friendly and it’s easy to follow along for the lay person. Can I have your permission to share this article on my Facebook page? I will credit you during the upload. I have many friends and family who are totally lost when it comes to cryptocurrency and how it works. You’ve made that very simple in this article to explain to others. Thank you in advance

Thank you for the comment! Of course, feel free to share the article as long as you point to the source so they can always read the latest version if they want to.

Interesting post. I was looking for some info about crypto mining. In today’s scenario how can I mine some crypto? Will you suggest some way?

Try checking out some of the articles here: http://research.aimultiple.com/category/invest

Great information!

Thanks for sharing

They say that there is no central bank or any authority to take care of your transactions. Then, what are crypto exchanges if they are not like banks?

Thanks for the question. Cryptoexchanges are like the stock or commodity markets where traders exchange different stores of value.

Very nice information about the bitcoin trading exchanges for the beginner’s level.

Looking for some more information about the same topic.

Thanks. FYI there is a error loading https://aimultiple.com/cryptoexchange/. “Error running query: no such column: Avg. Volume ($/24h)”

Thank you very much for informing us! We can’t see the same error now but will test from different machines and debug it.

Thanks for the article. I noticed that you have an asterisk on the Deposit Options column of the table, but there is no reference to it below the table. Oversight?

Also, if there is a percentage after the deposit option, that is the charge for depositing money with that method?

Thanks! Good catch! We are adding the explanation for the asterisk.

The percentages or the amounts within parentheses are the fees for the deposit or withdrawal operations

Comments

Your email address will not be published. All fields are required.