Bitcoin Challenges in 2024: Fiat Killer or a Speculation

“Bitcoin will replace the Dollar” is a heavily marketed narrative of many Bitcoin maximalists and crypto enthusiasts. Compared with 3-4 years ago, more people are aware of Bitcoin & cryptocurrencies now. However, Bitcoin has failed to take a meaningful position in day-to-day transactions. In this article, we will discuss the major challenges Bitcoin faces in becoming a viable payment method.

Though Bitcoin is not a widely used payment system yet, the adoption of the Lightning network is increasing

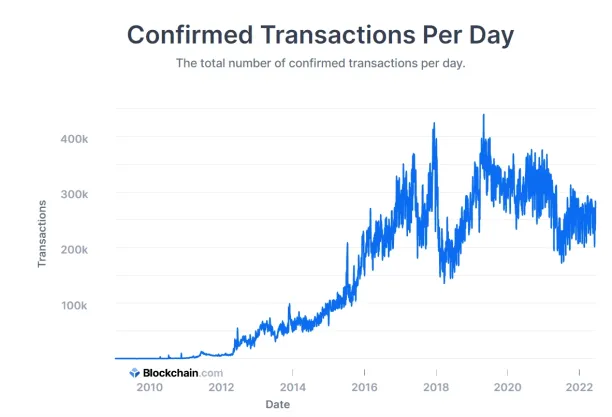

Bitcoin was developed to be a peer-to-peer digital cash payment system that replaces intermediaries and centralized currencies. Bitcoin has seen significant price appreciation and increase in the number of transactions in the last decade. However, it has struggled to become a widely used payment method. The number of confirmed Bitcoin transactions per day has been decreasing since 2020 as seen in figure 1.

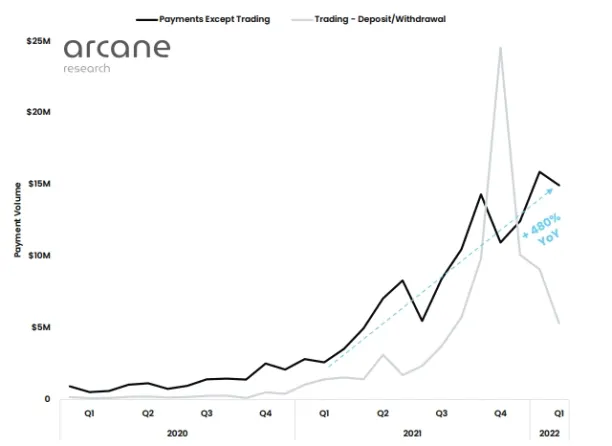

However, the Lightning network which is a layer 2 blockchain designed for making small Bitcoin payments has increased in popularity. It is estimated that the Lightning network handled 800,000 transactions worth $20 million in February 2022. (see Figure 2)

Figure1. Daily Bitcoin transactions

Figure 2. Payments made in the Lightning network

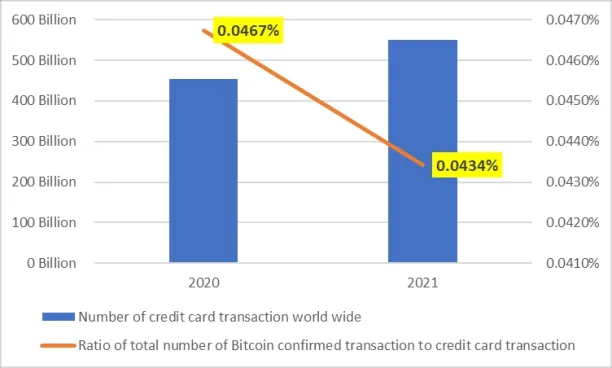

The total number of confirmed transactions per day for Bitcoin when compared to credit card companies, is insignificant as seen below.

Figure3. Bitcoin transactions vs credit card transactions

El Salvador is a real-life example of Bitcoin adoption for day-to-day payment. The government adopted Bitcoin as a legal tender in September 2021, to digitize the economy, reducing the dependency on the US dollar, and providing financial services to the 70% unbanked population. The government also provided a one-time $30 incentive for anyone who uses the El Salvador digital wallet app.

Even though the intentions were good, a report by the US National Bureau of Economic Research (NBER) concluded that Bitcoin usage for everyday transactions is low, and the people who use it consistently are the educated and banked portion of the population. The report found out:

- Only 20% of the people who downloaded the app kept using it after claiming the incentive.

- Only 17% of the sales that were made in Bitcoin were kept as Bitcoin, the remaining was converted to dollars and either withdrawn or kept in the app.

A report by the Rest of the Word organization shows that some merchants stopped accepting Bitcoin as payment due to its volatility.

Bitcoin’s challenges and initiatives to tackle these challenges

Volatility

Bitcoin is called a cryptocurrency but the name is misleading because Bitcoin fails to meet the store of value function of the money due to its volatility. The volatility of Bitcoin makes it a desirable speculative investment but not a currency that is efficient for value preservation.

For a long time, many financial professionals were categorizing Bitcoin as a commodity and not a currency. In a new bill introduced in the US Senate, Bitcoin officially is considered a commodity.

Volatility of Bitcoin compared to major currency pairs*

| USD/JPY | BTC/USD | USD/EUR | |

| Standard deviation | 0.409% | 4.802% | 0.420% |

Lack of built-in smart contracts

Unlike blockchains like Ethereum, Bitcoin itself was not initially designed for smart contracts which limits Bitcoin use cases in more complex transactions that are used in DeFi and NFTs.

Stacks, which is a separate blockchain that is connected to Bitcoin, was developed to enable the use of smart contracts that are secured by Bitcoin.

Speed

Transacting on Bitcoin is slow when compared to debit and credit card transactions.

Solutions have been developed to solve the Bitcoin transactions speed such as lightning network & RSK.

There are 2 projects that are also being developed on Stacks to increase the transaction speed. They are not labeling their solution as a jack of all trades like other blockchains, they indicate that there will be a trade-off between decentralization and speed. These 2 projects are:

Hyperchain

Hyperchain will give users the option of faster transactions while losing on decentralization. They correctly point out that fast transactions are crucial in time-sensitive transactions such as minting NFTs as a time delay can make users fail to obtain their NFTs during the mint.

App Chains

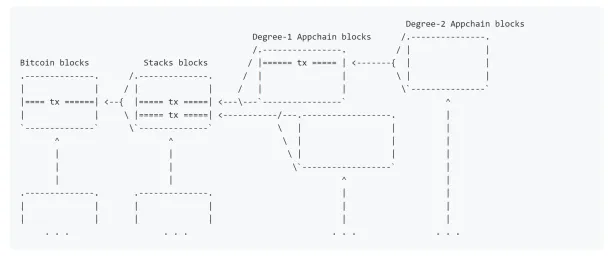

App Chains are chains that all are connected to the Stacks blockchain, hence Bitcoin. Every chain can have its own characteristics such as block size, miners, and incentive mechanism. The chain connectivity is possible due to Stack’s unique consensus mechanism, and proof of transfer (Pox).

Figure 4. How App chains work

Cem has been the principal analyst at AIMultiple since 2017. AIMultiple informs hundreds of thousands of businesses (as per similarWeb) including 60% of Fortune 500 every month.

Cem's work has been cited by leading global publications including Business Insider, Forbes, Washington Post, global firms like Deloitte, HPE, NGOs like World Economic Forum and supranational organizations like European Commission. You can see more reputable companies and media that referenced AIMultiple.

Throughout his career, Cem served as a tech consultant, tech buyer and tech entrepreneur. He advised businesses on their enterprise software, automation, cloud, AI / ML and other technology related decisions at McKinsey & Company and Altman Solon for more than a decade. He also published a McKinsey report on digitalization.

He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem's work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider.

Cem regularly speaks at international technology conferences. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

To stay up-to-date on B2B tech & accelerate your enterprise:

Follow on

Comments

Your email address will not be published. All fields are required.